Menon Pistons Share Price Target Tomorrow 2025 To 2030

Menon Pistons Limited is a prominent Indian manufacturer specializing in high-precision engine components. Established in 1971 and headquartered in Kolhapur, Maharashtra, the company produces aluminum alloy pistons, forged steel pistons, piston pins, and related parts for a diverse range of applications, including passenger cars, commercial vehicles, power generators, earthmovers, and compressors. Menon Pistons Share Price on BOM as of 3 May 2025 is 54.40 INR.

Menon Pistons Share Market Overview

- Open: 54.95

- High: 54.99

- Low: 53.25

- Previous Close: 54.29

- Volume: 10,461

- Value (Lacs): 5.69

- VWAP: 54.38

- UC Limit: 65.16

- LC Limit: 43.44

- 52 Week High: 98.30

- 52 Week Low: 43.00

- Mkt Cap (Rs. Cr.): 277

- Face Value: 1

Menon Pistons Share Price Chart

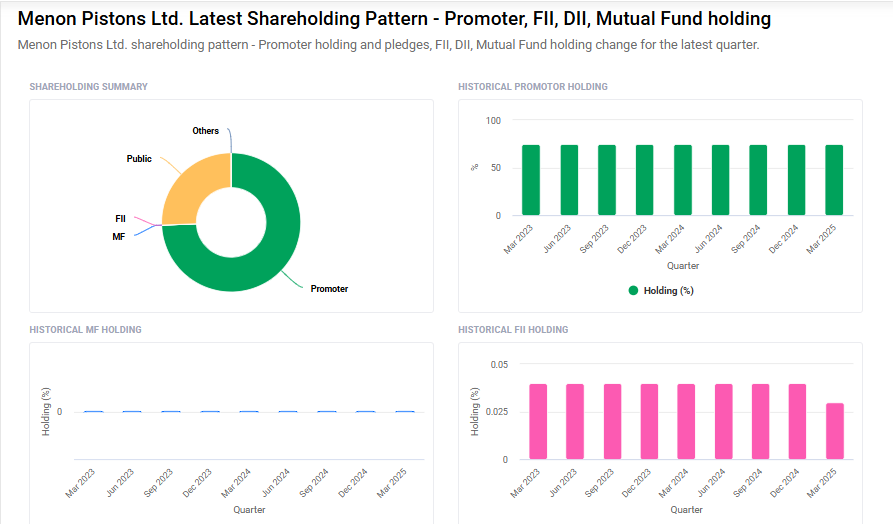

Menon Pistons Shareholding Pattern

- Promoters: 74.4%

- FII: 0%

- DII: 0%

- Public: 25.6%

Menon Pistons Share Price Target Tomorrow 2025 To 2030

| Menon Pistons Share Price Target Years | Menon Pistons Share Price |

| 2025 | ₹100 |

| 2026 | ₹120 |

| 2027 | ₹140 |

| 2028 | ₹160 |

| 2029 | ₹180 |

| 2030 | ₹200 |

Menon Pistons Share Price Target 2025

Menon Pistons share price target 2025 Expected target could ₹100. Here are four key factors that could influence the growth of Menon Pistons Ltd and its share price target for 2025:

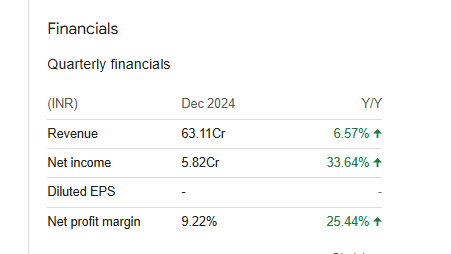

1. Consistent Revenue Growth

Menon Pistons has demonstrated steady financial performance, with consolidated net sales of ₹63.11 crore in December 2024, marking a 6.57% year-over-year increase. This consistent growth indicates strong demand for its products and effective operational strategies.

2. Robust Financial Health

The company maintains a healthy financial position, with a low debt-to-equity ratio of 0.15 and strong return metrics, including a Return on Equity (ROE) of 19.32% and Return on Capital Employed (ROCE) of 22.76%. Such financial stability positions Menon Pistons well for sustainable growth and potential share price appreciation.

3. Favorable Industry Outlook

The global piston market is experiencing steady growth, projected to expand from $3.57 billion in 2024 to $3.78 billion in 2025 at a CAGR of 5.9%. This positive industry trend provides a conducive environment for Menon Pistons to capitalize on increasing demand.

4. Strategic Investments in Renewable Energy

Menon Pistons has approved borrowing up to ₹14 crore for investment in a solar project, reflecting its commitment to sustainable practices and potential cost savings in the long term. Such strategic initiatives can enhance the company’s reputation and operational efficiency.

Menon Pistons Share Price Target 2030

Menon Pistons share price target 2030 Expected target could ₹200. Here are four key Risks and Challenges that could impact Menon Pistons Ltd:

1. Customer Concentration Risk

Approximately 50% of Menon Pistons’ revenue is derived from its top two customers, including Cummins India Limited. This heavy reliance on a limited customer base exposes the company to significant risks if any of these clients reduce their orders or switch to competitors. Such dependency can lead to revenue volatility and impact long-term financial stability.

2. Technological Disruption and Market Shifts

The automotive industry is rapidly evolving, with a shift towards electric vehicles (EVs) and alternative propulsion systems. As EVs do not require traditional internal combustion engine components like pistons, Menon Pistons may face declining demand for its core products. Adapting to these technological changes is crucial to remain competitive and sustain growth.

3. Intense Industry Competition

The piston manufacturing sector is highly competitive, with numerous players vying for market share. This intense competition can lead to pricing pressures, reduced profit margins, and the need for continuous innovation. Menon Pistons must invest in research and development to differentiate its products and maintain its market position.

4. Regulatory and Environmental Challenges

Stricter environmental regulations and emission norms are being implemented globally. Compliance with these regulations may require significant investments in cleaner technologies and processes. Failure to meet regulatory standards can result in penalties, operational disruptions, and reputational damage.

Menon Pistons Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 2.56B | 1.78% |

| Operating expense | 1.08B | 4.93% |

| Net income | 264.51M | 13.34% |

| Net profit margin | 10.35 | 11.41% |

| Earnings per share | — | — |

| EBITDA | 455.09M | 4.83% |

| Effective tax rate | 23.49% | — |

Read Also:- RCF Share Price Target Tomorrow 2025 To 2030