Moil Share Price Target Tomorrow 2025 To 2030

MOIL Limited is a government-owned mining company in India and the largest producer of manganese ore in the country. Headquartered in Nagpur, Maharashtra, MOIL plays a key role in supplying raw materials to the steel industry, which depends on manganese for manufacturing. The company operates several mines in Madhya Pradesh and Maharashtra, and it continues to grow by increasing its production and exploring new reserves. MOIL is also focusing on value-added products and cleaner, more efficient mining practices. Moil Share Price on NSE as of 2 May 2025 is 314.60 INR.

Moil Share Market Overview

- Open: 326.00

- High: 326.00

- Low: 314.10

- Previous Close: 324.10

- Volume: 554,650

- Value (Lacs): 1,751.58

- 52 Week High: 588.00

- 52 Week Low: 274.05

- Mkt Cap (Rs. Cr.): 6,426

- Face Value: 10

Moil Share Price Chart

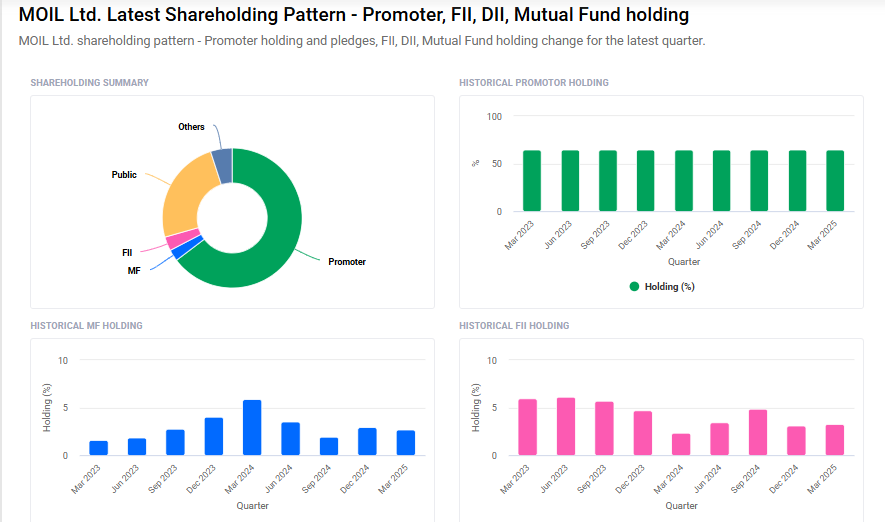

Moil Shareholding Pattern

- Promoters: 64.7%

- FII: 3.3%

- DII: 7.7%

- Public: 24.4%

Moil Share Price Target Tomorrow 2025 To 2030

| Moil Share Price Target Years | Moil Share Price |

| 2025 | ₹590 |

| 2026 | ₹620 |

| 2027 | ₹650 |

| 2028 | ₹680 |

| 2029 | ₹710 |

| 2030 | ₹740 |

Moil Share Price Target 2025

Moil share price target 2025 Expected target could ₹590. Here are four key factors influencing the growth of MOIL Limited and its share price target for 2025:

1. Record Manganese Ore Production

In the fiscal year 2024-25, MOIL achieved a record production of 18.02 lakh tonnes of manganese ore, marking a 2.7% increase over the previous year. This milestone reflects the company’s operational efficiency and its ability to meet rising demand in the steel industry.

2. Strategic Price Revisions

Effective March 1, 2025, MOIL increased the prices of ferro grades of manganese ore by 10% and other grades by 6.5%. This strategic move aligns with market conditions and is expected to enhance the company’s revenue streams.

3. Positive Financial Forecasts

Analysts forecast that MOIL’s earnings and revenue will grow by 26.4% and 17.4% per annum, respectively. The company’s earnings per share (EPS) is expected to grow by 26.8% annually, indicating strong financial health and potential for share price appreciation.

4. Favorable Analyst Ratings

Brokerage firm Anand Rathi has assigned a ‘Buy’ rating to MOIL, with a target price of ₹400, suggesting a 21% upside from the last traded price of ₹328. Such endorsements from financial analysts can boost investor confidence and positively influence the share price.

Moil Share Price Target 2030

Moil share price target 2030 Expected target could ₹740. Here are four key Risks and Challenges that could impact MOIL Limited:

1. Dependence on Steel Industry Demand

MOIL’s primary product, manganese ore, is heavily utilized in steel manufacturing. Any slowdown in the steel industry, due to global economic downturns or reduced infrastructure spending, could lead to decreased demand for manganese ore, adversely affecting MOIL’s revenues and profitability.

2. Regulatory and Environmental Compliance

The mining sector is subject to stringent environmental regulations. Changes in governmental policies related to pollution control and mining operations could increase compliance costs or restrict production activities, potentially impacting MOIL’s operational efficiency and financial performance.

3. Global Market Competition

MOIL faces competition from international manganese ore producers, especially from countries with lower production costs. Increased global supply or aggressive pricing by competitors could pressure MOIL’s market share and margins, affecting its competitiveness in both domestic and international markets.

4. Operational and Expansion Risks

MOIL has set ambitious targets to increase its production capacity to 3 million tonnes by 2030. Achieving this goal involves significant capital expenditure and operational scaling. Delays in project execution, cost overruns, or challenges in acquiring new mining leases could hinder growth plans and affect investor confidence.

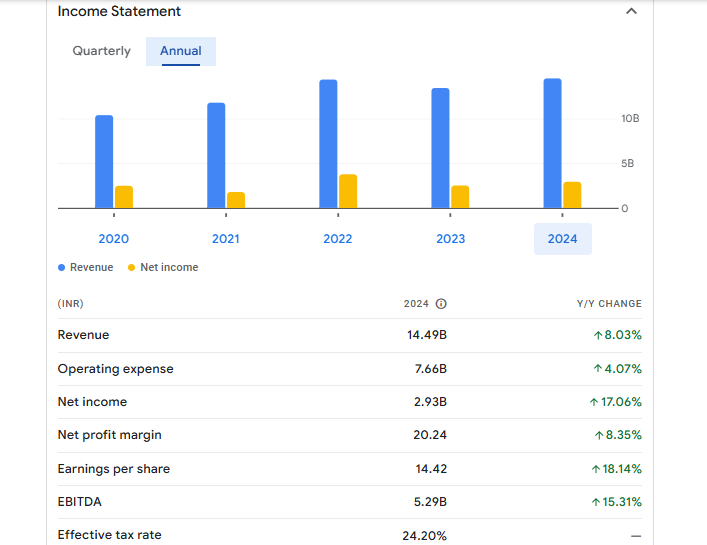

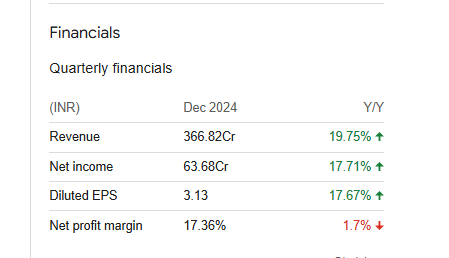

Moil Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 14.49B | 8.03% |

| Operating expense | 7.66B | 4.07% |

| Net income | 2.93B | 17.06% |

| Net profit margin | 20.24 | 8.35% |

| Earnings per share | 14.42 | 18.14% |

| EBITDA | 5.29B | 15.31% |

| Effective tax rate | 24.20% | — |

Read Also:- Shree Renuka Sugars Share Price Target Tomorrow 2025 To 2030