Lupin Share Price Target Tomorrow 2025 To 2030

Lupin Limited is a leading global pharmaceutical company based in India, known for its high-quality medicines and strong presence in over 100 countries. The company specializes in the production of generic drugs, active pharmaceutical ingredients (APIs), and biosimilars. Lupin focuses on key therapeutic areas, including cardiovascular, diabetes, central nervous system, and respiratory treatments. Lupin Share Price on NSE as of 19 April 2025 is 1,934.10 INR.

Lupin Share Market Overview

- Open: 1,935.00

- High: 1,961.90

- Low: 1,922.10

- Previous Close: 1,934.20

- Volume: 1,443,207

- Value (Lacs): 27,957.81

- VWAP: 1,938.66

- UC Limit: 2,127.60

- LC Limit: 1,740.80

- 52 Week High: 2,402.90

- 52 Week Low: 1,493.30

- Mkt Cap (Rs. Cr.): 88,445

- Face Value: 2

Lupin Share Price Chart

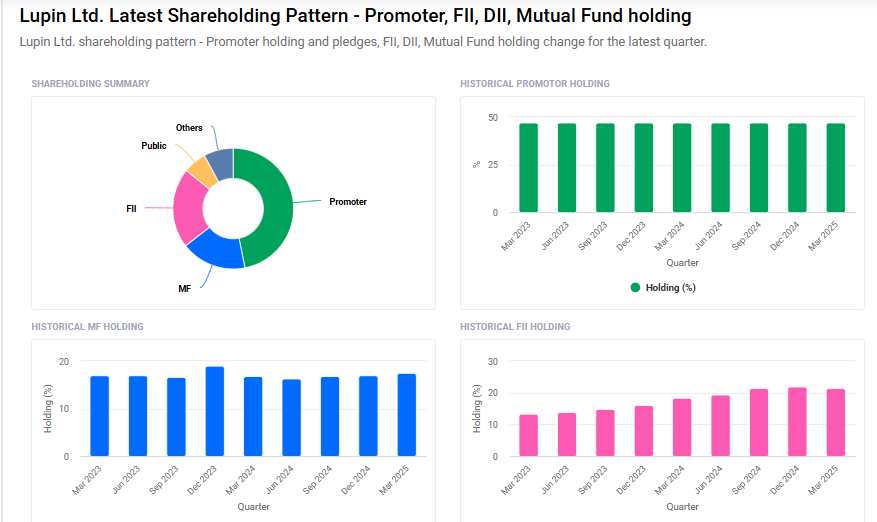

Lupin Shareholding Pattern

- Promoters: 46.9%

- FII: 21.5%

- DII: 25.4%

- Public: 6.2%

Lupin Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹2400

- 2026 – ₹2800

- 2027 – ₹3200

- 2028 – ₹3800

- 2030 – ₹4200

Major Factors Affecting Lupin Share Price

1. Regulatory Approvals and Compliance

Lupin’s share price can be affected by regulatory actions, especially from the U.S. FDA. For instance, the company experienced a decline in share price when the FDA issued observations for its Pithampur Unit-1, which raised concerns about potential delays in product approvals.

2. Financial Performance and Profit Margins

Investors closely monitor Lupin’s financial results. Despite a 38.8% year-on-year increase in profit for Q3, the share price fell by 2.8% due to broader market conditions and mixed analyst sentiments.

3. Product Launches and Market Demand

The introduction of new products can impact Lupin’s revenue and stock price. The launch of Rivaroxaban Tablets in the U.S. led to a 3% rise in shares, indicating positive investor response to new offerings.

4. Debt Levels and Financial Health

Lupin’s low debt-to-equity ratio (0.0009) suggests strong financial health, which can positively influence investor confidence and share price.

5. Market Sentiment and Economic Conditions

Broader market trends and economic conditions play a role in Lupin’s stock performance. For example, a 2.8% drop in shares occurred despite strong quarterly profits, possibly due to overall market weakness.

6. Valuation Metrics

Analysts assess Lupin’s valuation to determine if the stock is overvalued or undervalued. With a current price-to-earnings (P/E) ratio of 44, Lupin may be considered fairly valued, reflecting moderate growth expectations.

Risks and Challenges for Lupin Share Price

Here are six risks and challenges that could affect the share price of Lupin Limited:

-

Regulatory and Compliance Risks

Lupin operates in many countries, including the United States, where it faces strict regulatory standards from organizations like the U.S. Food and Drug Administration (FDA). If the company fails to meet these standards or experiences delays in receiving drug approvals, it could lead to a negative impact on its stock price. For example, issues with the company’s manufacturing plants or drug submissions can raise investor concerns. -

Competitive Pressure

The pharmaceutical industry is highly competitive, with many global players in the market. Lupin faces competition from both large multinational companies and smaller generic drug manufacturers. If competitors launch similar drugs at lower prices or with better features, it could hurt Lupin’s market share and overall profitability, potentially leading to a decline in its stock price. -

Currency Fluctuations

Lupin earns revenue from various international markets, and its financial results can be affected by changes in currency exchange rates. A sharp fluctuation in the value of the Indian Rupee or other major currencies can impact the company’s earnings, especially from global markets. These fluctuations can create uncertainty among investors and influence the stock price. -

Debt and Financial Health

While Lupin maintains a low debt-to-equity ratio, any increase in debt or financial strain could raise concerns among investors. Higher levels of debt can lead to increased interest payments, which may reduce profitability. This could make investors worry about the company’s financial stability, potentially leading to a decrease in the share price. -

Patent Expirations and Generic Competition

A significant portion of Lupin’s revenue comes from selling generic versions of branded drugs. When patents for branded medications expire, competitors can produce and sell cheaper generic versions. This increased competition could negatively affect Lupin’s sales from those products, reducing its revenue and ultimately impacting the stock price. -

Market Sentiment and Economic Conditions

The pharmaceutical industry is sensitive to both market sentiment and broader economic conditions. During economic downturns or times of uncertainty, investors may become more cautious and less willing to invest in stocks like Lupin. A decline in market sentiment can lead to price volatility, which may cause Lupin’s share price to fall, even if the company’s fundamentals are strong.

Read Also:- Piramal Pharma Share Price Target Tomorrow 2025 To 2030