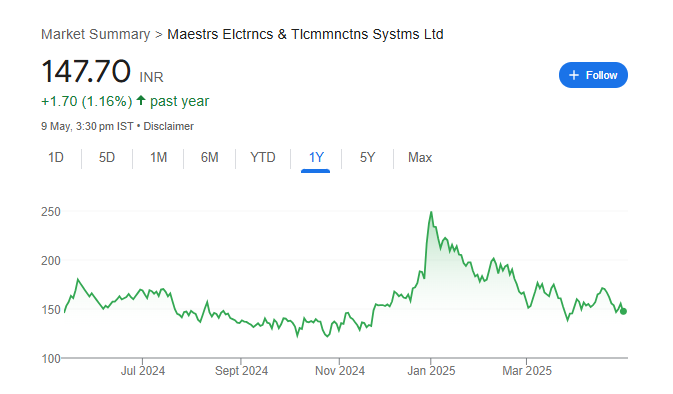

Maestros Electronics Share Price Target Tomorrow 2025 To 2030

Maestros Electronics & Telecommunications Systems Ltd., founded in 2010 and headquartered in Navi Mumbai, is a prominent Indian company specializing in the design, development, and manufacturing of advanced medical and telecommunication equipment. With a strong focus on innovation, the company offers a diverse range of products including electrocardiographs (ECGs), patient monitors, defibrillators, pulse oximeters, fetal monitors, and telemedicine solutions. Maestros operates through two main segments: Electronics & Instrumentation (E&T) and Telemedicine, catering to various healthcare needs such as cardiology, gynecology, critical care, and disease management. Maestros Electronics Share Price on BOM as of 10 May 2025 is 147.70 INR.

Maestros Electronics Share Market Overview

- Open: 154.95

- High: 155.05

- Low: 147.70

- Previous Close: 155.45

- Volume: 2,310

- Value (Lacs): 3.41

- VWAP: 148.87

- UC Limit: 155.45

- LC Limit: 140.65

- 52 Week High: 262.15

- 52 Week Low: 113.40

- Mkt Cap (Rs. Cr.): 81

- Face Value: 10

Maestros Electronics Share Price Chart

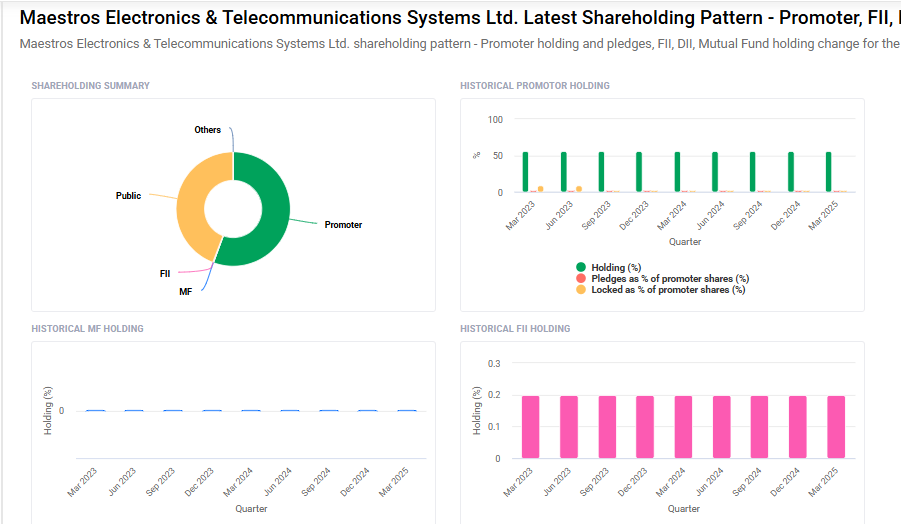

Maestros Electronics Shareholding Pattern

- Promoters: 55.6%

- FII: 0.2%

- DII: 0%

- Public: 44.2%

Maestros Electronics Share Price Target Tomorrow 2025 To 2030

| Maestros Electronics Share Price Target Years | Maestros Electronics Share Price |

| 2025 | ₹265 |

| 2026 | ₹280 |

| 2027 | ₹300 |

| 2028 | ₹320 |

| 2029 | ₹340 |

| 2030 | ₹360 |

Maestros Electronics Share Price Target 2025

Maestros Electronics share price target 2025 Expected target could ₹265. Here are four key factors that could influence Maestros Electronics & Telecommunications Systems Ltd.’s share price target for 2025:

-

Robust Financial Performance

In the third quarter of FY2024–25, Maestros Electronics reported a revenue of ₹5.66 crore, marking a 43.29% increase compared to the same period in the previous year. Net profit surged by 284.21% year-over-year to ₹0.73 crore, with net profit margins improving to 12.90% . This strong financial performance indicates enhanced operational efficiency and could positively impact investor confidence. -

Strategic Government Contracts

The company secured significant orders from government entities, including a contract from the Director General Armed Forces Medical Services for 1,046 ECG machines valued at ₹4.46 crore . Such contracts not only boost revenue but also enhance the company’s credibility and visibility in the healthcare sector. -

Consistent Revenue Growth

Over the past five years, Maestros Electronics has achieved a compound annual growth rate (CAGR) of 28.58% in revenue, outperforming the industry average of 10.02% . This consistent growth trajectory suggests a strong market position and effective business strategies. -

Product Diversification in Healthcare Technology

Maestros Electronics offers a diverse range of medical equipment, including ECG machines, patient monitors, defibrillators, and telemedicine solutions . This diversification allows the company to cater to various segments within the healthcare industry, potentially driving sustained growth.

Maestros Electronics Share Price Target 2030

Maestros Electronics share price target 2030 Expected target could ₹360. Here are four key risks and challenges that could impact Maestros Electronics & Telecommunications Systems Ltd.‘s share price target by 2030:

-

Volatile Stock Performance and Market Sentiment

Despite periods of growth, Maestros Electronics has experienced significant stock volatility. For instance, the stock declined notably in April 2025, underperforming relative to the Sensex and indicating a bearish trend. Such fluctuations can affect investor confidence and long-term valuation. -

Financial Constraints and Profitability Issues

The company has faced challenges related to low profits and high debts. Although there have been efforts to reduce debt, these financial constraints can limit the company’s ability to invest in growth opportunities and may impact its long-term sustainability. -

Intense Industry Competition

Operating in the medical electronics and telecommunication systems sector, Maestros Electronics faces stiff competition from both domestic and international players. This competitive landscape can pressure profit margins and market share, especially if larger competitors leverage economies of scale. -

Dependence on Government Contracts

A significant portion of Maestros Electronics’ revenue comes from government contracts. While these can provide substantial business, they also expose the company to risks related to policy changes, budget allocations, and procurement processes, which can be unpredictable and affect revenue stability.

Maestros Electronics Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 332.89M | 35.33% |

| Operating expense | 88.19M | 13.38% |

| Net income | 49.38M | 65.71% |

| Net profit margin | 14.83 | 22.46% |

| Earnings per share | — | — |

| EBITDA | 67.44M | 78.60% |

| Effective tax rate | 28.52% | — |

Read Also:- Take Solutions Share Price Target Tomorrow 2025 To 2030