NCC Share Price Target Tomorrow 2025 To 2030

NCC Limited, formerly known as Nagarjuna Construction Company, is a well-known Indian infrastructure firm that has been helping build the nation since 1978. Headquartered in Hyderabad, the company works across various sectors like roads, buildings, water, power, and mining. NCC is known for its large project portfolio and has taken part in key government and private sector developments. With a strong order book and years of experience, NCC continues to grow steadily. NCC Share Price on NSE as of 15 May 2025 is 225.70 INR.

NCC Share Market Overview

- Open: 221.00

- High: 227.30

- Low: 220.11

- Previous Close: 220.15

- Volume: 6,169,705

- Value (Lacs): 13,950.32

- 52 Week High: 364.50

- 52 Week Low: 117.40

- Mkt Cap (Rs. Cr.): 14,196

- Face Value: 2

NCC Share Price Chart

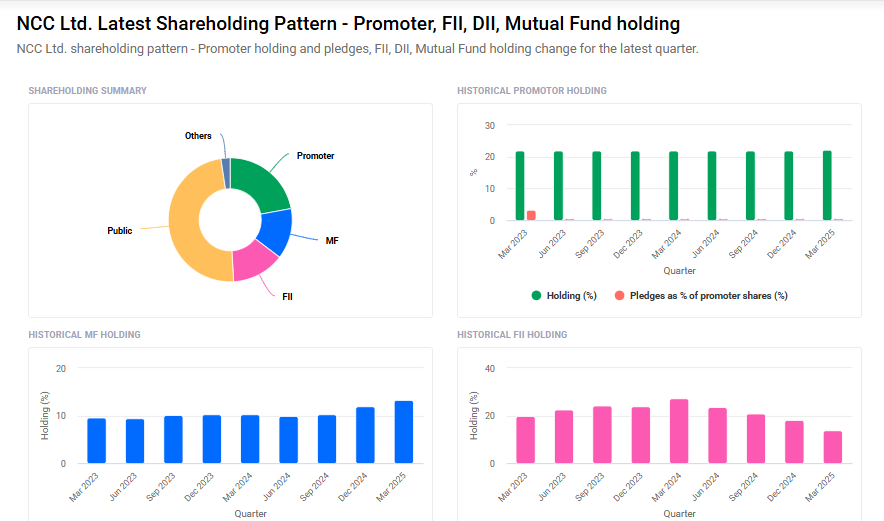

NCC Shareholding Pattern

- Promoters: 22.1%

- FII: 13.8%

- DII: 15.6%

- Public: 48.5%

NCC Share Price Target Tomorrow 2025 To 2030

| NCC Share Price Target Years | NCC Share Price |

| 2025 | ₹370 |

| 2026 | ₹400 |

| 2027 | ₹430 |

| 2028 | ₹460 |

| 2029 | ₹490 |

| 2030 | ₹520 |

NCC Share Price Target 2025

NCC share price target 2025 Expected target could ₹370. Here are five key factors that could influence the growth of NCC Limited’s share price target for 2025:

-

Robust Order Book: As of December 2024, NCC reported a strong order book valued at ₹55,548 crore, indicating a healthy pipeline for future projects and potential revenue growth.

-

Strategic Project Wins: In September 2024, NCC secured orders totaling ₹2,327 crore across its Transportation, Electrical, and Building divisions. These contracts, awarded by state government agencies and private firms, demonstrate NCC’s competitive positioning in the infrastructure sector.

-

Revised Revenue Guidance: For FY25, NCC has adjusted its revenue growth guidance to 5%, down from the earlier 15%, due to election-related slowdowns and delayed payments. This conservative outlook reflects the company’s cautious approach amid macroeconomic uncertainties.

-

Analyst Price Targets: Analysts have set a price target of ₹272.77 for NCC, with estimates ranging between ₹150.00 and ₹335.00. These projections suggest potential upside, contingent on the company’s execution and market conditions.

-

Strong Promoter Confidence: The late investor Rakesh Jhunjhunwala’s portfolio included a significant stake in NCC, with his wife Rekha Jhunjhunwala holding 10.63% as of December 2024. Such substantial promoter holding often signals confidence in the company’s long-term prospects.

NCC Share Price Target 2030

NCC share price target 2030 Expected target could ₹520. Here are five key risks and challenges that could impact NCC Limited’s share price target by 2030:

-

Macroeconomic Uncertainties: NCC’s performance is closely tied to government infrastructure spending. Economic slowdowns, policy shifts, or reduced public investment could adversely affect project inflows and revenue growth.

-

Execution Risks: Large-scale infrastructure projects often encounter delays due to regulatory approvals, land acquisition issues, or unforeseen challenges. Such delays can escalate costs and impact profitability.

-

Competitive Pressure: The construction sector is highly competitive, with numerous players vying for projects. Increased competition can lead to margin pressures and affect NCC’s market share.

-

Regulatory and Environmental Compliance: Evolving environmental regulations and compliance requirements can lead to increased operational costs and project delays if not managed effectively.

-

Financial Leverage: High levels of debt can strain the company’s financial health, especially if project cash flows are delayed. Managing debt levels is crucial to maintain investor confidence and financial stability.

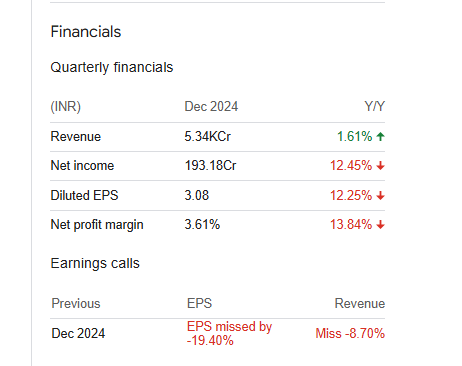

NCC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 208.45B | 34.02% |

| Operating expense | 14.38B | 11.54% |

| Net income | 7.11B | 16.66% |

| Net profit margin | 3.41 | -13.01% |

| Earnings per share | 11.68 | 27.95% |

| EBITDA | 17.69B | 21.24% |

| Effective tax rate | 30.21% | — |

Read Also:- SEL Manufacturing Share Price Target Tomorrow 2025 To 2030