Kpit Share Price Target Tomorrow 2025 To 2030

KPIT Technologies is a global technology company specializing in automotive software and engineering solutions. Headquartered in Pune, India, and founded in 1990 by Ravi Pandit and Kishor Patil, KPIT focuses on developing software for autonomous driving, electric and conventional powertrains, connected vehicles, and vehicle diagnostics. Kpit Share Price on NSE as of 15 May 2025 is 1,351.00 INR.

Kpit Share Market Overview

- Open: 1,349.00

- High: 1,378.60

- Low: 1,346.20

- Previous Close: 1,346.10

- Volume: 987,041

- Value (Lacs): 13,339.86

- 52 Week High: 1,928.70

- 52 Week Low: 961.00

- Mkt Cap (Rs. Cr.): 37,050

- Face Value: 10

Kpit Share Price Chart

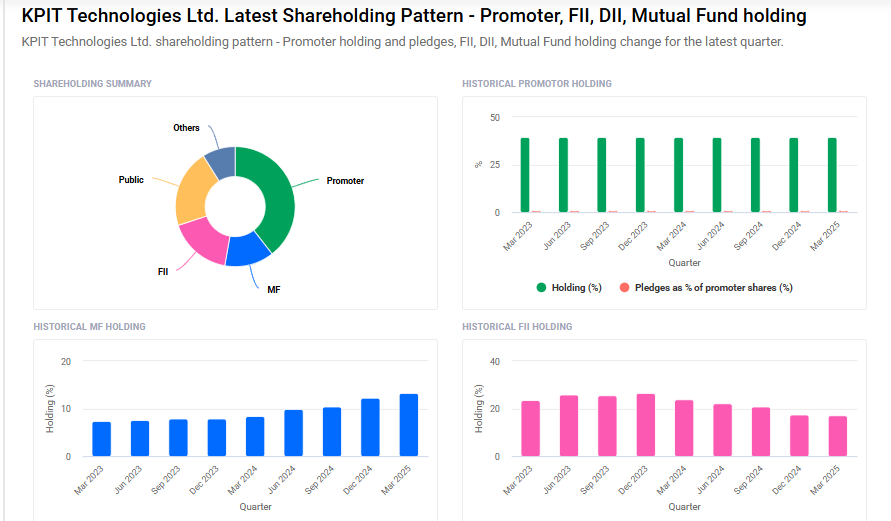

Kpit Shareholding Pattern

- Promoters: 39.5%

- FII: 17.2%

- DII: 21.3%

- Public: 21.2%

Kpit Share Price Target Tomorrow 2025 To 2030

| Kpit Share Price Target Years | Kpit Share Price |

| 2025 | ₹1930 |

| 2026 | ₹2056 |

| 2027 | ₹2140 |

| 2028 | ₹2280 |

| 2029 | ₹2365 |

| 2030 | ₹2450 |

Kpit Share Price Target 2025

Kpit share price target 2025 Expected target could ₹1930. Here are five key factors that could influence the growth of KPIT Technologies Ltd. share price target for 2025:

-

Robust Financial Performance: In FY25, KPIT Technologies reported revenues of USD 691 million, marking an 18.7% growth in constant currency terms. The company’s EBITDA margin stood at 21%, and net profit increased by 41.2% year-over-year, reflecting strong operational efficiency and profitability.

-

Strategic Collaborations: KPIT has entered into significant partnerships, such as with Mercedes-Benz Research and Development India, to accelerate the development of Software-Defined Vehicles (SDVs). These collaborations enhance KPIT’s position in the evolving automotive software landscape.

-

Consistent Deal Wins: The company secured new total contract value engagements worth $280 million during Q4 FY25, indicating a strong and growing order book that supports future revenue streams.

-

Focus on Emerging Technologies: KPIT’s investments in electric vehicles (EVs), autonomous driving, and connected vehicle technologies position it well to capitalize on the automotive industry’s shift towards these innovations.

-

Strong Return on Capital Employed (ROCE): The company achieved a ROCE of 34%, significantly higher than the industry average, indicating efficient use of capital and strong financial health.

Kpit Share Price Target 2030

Kpit share price target 2030 Expected target could ₹2450. Here are five key risks and challenges that could impact KPIT Technologies Ltd.’s share price target by 2030:

-

Exposure to Global Economic Slowdowns: KPIT derives approximately 75% of its revenue from Europe and the United States. Economic downturns or trade disruptions in these regions could adversely affect the company’s financial performance.

-

Intensifying Competition in the EV Sector: The electric vehicle (EV) market is becoming increasingly competitive, with significant advancements from Chinese manufacturers. This heightened competition may pressure KPIT to innovate continuously and could impact its market share.

-

High Valuation Concerns: KPIT’s stock has experienced substantial growth, leading to a high price-to-earnings (P/E) ratio. Such elevated valuations may not be sustainable if the company faces earnings pressure, potentially leading to stock price corrections.

-

Dependence on the Automotive Sector: Over 80% of KPIT’s business is tied to the passenger vehicle segment. Any downturns or structural changes in the automotive industry could significantly impact the company’s revenue streams.

-

Technological Disruptions and Integration Challenges: The rapid evolution of vehicle architectures, such as the shift to zonal controller-based systems, requires KPIT to adapt swiftly. Failure to keep pace with these technological changes could affect its competitiveness.

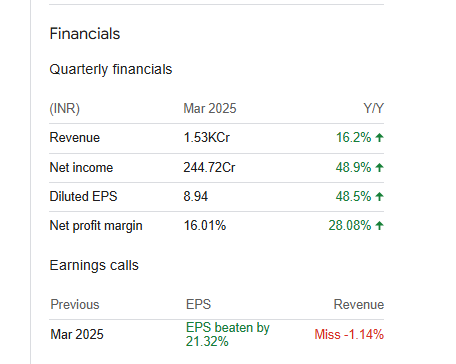

Kpit Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 58.42B | 19.93% |

| Operating expense | 10.82B | 27.32% |

| Net income | 8.40B | 41.22% |

| Net profit margin | 14.37 | 17.79% |

| Earnings per share | 30.70 | 41.02% |

| EBITDA | 12.30B | 41.74% |

| Effective tax rate | 25.87% | — |

Read Also:- Adani Green Share Price Target Tomorrow 2025 To 2030