Nova Agritech Share Price Target Tomorrow 2025 To 2030

Nova Agritech Limited is an Indian agricultural inputs company founded in 2007 and headquartered in Hyderabad, Telangana. Established by Sambasivarao Yeluri and Kalyana Chakravarthy, the company aims to provide ecologically sustainable and nutritionally balanced solutions to farmers.

Nova Agritech specializes in soil health management, crop nutrition, and crop protection. Its product range includes organic and inorganic fertilizers, micronutrients, bio-stimulants, bio-pesticides, and integrated pest management (IPM) products. Nova Agritech Share Price on NSE as of 18 April 2025 is 47.80 INR.

Nova Agritech Share Market Overview

- Open: 47.10

- High: 48.44

- Low: 46.75

- Previous Close: 47.10

- Volume: 210,353

- Value (Lacs): 100.97

- VWAP: 47.73

- UC Limit: 56.52

- LC Limit: 37.68

- 52 Week High: 94.00

- 52 Week Low: 40.40

- Mkt Cap (Rs. Cr.): 444

- Face Value: 2

Nova Agritech Share Price Chart

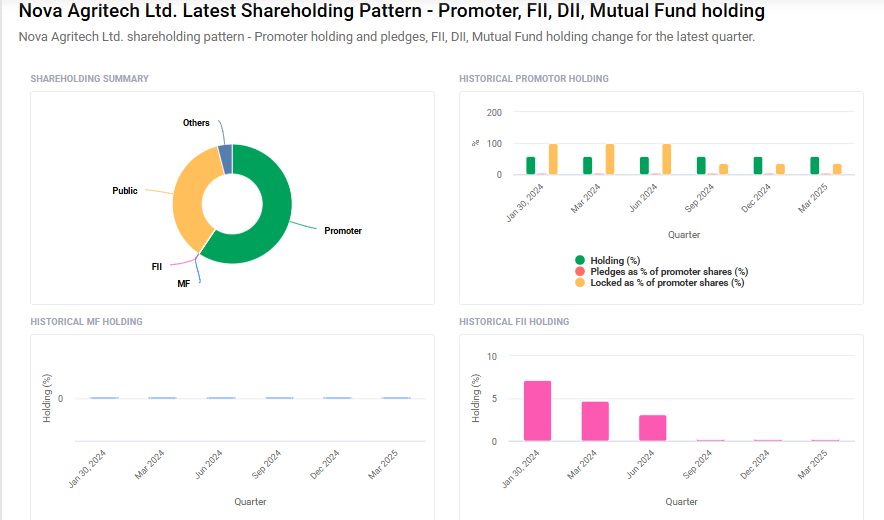

Nova Agritech Shareholding Pattern

- Promoters: 59.4%

- FII: 0.1%

- DII: 1.3%

- Public: 39.3%

Nova Agritech Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹100

- 2026 – ₹150

- 2027 – ₹200

- 2028 – ₹250

- 2030 – ₹300

Major Factors Affecting Nova Agritech Share Price

-

Financial Performance and Profit Growth

Nova Agritech has demonstrated strong financial growth, with a net profit increase of 38.2% year-on-year in FY24, reaching ₹283 million. Consistent earnings growth often boosts investor confidence and positively influences the share price. -

Market Valuation Metrics

The company’s Price-to-Earnings (P/E) ratio stands at approximately 14.5x, which is considered favorable compared to the industry average of 16.7x. A reasonable P/E ratio can make the stock attractive to investors seeking value. -

Operational Efficiency and Return on Equity (ROE)

Nova Agritech maintains a healthy ROE of around 14.2%, indicating effective utilization of shareholders’ equity to generate profits. High ROE is often viewed positively by investors and can support a higher share price. -

Debt Management and Financial Health

The company has effectively reduced its debt, achieving a debt-to-equity ratio of 0.0 in FY24, down from 0.3 in FY23. A strong balance sheet with low debt levels enhances financial stability and can positively impact the stock’s valuation. -

Cash Flow Position

Despite profitability, Nova Agritech experienced a significant decrease in cash flow from operations in FY24, dropping to ₹8 million from ₹57 million in FY23. Sustained negative cash flow could raise concerns about liquidity and affect investor sentiment. -

Market Sentiment and Stock Volatility

The company’s stock has experienced volatility, recently nearing its 52-week low of ₹40.40. Market sentiment, influenced by broader economic factors and investor perceptions, can lead to fluctuations in share price regardless of the company’s financial performance.

Risks and Challenges for Nova Agritech Share Price

-

Dependence on Agriculture Sector Performance

Nova Agritech’s business is closely tied to the performance of the agriculture sector, which can be influenced by factors like weather conditions, crop yields, and seasonal demand. Poor agricultural performance, such as droughts or floods, can affect the company’s sales and ultimately impact its stock price. -

Fluctuating Raw Material Prices

As a company involved in the production and supply of agricultural products, Nova Agritech is vulnerable to fluctuations in the prices of raw materials, such as seeds, fertilizers, and other farming supplies. A sudden increase in these costs can reduce profit margins and hurt investor sentiment, leading to a decline in share price. -

Debt Management Risks

While Nova Agritech has made progress in reducing its debt, any future borrowing or debt mismanagement could affect the company’s financial stability. Increased debt or poor debt servicing may cause investors to worry, which could negatively impact the share price. -

Regulatory and Policy Changes

Agriculture and farming-related industries are highly regulated. Changes in government policies, such as subsidies, tax rates, or export-import restrictions, can impact Nova Agritech’s business operations. Uncertainty in government policy can lead to a lack of investor confidence and cause volatility in the stock price. -

Cash Flow Issues

Although the company has been profitable, Nova Agritech has experienced fluctuations in its cash flow. Negative or inconsistent cash flow, especially when it is lower than expected, can raise concerns about the company’s ability to reinvest in its operations or pay dividends, which may result in a drop in share price. -

Market Competition

The agricultural industry is highly competitive, with many companies vying for market share. If Nova Agritech fails to maintain a competitive edge in terms of quality, pricing, or innovation, it could lose customers and market share. Increased competition can affect the company’s revenue growth and lower the share price over time.

Read Also:- Tata Investment Share Price Target Tomorrow 2025 To 2030