JSW Infra Share Price Target Tomorrow 2025 To 2030

JSW Infrastructure Limited is one of India’s leading private infrastructure companies, specializing in the development, operation, and maintenance of port services and related infrastructure. Established in 1999, it is a part of the JSW Group, a diversified conglomerate with interests in steel, energy, and cement. JSW Infrastructure operates several ports and terminals across India, including notable facilities like Jaigad and Dharamtar ports in Maharashtra. JSW Infra Share Price on NSE as of 22 May 2025 is 284.50 INR.

JSW Infra Share Market Overview

- Open: 288.05

- High: 289.30

- Low: 281.75

- Previous Close: 288.15

- Volume: 1,959,528

- Value (Lacs): 5,568.00

- 52 Week High: 360.95

- 52 Week Low: 218.20

- Mkt Cap (Rs. Cr.): 59,671

- Face Value: 2

JSW Infra Share Price Chart

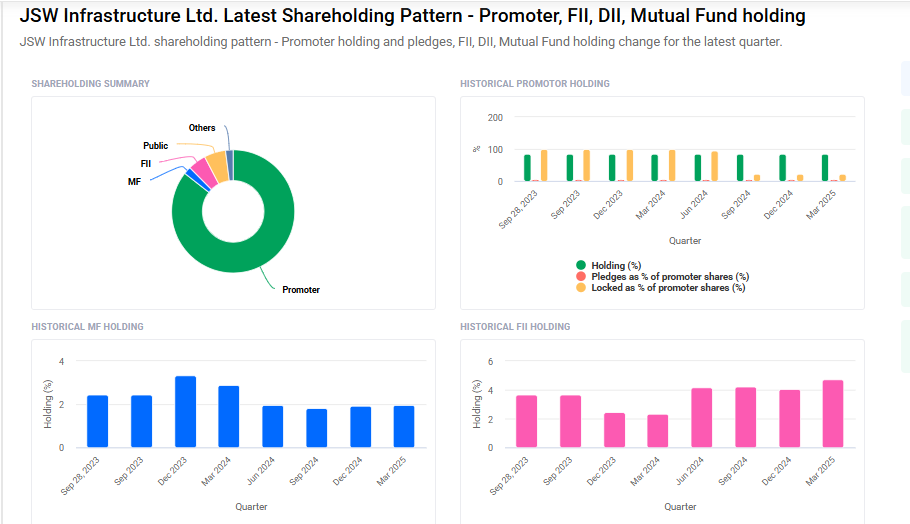

JSW Infra Shareholding Pattern

- Promoters: 85.6%

- FII: 4.8%

- DII: 2.7%

- Public: 5.7%

- Others: 1.3%

JSW Infra Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹365 |

| 2026 | ₹400 |

| 2027 | ₹440 |

| 2028 | ₹480 |

| 2029 | ₹520 |

| 2030 | ₹560 |

JSW Infra Share Price Target 2025

JSW Infra share price target 2025 Expected target could ₹365. Here are five key factors that could drive the growth of JSW Infra’s share price toward its 2025 target:

-

Robust Order Book and Project Pipeline:

JSW Infra’s strong lineup of contracts—spanning road projects, urban infrastructure, and industrial parks—provides a steady stream of revenue opportunities. A consistently healthy order book boosts investor confidence and sets the foundation for future growth. -

Favorable Government Infrastructure Spending:

Increased public investment in infrastructure, supported by government programs and initiatives like Bharatmala Pariyojana, can provide a significant tailwind. This boost in government spending is expected to increase project demand and enhance JSW Infra’s business prospects. -

Operational Efficiency and Technological Advancements:

Improvements in operational efficiency through better project management, cost control, and the adoption of innovative construction technologies can drive profit margins. Investments in digitalization and modern machinery may help the company complete projects faster and at lower costs. -

Market Expansion and Geographic Diversification:

JSW Infra’s expansion into new regions and sectors, along with diversification of its project portfolio, helps mitigate risk. A broader geographic footprint and diverse project mix can protect the company against regional economic slowdowns and sector-specific challenges. -

Economic Growth and Urbanization Trends:

The ongoing growth in India’s economy, combined with rapid urbanization, fuels demand for modern infrastructure. As cities expand and industrial activities increase, the overall market for infrastructure projects is expected to grow, directly benefiting companies like JSW Infra.

JSW Infra Share Price Target 2030

JSW Infra share price target 2030 Expected target could ₹560. Here are five key risks and challenges that could impact JSW Infrastructure’s share price target by 2030:

-

Regulatory and Policy Uncertainty

Changes in government policies, environmental regulations, or port operation guidelines can significantly affect JSW Infra’s long-term plans. Delays in project approvals, new compliance burdens, or shifts in foreign trade policies may slow growth and affect profitability.

-

Dependence on Global Trade Cycles

As a major player in port and logistics infrastructure, JSW Infra’s performance is closely tied to global trade volumes. Economic slowdowns, geopolitical tensions, or supply chain disruptions could reduce cargo throughput at its terminals, directly impacting revenue.

-

High Capital Expenditure and Debt Risks

Infrastructure development is capital-intensive. If JSW Infra continues aggressive expansion through debt-financed projects, it may face interest burden and repayment challenges. Rising interest rates or lower-than-expected returns could strain cash flows.

-

Operational and Execution Risks

Delays in project execution, cost overruns, or technical failures in large-scale infrastructure projects can damage the company’s reputation and reduce investor trust. Efficient execution is critical for maintaining growth momentum and share price stability.

-

Competition and Market Saturation

The port and logistics sector in India is becoming increasingly competitive, with both domestic and international players expanding their footprints. Intense competition could pressure margins, reduce market share, and limit JSW Infra’s ability to maintain premium pricing.

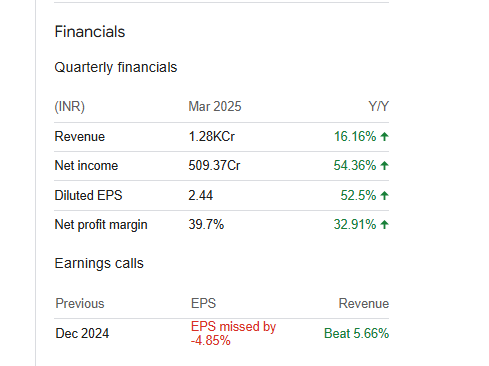

JSW Infra Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 44.76B | 18.69% |

| Operating expense | 7.76B | 33.54% |

| Net income | 15.03B | 30.03% |

| Net profit margin | 33.58 | 9.56% |

| Earnings per share | 7.19 | 22.28% |

| EBITDA | 22.62B | 15.54% |

| Effective tax rate | 15.61% | — |

Read Also:- Unitech Share Price Target Tomorrow 2025 To 2030