Morarjee Textiles Share Price Target Tomorrow 2025 To 2030

Morarjee Textiles Limited, established in 1871, is one of India’s oldest textile companies and a pioneer in the cotton fabric industry. Headquartered in Mumbai, the company specializes in premium yarn-dyed shirting and high-fashion printed fabrics, serving both domestic and international markets. With a rich legacy, Morarjee has evolved by integrating state-of-the-art technology and sustainable practices into its operations. Its product range includes fashion prints, voiles, and white fabrics, catering to renowned global brands. Morarjee Textiles Share Price on NSE as of 18 April 2025 is 7.58 INR.

Morarjee Textiles Share Market Overview

- Open: 7.58

- High: 7.58

- Low: 6.91

- Previous Close: 7.22

- Volume: 30,742

- Value (Lacs): 2.33

- VWAP: 7.56

- UC Limit: 7.58

- LC Limit: 6.85

- 52 Week High: 19.65

- 52 Week Low: 4.56

- Mkt Cap (Rs. Cr.): 27

- Face Value: 7

Morarjee Textiles Share Price Chart

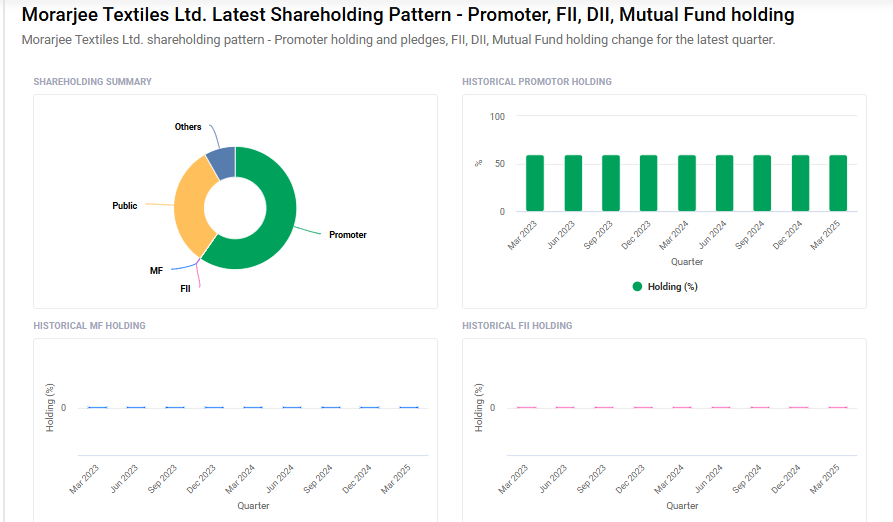

Morarjee Textiles Shareholding Pattern

- Promoters: 59.7%

- FII: 0%

- DII: 4%

- Public: 36.3%

Morarjee Textiles Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹20

- 2026 – ₹30

- 2027 – ₹40

- 2028 – ₹50

- 2030 – ₹60

Major Factors Affecting Morarjee Textiles Share Price

-

Financial Performance and Profitability

Morarjee Textiles has faced challenges in maintaining consistent profitability. Over the past five years, the company has experienced a decline in net sales and operating profit, indicating financial stress. Such financial performance can influence investor confidence and, consequently, the share price. -

Debt Levels and Financial Leverage

The company has a high debt-to-equity ratio, averaging around 2.75 times, suggesting significant reliance on borrowed funds. High debt levels can lead to increased interest obligations and financial risk, potentially impacting the company’s valuation and share price. -

Market Demand and Export Exposure

Morarjee Textiles caters to both domestic and international markets, supplying premium cotton shirting and fashion fabrics. Fluctuations in global demand, especially in key export regions, can affect sales volumes and revenue, thereby influencing the share price. -

Raw Material Costs and Input Prices

The textile industry is sensitive to changes in raw material prices, such as cotton and dyes. Increases in these input costs can compress profit margins if not passed on to customers, potentially affecting the company’s profitability and share valuation. -

Operational Efficiency and Asset Utilization

Efficient use of assets is crucial for profitability. Morarjee Textiles has shown signs of inefficient asset utilization, with a declining return on assets (ROA) in recent years. Such operational challenges can impact investor perceptions and the company’s market value. -

Regulatory Environment and Compliance

The textile sector is subject to various regulations related to labor laws, environmental standards, and trade policies. Changes in these regulations or non-compliance can lead to operational disruptions or financial penalties, potentially affecting the company’s performance and share price.

Risks and Challenges for Morarjee Textiles Share Price

-

High Debt Burden

Morarjee Textiles has a significant amount of debt, which puts pressure on its financial health. A high debt level increases interest costs and limits the company’s ability to invest in new opportunities. If not managed well, this can impact profitability and lower investor confidence, affecting the share price. -

Weak Financial Performance

In recent years, the company has reported losses and a decline in revenue. Continuous financial struggles may raise doubts about future growth, causing long-term investors to stay cautious. Poor earnings can lead to negative sentiment in the market, pushing the share price down. -

Dependence on Global Demand

A large part of Morarjee’s business comes from exports. So, changes in global fashion trends, economic slowdowns in importing countries, or trade restrictions can reduce demand for its products. This makes the business vulnerable to factors beyond its control, which can affect its stock performance. -

Fluctuating Raw Material Prices

The cost of raw materials like cotton, dyes, and chemicals plays a big role in the textile business. If input costs rise sharply and the company is unable to pass them on to customers, it can shrink profit margins. This financial pressure may be reflected in the share price. -

Competition in the Textile Sector

The textile industry in India is highly competitive, with many local and international players offering similar products. If Morarjee cannot stay ahead with quality, innovation, or pricing, it may lose market share. A decline in market position often leads to reduced investor interest and a dip in share value. -

Regulatory and Environmental Risks

The company must follow strict environmental and labor regulations. Any failure to comply can result in penalties or restrictions on operations. In addition, changes in government policies, such as taxation or import/export rules, can bring uncertainty, making the stock more volatile.

Read Also:- KIOCL Share Price Target Tomorrow 2025 To 2030