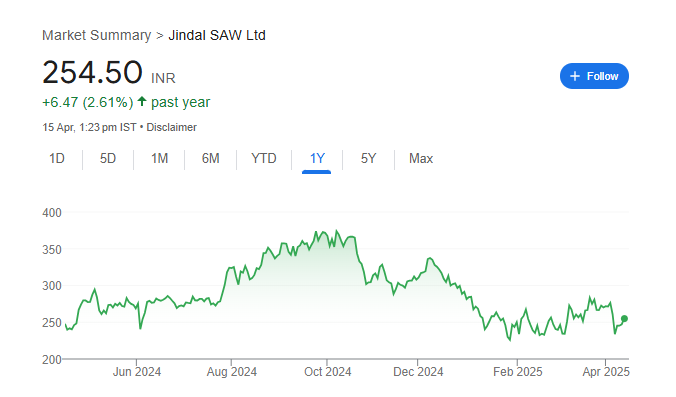

Jindal Saw Share Price Target Tomorrow 2025 To 2030

Jindal SAW Ltd. is a prominent Indian company specializing in the manufacturing of iron and steel pipes, fittings, and pellets. Established in 1984, it operates globally with manufacturing facilities in India, the United States, Europe, and the United Arab Emirates. The company offers a diverse range of products, including large-diameter Submerged Arc Welded (SAW) pipes, ductile iron pipes, carbon, alloy, and stainless steel pipes and tubes, catering to sectors such as oil and gas, water and wastewater transportation, power, and general engineering. Jindal Saw Share Price on NSE as of 15 April 2025 is 254.50 INR.

Jindal Saw Share Market Overview

- Open: 252.00

- High: 256.10

- Low: 250.55

- Previous Close: 247.10

- Volume: 515,544

- Value (Lacs): 1,313.61

- VWAP: 254.02

- UC Limit: 296.50

- LC Limit: 197.70

- 52 Week High: 383.85

- 52 Week Low: 217.65

- Mkt Cap (Rs. Cr.): 16,294

- Face Value: 1

Jindal Saw Share Price Chart

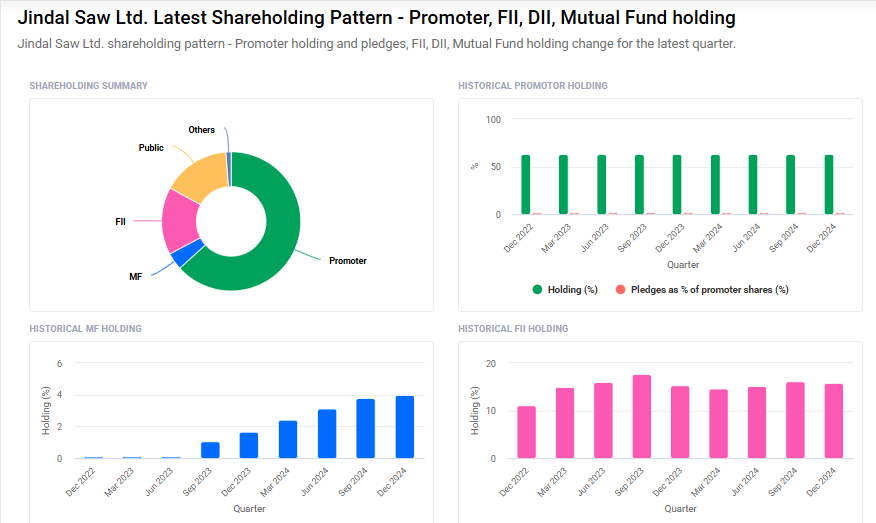

Jindal Saw Shareholding Pattern

- Promoters: 63.3%

- FII: 15.7%

- DII: 4.7%

- Public: 15.8%

Jindal Saw Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹390

- 2026 – ₹440

- 2027 – ₹490

- 2028 – ₹540

- 2030 – ₹590

Major Factors Affecting Jindal Saw Share Price

Here are six key factors influencing the share price of Jindal SAW Ltd:

1. Financial Performance and Profit Margins

Jindal SAW has demonstrated strong financial performance, with a 32.5% increase in Q2 profit due to steady demand in its Middle East and North Africa (MENA) markets and flat expenses. Additionally, raw material expenses dropped by 14.4%, partially offsetting weaker steel prices in India.

2. Global Market Demand

The company’s substantial order book from the MENA region, accounting for 32% of total orders, significantly contributes to its revenue. This international demand helps mitigate fluctuations in domestic market conditions.

3. Raw Material Costs

Fluctuations in the prices of key raw materials like iron ore and coking coal directly impact production costs. In Q2, a 14.4% decrease in raw material expenses positively affected profit margins.

4. Domestic Market Conditions

Domestic demand can be influenced by factors such as government spending and economic policies. For instance, during the national election period, decreased government spending in manufacturing and construction sectors led to muted domestic demand.

5. Debt Levels and Financial Ratios

Jindal SAW maintains a debt-to-equity ratio of 54.5%, indicating a moderate level of debt. Financial metrics like Return on Equity (ROE) and Interest Coverage Ratio are essential for assessing the company’s financial health and its ability to service debt.

6. Analyst Ratings and Valuation

Analysts have set a 12-month average price target of ₹413 for Jindal SAW, suggesting a potential upside of over 60% from the current price . However, it’s important to note that the company’s forecasted growth is lower than the broader market, which may influence investor sentiment .

Risks and Challenges for Jindal Saw Share Price

Here are six key risks and challenges that could impact the share price of Jindal SAW Ltd:

1. High Debt Levels

Jindal SAW has significant liabilities, with ₹83.5 billion due within a year and ₹26.3 billion due after that. This amounts to a total liability of ₹109.8 billion, which is substantially higher than its cash reserves of ₹7.27 billion. Such a high debt load can strain the company’s financial health and may affect its stock price negatively.

2. Declining Domestic Demand

In Q3 FY25, the company reported a 2.5% drop in sales of iron and steel pipes, totaling 432,000 metric tonnes. This decline was attributed to muted domestic steel demand, which was influenced by lower construction activity and project delays. Such factors can adversely affect the company’s revenue and, consequently, its share price.

3. Volatile Stock Performance

Jindal SAW’s stock has exhibited significant volatility, with a 52-week high of ₹383.85 and a low of ₹217.65. Such fluctuations can be unsettling for investors and may lead to decreased investor confidence, impacting the share price.

4. Bearish Technical Indicators

On March 21, 2025, Jindal SAW’s stock closed more than 1.5% below its Volume Weighted Average Price (VWAP), suggesting a potential bearish trend. Such technical indicators can signal declining investor sentiment and may lead to a decrease in the stock price.

5. Economic Sensitivity

As a company operating in the steel and pipe manufacturing sector, Jindal SAW is highly sensitive to economic cycles. Economic slowdowns can lead to reduced demand for steel products, adversely affecting the company’s sales and profitability, which in turn can impact its share price.

6. Currency Exchange Risks

Being a significant exporter, Jindal SAW is exposed to currency exchange risks. Fluctuations in foreign exchange rates can affect the company’s revenue from international markets, potentially leading to lower profits and a decline in share price.

Read Also:- Pratap Snacks Share Price Target Tomorrow 2025 To 2030