Kims Share Price Target Tomorrow 2025 To 2030

Krishna Institute of Medical Sciences Limited (KIMS) is a prominent healthcare provider based in Secunderabad, India. The company offers a wide range of medical services, including cardiac care, oncology, neurosciences, orthopedics, and organ transplantation. As of April 22, 2025, KIMS reflecting a significant increase of approximately 149% over the past three years. The company’s financial performance is robust, with a revenue of ₹28,719 crore and a net income of ₹3,480 crore in the trailing twelve months. KIMS maintains a return on equity of 18.18% and an operating margin of 19.94%, indicating efficient management and profitability. Kims Share Price on NSE as of 22 April 2025 is 680.00 INR.

Kims Share Market Overview

- Open: 658.00

- High: 697.95

- Low: 658.00

- Previous Close: 660.75

- Volume: 1,826,859

- Value (Lacs): 12,488.41

- VWAP: 684.79

- UC Limit: 792.90

- LC Limit: 528.60

- 52 Week High: 697.95

- 52 Week Low: 350.00

- Mkt Cap (Rs. Cr.): 27,353

- Face Value: 2

Kims Share Price Chart

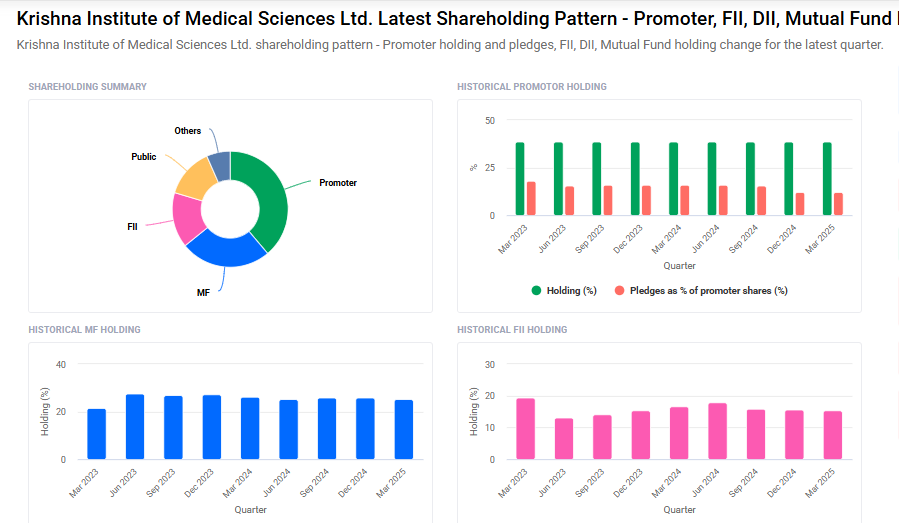

Kims Shareholding Pattern

- Promoters: 38.8%

- FII: 15.4%

- DII: 32%

- Public: 13.8%

Kims Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹700

- 2026 – ₹1000

- 2027 – ₹1300

- 2028 – ₹1600

- 2030 – ₹1900

Major Factors Affecting Kims Share Price

Here are six key factors that can influence the share price of Krishna Institute of Medical Sciences Limited (KIMS):

1. Strong Financial Performance

KIMS has demonstrated consistent growth in its financial metrics. Over the past three years, the company’s share price has increased by approximately 149%, reflecting investor confidence in its performance. This upward trend is supported by steady revenue growth and profitability.

2. High Valuation Metrics

The company’s stock is currently trading at a Price-to-Earnings (P/E) ratio of 75.49, which is significantly higher than the industry average. Such a high valuation suggests that investors have strong expectations for the company’s future earnings growth.

3. Growth Prospects

Analysts project a compound annual growth rate (CAGR) of 26% for KIMS over the next three years. This anticipated growth is driven by the company’s expansion plans and increasing demand for healthcare services in India.

4. Market Sentiment and Technical Indicators

The stock has been trading above key moving averages, indicating a bullish trend. Experts suggest that the stock is a good buy on dips, with potential targets above ₹700.

5. Analyst Recommendations

Multiple analysts have provided positive recommendations for KIMS, with an average target price of ₹680.86. These endorsements can influence investor sentiment and drive demand for the stock.

6. Industry Growth and Demand

The healthcare sector in India is experiencing rapid growth due to increasing population, rising income levels, and greater health awareness. As a prominent player in this sector, KIMS stands to benefit from these favorable industry dynamics.

Risks and Challenges for Kims Share Price

Here are six key risks and challenges that could influence the share price of Krishna Institute of Medical Sciences Limited (KIMS):

1. High Valuation Amid Slower Earnings Growth

KIMS is currently trading at a high price-to-earnings (P/E) ratio, which suggests that investors have strong expectations for future growth. However, if the company’s earnings do not grow as anticipated, this high valuation may not be justified, potentially leading to a decline in the share price.

2. Recent Downgrade Due to Weak Financial Performance

In March 2024, MarketsMojo downgraded KIMS to a ‘Sell’ rating, citing poor long-term growth and negative financial results. Specifically, the company reported a 7.15% decline in net sales and a decrease in operating profit growth to an annual rate of 9.64% over the last five years.

3. Rising Interest Costs

KIMS has experienced an increase in interest expenses, which now account for 1.88% of its operating revenues. Higher interest costs can reduce net profits and may impact the company’s ability to invest in growth opportunities.

4. Operational Challenges and Cost Pressures

The company faces operational challenges, including rising employee costs, which constitute 16.91% of operating revenues. Managing these expenses is crucial to maintain profitability, and failure to do so could affect the company’s financial health.

5. Dependence on Regional Markets

KIMS primarily operates in specific regions of India, making it susceptible to regional economic fluctuations and competitive pressures. Any adverse developments in these areas could impact the company’s performance and, consequently, its share price.

6. Regulatory and Compliance Risks

As a healthcare provider, KIMS is subject to stringent regulatory requirements. Changes in healthcare policies, regulations, or compliance standards could increase operational costs or limit the company’s ability to expand, potentially affecting its profitability and stock performance.

Read Also:- Sumedha Fiscal Share Price Target Tomorrow 2025 To 2030