Munjal Auto Share Price Target Tomorrow 2025 To 2030

Munjal Auto Industries Limited, established in 1985 and headquartered in Gurugram, India, is a prominent manufacturer of auto components. As part of the Hero Group, the company specializes in producing exhaust systems, fuel tanks, wheel rims, and body-in-white (BIW) parts for two-wheelers and four-wheelers. With manufacturing facilities in Gujarat, Haryana, and Uttarakhand, Munjal Auto serves major automotive manufacturers across India. Munjal Auto Share Price on NSE as of 3 May 2025 is 72.04 INR.

Munjal Auto Share Market Overview

- Open: 72.00

- High: 73.65

- Low: 71.11

- Previous Close: 72.26

- Volume: 90,050

- Value (Lacs): 65.36

- VWAP: 72.45

- UC Limit: 86.71

- LC Limit: 57.80

- 52 Week High: 145.70

- 52 Week Low: 60.52

- Mkt Cap (Rs. Cr.): 725

- Face Value: 2

Munjal Auto Share Price Chart

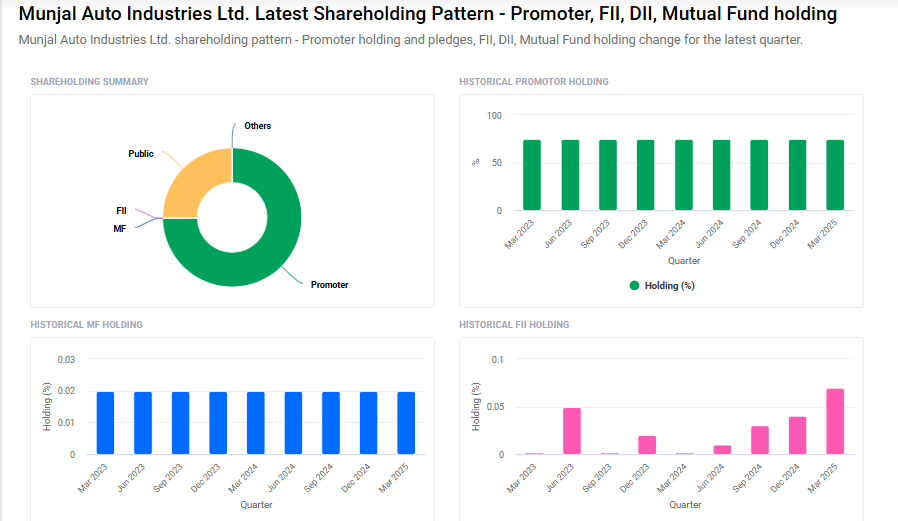

Munjal Auto Shareholding Pattern

- Promoters: 74.8%

- FII: 0.1%

- DII: 0%

- Public: 25.1%

Munjal Auto Share Price Target Tomorrow 2025 To 2030

| Munjal Auto Share Price Target Years | Munjal Auto Share Price |

| 2025 | ₹150 |

| 2026 | ₹170 |

| 2027 | ₹190 |

| 2028 | ₹210 |

| 2029 | ₹230 |

| 2030 | ₹250 |

Munjal Auto Share Price Target 2025

Munjal Auto share price target 2025 Expected target could ₹150. Here are four key factors that could influence the growth of Munjal Auto Industries Ltd:

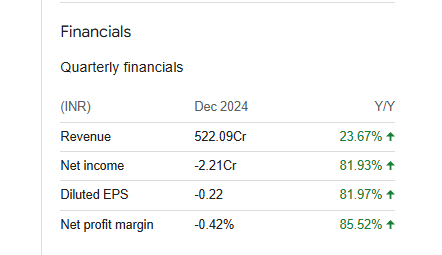

1. Robust Revenue Growth

Munjal Auto Industries has demonstrated strong revenue performance, with net sales reaching ₹522.09 crore in December 2024, marking a 23.67% year-over-year increase. This significant growth indicates a healthy demand for the company’s products and services, which could positively impact its share price.

2. Competitive Valuation

The company’s Price-to-Earnings (P/E) ratio stands at 13.2x, which is considerably lower than the peer average of 33.8x. This suggests that Munjal Auto Industries is undervalued relative to its peers, potentially offering investors an attractive entry point.

3. Positive Earnings Momentum

Munjal Auto Industries has shown a consistent improvement in earnings, with an average annual growth rate of 26.2%. This upward trend in profitability reflects the company’s effective operational strategies and market positioning.

4. Favorable Industry Outlook

The Indian auto sector is projected to grow at a compound annual growth rate (CAGR) of 10% over the next five years, driven by increased demand for vehicles and supportive government policies. As a key player in the auto components industry, Munjal Auto Industries stands to benefit from this sectoral growth.

Munjal Auto Share Price Target 2030

Munjal Auto share price target 2030 Expected target could ₹250. Here are 4 key risks and challenges that could affect the long-term growth and share price target of Munjal Auto Industries Ltd. by 2030::

1. Dependence on Two-Wheeler and Auto Sector Cycles

Munjal Auto’s performance is closely tied to the two-wheeler and broader automobile industry. Any prolonged slowdown in vehicle sales, due to economic downturns or consumer preference shifts (like move to electric vehicles), could hurt demand for its components.

2. Transition to Electric Vehicles (EVs)

The global shift towards electric mobility may disrupt traditional auto component suppliers. If Munjal Auto doesn’t adapt quickly by diversifying into EV-related components, its traditional business could face obsolescence risk.

3. Raw Material Price Volatility

Fluctuations in the prices of steel and other metals used in manufacturing can significantly impact profit margins. Munjal Auto may struggle to pass on these cost increases to OEMs (original equipment manufacturers).

4. High Competition and Margin Pressure

The auto component industry is highly competitive, with many domestic and international players. This can lead to pricing pressure and impact profitability, especially if the company cannot maintain technological or operational advantages.

Munjal Auto Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 18.82B | -5.17% |

| Operating expense | 4.87B | 12.15% |

| Net income | 384.90M | -31.43% |

| Net profit margin | 2.05 | -27.56% |

| Earnings per share | — | — |

| EBITDA | 902.75M | 43.29% |

| Effective tax rate | 37.90% | — |

Read Also:- Sterlite Power Share Price Target Tomorrow 2025 To 2030