NLC Share Price Target Tomorrow 2025 To 2030

NLC India Limited, formerly known as Neyveli Lignite Corporation, is a government-owned company that plays a key role in the power and energy sector of India. It mainly operates in lignite mining and power generation, making it an important contributor to the country’s electricity supply. The company is also expanding into renewable energy, showing its commitment to a greener future. NLC shares are often seen as a long-term investment option, especially for those who prefer public sector undertakings with a stable business model. NLC Share Price on NSE as of 22 April 2025 is 245.80 INR.

NLC Share Market Overview

- Open: 248.22

- High: 250.70

- Low: 244.10

- Previous Close: 247.51

- Volume: 1,013,167

- Value (Lacs): 2,492.09

- VWAP: 247.42

- UC Limit: 297.01

- LC Limit: 198.00

- 52 Week High: 311.80

- 52 Week Low: 186.03

- Mkt Cap (Rs. Cr.): 34,107

- Face Value: 10

NLC Share Price Chart

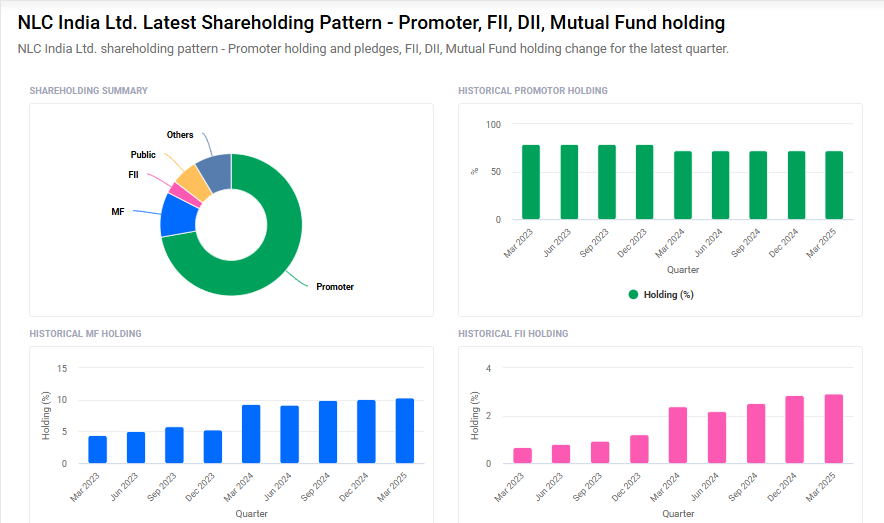

NLC Shareholding Pattern

- Promoters: 72.2%

- FII: 2.9%

- DII: 18.9%

- Public: 6%

NLC Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹315

- 2026 – ₹360

- 2027 – ₹400

- 2028 – ₹440

- 2030 – ₹480

Major Factors Affecting NLC Share Price

Here are six key factors that influence the share price of NLC India Ltd:

1. Financial Performance and Earnings Growth

NLC India’s share price is closely tied to its financial results. For instance, in the third quarter of FY25, the company reported a significant increase in earnings per share (EPS), rising to ₹5.02 from ₹1.83 in the same quarter of the previous year. Such strong earnings growth can boost investor confidence and positively impact the share price.

2. Valuation Metrics

Analysts assess whether a stock is undervalued or overvalued by comparing its intrinsic value to the current market price. As of April 2025, NLC India’s intrinsic value is estimated at ₹377.74 per share, while the market price is around ₹246.34, suggesting the stock may be undervalued by approximately 35%.

3. Debt Levels and Financial Leverage

The company’s debt levels can influence investor perception. NLC India has a debt-to-equity ratio of 0.50, indicating a moderate level of debt relative to its equity. While this suggests prudent financial management, investors monitor such ratios to assess financial stability.

4. Dividend Policy

Dividend announcements can affect a company’s share price. In February 2025, NLC India declared a dividend of ₹1.50 per share. Regular dividends can attract income-focused investors, potentially supporting the share price.

5. Operational Performance and Expansion Plans

NLC India’s operational efficiency and expansion initiatives play a role in its stock performance. The company operates in lignite mining and power generation, with plans to diversify its energy mix through joint ventures in Rajasthan and Assam. Such strategic moves can influence investor sentiment and the share price.

6. Market Sentiment and Technical Indicators

Investor sentiment and technical analysis indicators, such as moving averages and momentum oscillators, can impact short-term share price movements. For NLC India, technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are monitored by traders to gauge potential price trends.

Risks and Challenges for NLC Share Price

Here are six key risks and challenges that could influence the share price of NLC India Ltd:

1. High Debt Levels

NLC India has taken on significant debt, including a recent approval for $200 million in external commercial borrowing. While borrowing can support expansion, excessive debt may strain the company’s finances, especially if revenues do not grow as expected. This financial pressure can affect investor confidence and the share price.

2. Overvaluation Concerns

As of April 2025, NLC India’s stock is trading at a premium of 128% compared to its estimated intrinsic value of ₹108.76. Such overvaluation suggests that the market price may not be justified by the company’s fundamentals, posing a risk of price correction.

3. Market Volatility

The company’s stock has experienced significant price fluctuations, including a 3.12% decline on April 4, 2025. Such volatility can be unsettling for investors and may lead to short-term trading losses.

4. Regulatory and Bureaucratic Challenges

Being a public sector enterprise, NLC India may face bureaucratic hurdles and policy changes that can impact its operations and profitability. Regulatory challenges can introduce uncertainties that affect investor sentiment.

5. Declining Earnings Performance

Recent analyses indicate that NLC India’s earnings have not kept pace with other companies in the sector. This underperformance may lead investors to question the company’s growth prospects, potentially impacting the share price.

6. Macroeconomic Factors

Broader economic issues, such as inflation, interest rate changes, and global economic slowdowns, can affect NLC India’s operations and profitability. These macroeconomic factors can influence investor confidence and the company’s stock performance.

Read Also:- HDFC Bank Share Price Target Tomorrow 2025 To 2030