MCX Share Price Target Tomorrow 2025 To 2030

MCX, or Multi Commodity Exchange of India Limited, is the country’s leading platform for commodity derivatives trading. It allows people to trade in commodities like gold, silver, crude oil, natural gas, and agricultural products. Headquartered in Mumbai, MCX helps businesses and investors manage price risks and discover fair market prices for various commodities. It is regulated by SEBI, which ensures that trading is safe, transparent, and well-monitored. MCX Share Price on NSE as of 24 April 2025 is 6,139.00 INR.

MCX Share Market Overview

- Open: 6,000.00

- High: 6,213.50

- Low: 5,909.00

- Previous Close: 5,977.50

- Volume: 492,531

- Value (Lacs): 30,231.55

- 52 Week High: 7,048.60

- 52 Week Low: 2,917.85

- Mkt Cap (Rs. Cr.): 31,302

- Face Value: 10

MCX Share Price Chart

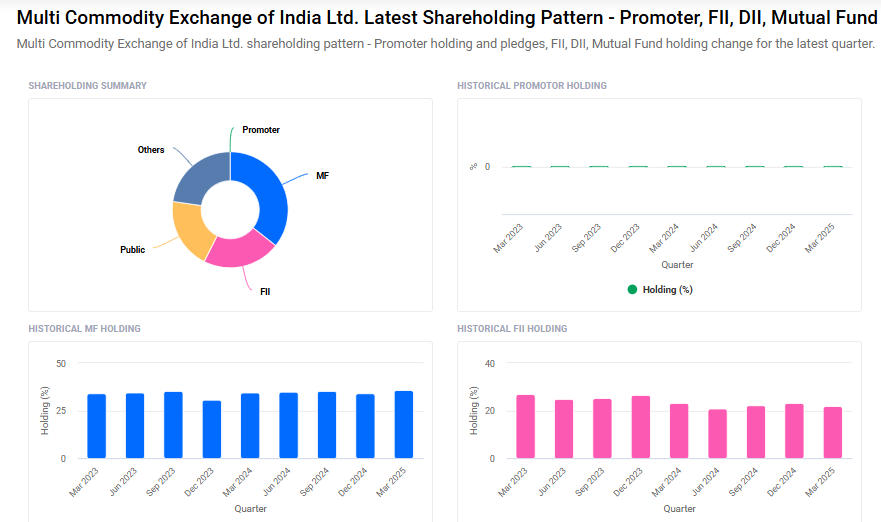

MCX Shareholding Pattern

- Promoters: 0%

- FII: 21.8%

- DII: 58.1%

- Public: 19.9%

MCX Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹7050

- 2026 – ₹9000

- 2027 – ₹11000

- 2028 – ₹13000

- 2030 – ₹15000

Major Factors Affecting MCX Share Price

Here are six key factors that influence the share price of Multi Commodity Exchange of India Ltd. (MCX):

1. Trading Volumes and Market Share

MCX’s revenue is closely tied to the trading volumes on its platform. The exchange holds a dominant position in the Indian commodity futures market, with a 95.9% share in FY24. Higher trading volumes, especially in energy and bullion futures, can boost MCX’s earnings and positively impact its share price.

2. Commodity Price Volatility

Fluctuations in commodity prices, influenced by global demand-supply dynamics, geopolitical tensions, and economic policies, can affect trading activity on MCX. Increased volatility often leads to higher trading volumes as traders seek to capitalize on price movements, potentially benefiting MCX’s revenue and share price.

3. Regulatory Environment

MCX operates under the oversight of regulatory bodies like the Securities and Exchange Board of India (SEBI). Changes in regulations, such as adjustments in trading norms or introduction of new compliance requirements, can influence the exchange’s operations and, consequently, its stock performance.

4. Technological Advancements

The efficiency and reliability of MCX’s trading platform are crucial for its operations. Upgrades or issues related to technology can impact trader confidence and participation. For instance, transitioning to a new trading system or addressing technical glitches can influence trading volumes and investor sentiment.

5. Financial Performance

MCX’s financial health, reflected in metrics like revenue growth, profit margins, and earnings per share, plays a significant role in determining its share price. Strong financial results can attract investors, while weaker performance may lead to stock price declines.

6. Investor Sentiment and Market Trends

Broader market trends and investor perceptions can influence MCX’s share price. Factors such as economic outlook, interest rate changes, and global financial events can affect investor behavior, leading to fluctuations in the stock’s demand and price.

Risks and Challenges for MCX Share Price

Here are six key risks and challenges that could influence the share price of Multi Commodity Exchange of India Ltd. (MCX):

1. High Valuation Concerns

MCX’s stock is currently considered overvalued by approximately 40% compared to its intrinsic value, which is estimated at ₹3,698.94. Such a high valuation may lead investors to be cautious, as the stock price might not be sustainable if the company’s earnings do not grow proportionally.

2. Technological Transition Challenges

MCX has faced delays in transitioning to a new trading platform developed by Tata Consultancy Services (TCS). These delays can disrupt trading activities and erode investor confidence, potentially impacting the share price negatively.

3. Commodity Price Volatility

MCX’s revenue is closely tied to trading volumes, which are influenced by commodity price volatility. Factors such as geopolitical tensions, natural disasters, and economic policies can cause significant fluctuations in commodity prices, affecting trading volumes and, consequently, MCX’s earnings.

4. Regulatory Risks

Operating under the oversight of regulatory bodies like the Securities and Exchange Board of India (SEBI), MCX is subject to changes in regulations. New compliance requirements or alterations in trading norms can impact the exchange’s operations and profitability.

5. Market Sentiment and Investor Behavior

Despite reporting a net profit of ₹160 crore for Q3 FY25, MCX’s shares fell by over 10%. This indicates that investor sentiment and market expectations play a significant role in the stock’s performance, sometimes outweighing actual financial results.

6. Economic and Trade Uncertainties

Global economic uncertainties and trade tensions can lead to reduced trading activity on commodity exchanges. Such slowdowns in trade can decrease MCX’s transaction volumes, thereby affecting its revenue and share price.

Read Also:- Super Crop Share Price Target Tomorrow 2025 To 2030