JBM Auto Share Price Target Tomorrow 2025 To 2030

JBM Auto Limited is a prominent Indian company specializing in the manufacturing of auto components, tools, dies, and buses. Established in 1990, it operates as the flagship entity of the JBM Group, a global conglomerate with a presence in over 37 countries and a workforce exceeding 30,000 employees. JBM Auto Share Price on NSE as of 20 May 2025 is 726.85 INR.

JBM Auto Share Market Overview

- Open: 728.00

- High: 741.85

- Low: 707.05

- Previous Close: 726.05

- Volume: 759,000

- Value (Lacs): 5,513.76

- 52 Week High: 1,214.18

- 52 Week Low: 489.80

- Mkt Cap (Rs. Cr.): 17,180

- Face Value: 2

JBM Auto Share Price Chart

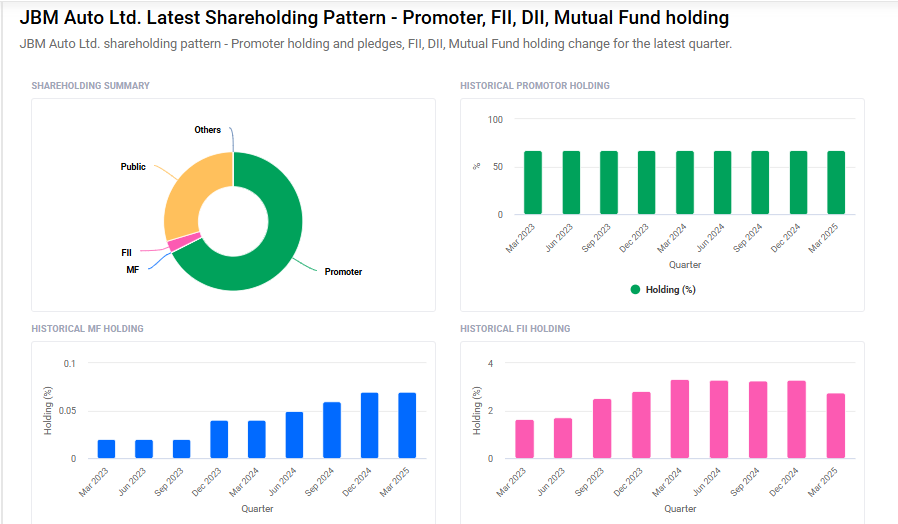

JBM Auto Shareholding Pattern

- Promoters: 67.5%

- FII: 2.8%

- DII: 0.1%

- Public: 29.6%

JBM Auto Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1,170 |

| 2026 | ₹1,400 |

| 2027 | ₹1,700 |

| 2028 | ₹2,000 |

| 2029 | ₹2,300 |

| 2030 | ₹2,600 |

JBM Auto Share Price Target 2025

JBM Auto share price target 2025 Expected target could ₹1,170. Here are five key factors influencing JBM Auto’s share price target for 2025:

1. Record-Breaking Financial Performance

In the quarter ending March 2025, JBM Auto achieved its highest net sales and operating profit in five quarters, with net sales reaching ₹1,645.70 crore and operating profit at ₹196.98 crore. This strong financial performance indicates robust demand and operational efficiency, which can positively impact investor confidence and share price.

2. Ambitious Revenue Targets

JBM Auto has set an ambitious revenue target of ₹6,000 to ₹6,500 crore for FY26, driven by strong demand in the electric vehicle (EV) segment. Achieving this target would signify significant growth and could lead to a re-rating of the company’s stock.

3. Consistent Earnings Growth

The company has demonstrated consistent earnings growth, with an average annual rate of 26.5% over recent years. This steady growth trajectory showcases JBM Auto’s ability to expand its business and generate shareholder value.

4. Positive Stock Price Forecasts

Analysts forecast a potential increase in JBM Auto’s stock price, with projections suggesting a rise from ₹726.00 to ₹1,020.60 within a year. Such positive outlooks can attract investors and drive share price appreciation.

5. Strategic Initiatives and Market Positioning

JBM Auto’s strategic focus on the EV segment and its efforts to expand its product portfolio position the company to capitalize on emerging market trends. Such initiatives can enhance the company’s competitiveness and growth prospects.

JBM Auto Share Price Target 2030

JBM Auto share price target 2030 Expected target could ₹2,600. Here are five key risks and challenges that could influence JBM Auto’s share price trajectory by 2030:

1. Dependence on Government Policies and Subsidies

JBM Auto’s growth, particularly in the electric vehicle (EV) segment, is significantly influenced by government initiatives such as the PM E-DRIVE Scheme and subsidies for electric buses. Any changes or reductions in these policies could adversely affect demand and profitability.

2. Intensifying Competition in the EV Market

The EV industry is becoming increasingly competitive, with numerous players entering the market. This heightened competition may lead to pricing pressures and reduced market share for JBM Auto if it does not continue to innovate and differentiate its offerings.

3. Operational Challenges Due to Outdated Machinery

Some of JBM Auto’s production lines utilize machinery dating back to the early 2000s, leading to higher maintenance costs and lower efficiency. This could impact the company’s ability to scale operations and meet future demand effectively.

4. Macroeconomic and Geopolitical Uncertainties

Global economic fluctuations and geopolitical tensions can affect supply chains, raw material costs, and overall demand in the automotive sector. Such uncertainties may pose risks to JBM Auto’s international operations and profitability.

5. Technological Disruptions and Rapid Industry Changes

The automotive industry is undergoing rapid technological advancements. Failure to keep pace with innovations in EV technology, autonomous driving, or connectivity could render JBM Auto’s products less competitive, impacting its market position and share price.

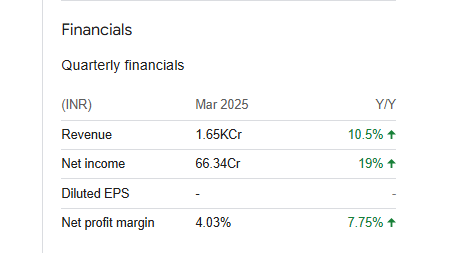

JBM Auto Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 54.72B | 9.17% |

| Operating expense | 12.63B | 28.55% |

| Net income | 2.02B | 12.91% |

| Net profit margin | 3.69 | 3.36% |

| Earnings per share | — | — |

| EBITDA | 6.77B | 15.70% |

| Effective tax rate | 21.44% | — |

Read Also:- TATA ELXSI Share Price Target Tomorrow 2025 To 2030