Lotus Chocolate Share Price Target Tomorrow 2025 To 2030

Lotus Chocolate Company Limited, established in 1988 and commencing operations in 1992, is a notable Indian manufacturer specializing in chocolates, cocoa products, and cocoa derivatives. Headquartered in Hyderabad, Telangana, the company operates a fully integrated manufacturing facility equipped with advanced technology sourced from Germany, the UK, Denmark, and Italy. This strategic setup enables Lotus Chocolate to process cocoa beans into a variety of products, catering to both domestic and international markets. Lotus Chocolate Share Price on NSE as of 29 April 2025 is 1,001.00 INR.

Lotus Chocolate Share Market Overview

- Open: 996.10

- High: 1,027.85

- Low: 990.00

- Previous Close: 996.10

- Volume: 7,157

- Value (Lacs): 71.91

- VWAP: 1,007.46

- 52 Week High: 2,608.65

- 52 Week Low: 305.20

- Mkt Cap (Rs. Cr.): 1,290

- Face Value: 10

Lotus Chocolate Share Price Chart

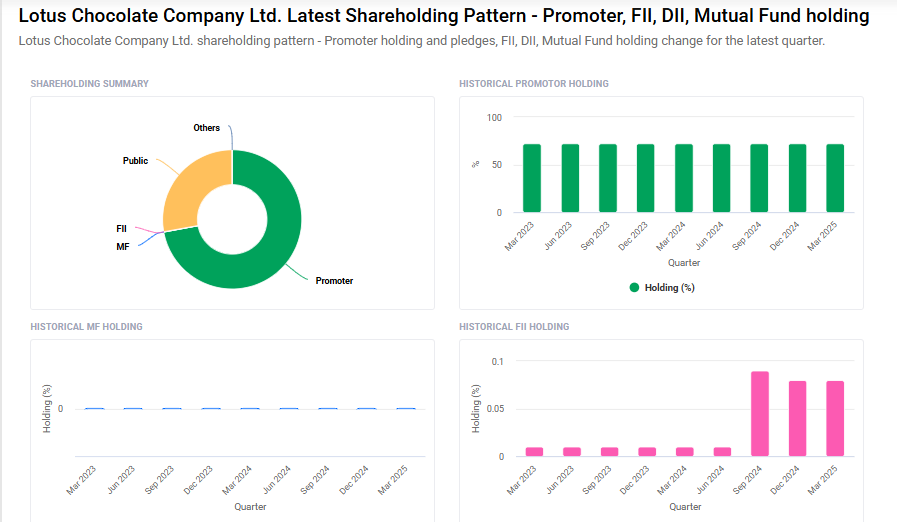

Lotus Chocolate Shareholding Pattern

- Promoters: 72.1%

- FII: 0.1%

- DII: 0%

- Public: 27.8%

Lotus Chocolate Share Price Target Tomorrow 2025 To 2030

| Lotus Chocolate Share Price Target Years | Lotus Chocolate Share Price |

| 2025 | ₹2610 |

| 2026 | ₹2200 |

| 2027 | ₹2800 |

| 2028 | ₹3400 |

| 2029 | ₹4000 |

| 2030 | ₹4600 |

Lotus Chocolate Share Price Target 2025

Here are 4 key factors that could affect the growth of Lotus Chocolate’s share price by 2025:

1. Strong Backing from Reliance Group

Lotus Chocolate has gained strong financial and strategic support after Reliance Consumer Products acquired a majority stake. This backing can help the company expand its brand, enter new markets, and strengthen its supply chain, boosting future revenue and share value.

2. Rising Demand for Premium Chocolates

As consumer preferences shift toward premium and healthier chocolate products in India, Lotus Chocolate is well-positioned to meet this demand. Launching new and innovative products can drive higher sales and improve its growth outlook.

3. Expansion of Distribution Network

With Reliance’s massive retail network (including Reliance Retail stores), Lotus Chocolate can reach more customers across India. Wider product availability in supermarkets, local shops, and online platforms can support strong sales growth.

4. Brand Recognition and Marketing Efforts

Lotus Chocolate is focusing on building stronger brand recognition through advertising and promotions. A growing brand image can help the company capture market share from larger competitors, ultimately supporting its share price in the coming years.

Lotus Chocolate Share Price Target 2030

Here are four key risks and challenges that could impact Lotus Chocolate Company Ltd’s share price by 2030:

1. Intense Market Competition

Lotus Chocolate operates in a highly competitive market dominated by global giants like Cadbury (Mondelez), Nestlé, and Amul. These established players have significant brand recognition, extensive distribution networks, and substantial marketing budgets. Competing against such firms may limit Lotus Chocolate’s market share and growth potential.

2. Volatility in Raw Material Prices

The company’s profitability is sensitive to fluctuations in the prices of key raw materials like cocoa, sugar, and dairy products. Any significant increase in these input costs can erode profit margins, especially if the company is unable to pass on the cost to consumers.

3. Changing Consumer Preferences

Consumer preferences are evolving, with a growing demand for healthier and low-sugar snack options. If Lotus Chocolate does not adapt its product offerings to align with these trends, it risks losing relevance and market share to more agile competitors.

4. Financial Health and Operational Challenges

Despite recent growth, Lotus Chocolate has faced financial challenges, including a weak financial risk profile marked by low net worth due to accumulated losses in the past. Additionally, operational issues such as increased debtor days and working capital requirements could strain the company’s resources and affect its ability to invest in growth initiatives.

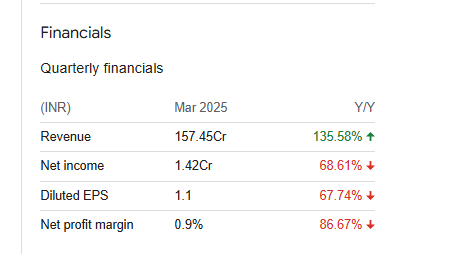

Lotus Chocolate Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 5.74B | 186.83% |

| Operating expense | 564.01M | 107.97% |

| Net income | 172.27M | 240.78% |

| Net profit margin | 3.00 | 18.58% |

| Earnings per share | — | — |

| EBITDA | 311.69M | 863.83% |

| Effective tax rate | 25.28% | — |

Read Also:- Patanjali Share Price Target Tomorrow 2025 To 2030