JTL Industries Share Price Target Tomorrow 2025 To 2030

JTL Industries Limited, established in 1991 and headquartered in Chandigarh, is a leading Indian manufacturer of Electric Resistance Welded (ERW) steel pipes and tubes. With four state-of-the-art manufacturing facilities across India, the company boasts an annual production capacity of approximately 600,000 metric tonnes. Its diverse product portfolio includes galvanized steel pipes, hollow sections, solar module mounting structures, and large-diameter steel tubes, catering to sectors such as construction, agriculture, infrastructure, and renewable energy. JTL Industries Share Price on NSE as of 30 May 2025 is 66.61 INR.

JTL Industries Share Market Overview

- Open: 68.75

- High: 68.95

- Low: 66.10

- Previous Close: 68.90

- Volume: 1,440,436

- Value (Lacs): 964.37

- 52 Week High: 123.75

- 52 Week Low: 59.77

- Mkt Cap (Rs. Cr.): 2,631

- Face Value: 2

JTL Industries Share Price Chart

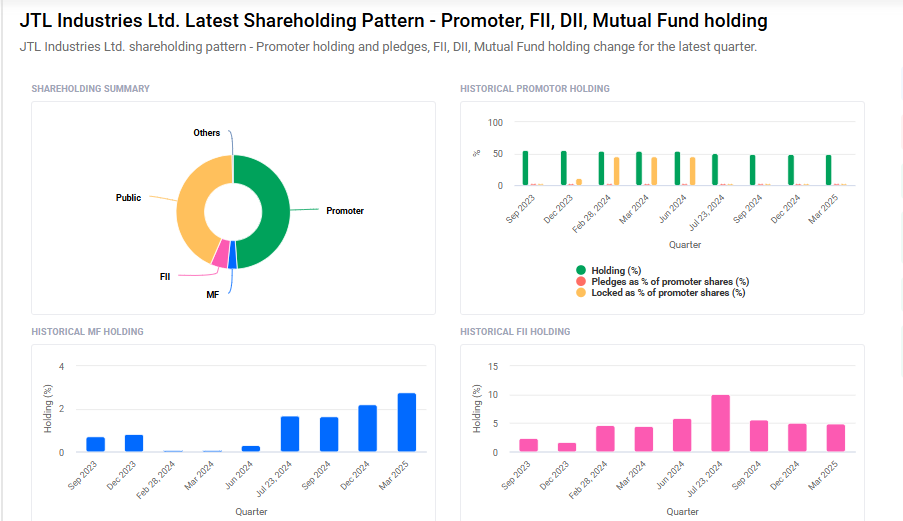

JTL Industries Shareholding Pattern

- Promoters: 48.9%

- FII: 4.9%

- DII: 3%

- Public: 43.2%

JTL Industries Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹130 |

| 2026 | ₹160 |

| 2027 | ₹190 |

| 2028 | ₹220 |

| 2029 | ₹250 |

| 2030 | ₹280 |

JTL Industries Share Price Target 2025

JTL Industries share price target 2025 Expected target could ₹130. Here are five key factors influencing the growth of JTL Industries’ share price target for 2025:

-

Strategic Capacity Expansion

JTL Industries is undertaking significant capacity expansion, aiming to increase its manufacturing capacity from 2 lakh tonnes to 10 lakh tonnes per annum by FY 2026-27. This expansion is expected to enhance production capabilities and meet growing demand in the steel industry. -

Strong Financial Performance

In FY 2024-25, JTL Industries reported consolidated net sales of ₹469.47 crore in March 2025, reflecting a year-on-year growth of 0.76%. Despite challenges in the steel sector, the company maintained stable financial performance, indicating resilience and operational efficiency. -

Positive Analyst Outlook

Analysts forecast JTL Industries’ earnings to grow by 31.7% and revenue by 28.1% per annum. The expected earnings per share (EPS) growth rate is 29.1% annually, with a projected return on equity of 12.3% over the next three years. These optimistic projections suggest strong growth potential. -

Product Diversification and Market Presence

JTL Industries specializes in manufacturing ERW pipes, GI pipes, MS black pipes, hollow sections, and solar structures. This diverse product portfolio caters to various sectors, including construction and renewable energy, positioning the company to capitalize on multiple market opportunities. -

International Market Expansion

The company is actively expanding its presence in international markets, participating in global events like Wire and Tube Mexico 2025. Such initiatives aim to showcase JTL Industries’ products to a broader audience, potentially leading to increased exports and global partnerships.

JTL Industries Share Price Target 2030

JTL Industries share price target 2030 Expected target could ₹280. Here are five key risks and challenges that could impact JTL Industries’ share price target by 2030:

-

Volatility in Steel Prices

JTL Industries operates in the steel industry, where raw material prices, especially steel, are subject to significant fluctuations. Such volatility can affect production costs and profit margins, posing a challenge to consistent financial performance. -

Economic Slowdown and Industry Cycles

The company’s growth is closely tied to the broader economy and the steel sector’s health. Economic downturns or cyclical slowdowns in the steel industry can lead to reduced demand for JTL’s products, impacting revenues and share price. -

Credit and Liquidity Risks

JTL Industries faces financial risks, including credit risk from customers failing to meet payment obligations and liquidity risk related to meeting its own financial commitments. Effective management of these risks is crucial to maintain financial stability. -

Market Risk and Interest Rate Fluctuations

Changes in market conditions, such as interest rate variations, can influence the company’s borrowing costs and investment returns. Such market risks can affect JTL’s financial performance and investor confidence. -

Intensifying Competition

The steel industry is highly competitive, with numerous players vying for market share. Increased competition can pressure JTL Industries to innovate and maintain cost efficiency, which, if not managed effectively, could impact profitability and market position.

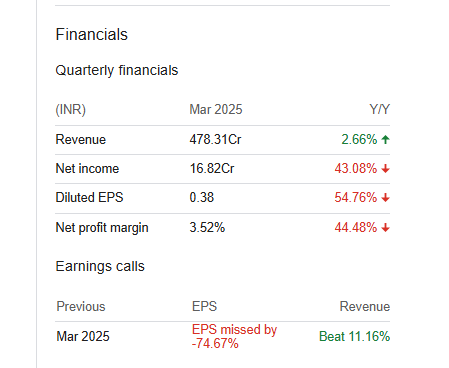

JTL Industries Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 19.39B | -4.97% |

| Operating expense | 1.20B | 26.04% |

| Net income | 988.18M | -12.56% |

| Net profit margin | 5.10 | -7.94% |

| Earnings per share | 2.30 | -29.45% |

| EBITDA | 1.45B | -4.46% |

| Effective tax rate | 24.91% | — |

Read Also:- Atul Share Price Target Tomorrow 2025 To 2030