NTPC Share Price Target Tomorrow 2025 To 2030

NTPC Limited, also known as National Thermal Power Corporation, is India’s largest power-generating company. It was founded in 1975 and is owned by the Government of India. NTPC plays a key role in meeting the country’s electricity needs by producing power from coal, gas, hydro, and now renewable sources like solar and wind. In recent years, the company has been working towards cleaner energy by investing in green projects such as solar parks and hydrogen energy. NTPC Share Price on NSE as of 26 May 2025 is 344.60 INR.

NTPC Share Market Overview

- Open: 342.00

- High: 344.95

- Low: 340.15

- Previous Close: 341.40

- Volume: 4,045,937

- Value (Lacs): 13,942.30

- 52 Week High: 448.45

- 52 Week Low: 292.80

- Mkt Cap (Rs. Cr.): 334,147

- Face Value: 10

NTPC Share Price Chart

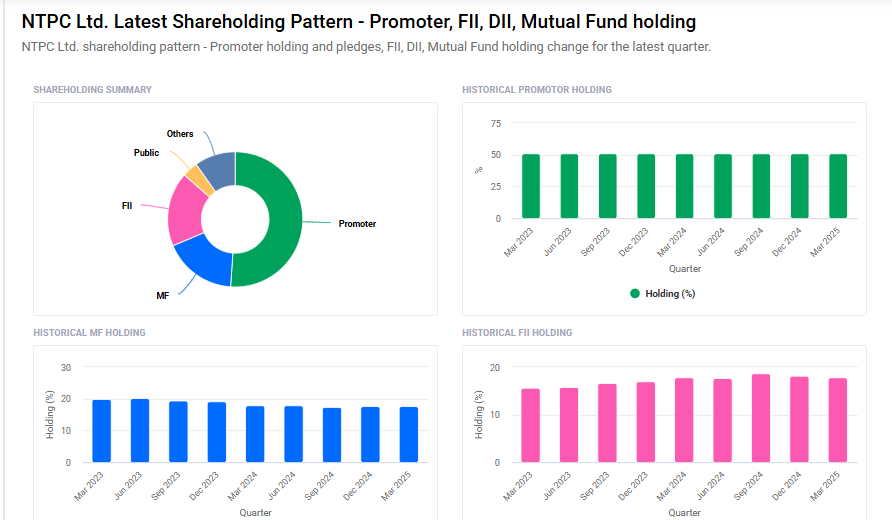

NTPC Shareholding Pattern

- Promoters: 51.1%

- FII: 17.8%

- DII: 27.3%

- Public: 3.8%

NTPC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹450 |

| 2026 | ₹480 |

| 2027 | ₹510 |

| 2028 | ₹540 |

| 2029 | ₹570 |

| 2030 | ₹600 |

NTPC Share Price Target 2025

NTPC share price target 2025 Expected target could ₹450. Here are five key factors that could influence NTPC Limited’s share price growth by 2025:

1. Strong Financial Performance

NTPC reported a 22% year-on-year increase in consolidated net profit for Q4 FY25, reaching ₹7,897 crore, driven by higher revenues from its power generation operations.

2. Expansion into Renewable Energy

The company added 3,312 megawatts of renewable capacity in FY25 and launched India’s first Green Hydrogen Hub in Andhra Pradesh, signaling a shift towards sustainable energy sources.

3. Analyst Endorsements and Positive Outlook

Analysts have maintained a positive outlook on NTPC, with some setting a target price of ₹500 per share, reflecting confidence in the company’s growth prospects.

4. Government Support and Policy Initiatives

As a state-owned enterprise, NTPC benefits from government policies promoting infrastructure development and clean energy, providing a favorable environment for growth.

5. Diversification of Energy Portfolio

NTPC is diversifying its energy mix by investing in hydroelectric and nuclear power projects, aiming to become a 128,000 MW company by 2032.

NTPC Share Price Target 2030

NTPC share price target 2030 Expected target could ₹600. Here are five key risks and challenges that could affect NTPC’s share price target by 2030:

1. Dependence on Coal-Based Power

NTPC still relies heavily on coal-fired power plants for a large portion of its electricity generation. This exposes the company to environmental concerns, stricter emission regulations, and rising costs of coal, which could impact profitability in the long term.

2. Slow Transition to Renewable Energy

Although NTPC is investing in green energy, the pace of transition might not be fast enough to meet future sustainability goals. Delays or underperformance in renewable projects could hamper its growth potential by 2030.

3. Regulatory and Policy Risks

As a government-owned company, NTPC is heavily influenced by changes in power sector regulations, tariffs, and subsidies. Sudden policy shifts or unfavorable regulatory changes could impact operations and earnings.

4. Debt and Capital-Intensive Projects

Large-scale power infrastructure projects require heavy capital investment. Managing high levels of debt and ensuring returns on investment will be crucial, especially in a competitive and changing energy landscape.

5. Fluctuating Demand and Competition

Increasing competition from private power producers and renewable energy firms, coupled with fluctuating power demand due to economic cycles or technological shifts (like energy efficiency), may challenge NTPC’s market dominance and growth.

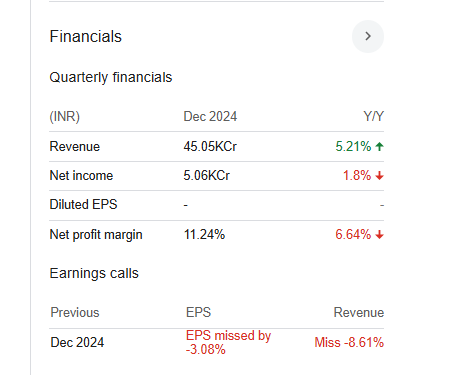

NTPC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.79T | 1.30% |

| Operating expense | 401.59B | 12.10% |

| Net income | 208.12B | 23.06% |

| Net profit margin | 11.66 | 21.46% |

| Earnings per share | 16.90 | -3.10% |

| EBITDA | 501.19B | 2.73% |

| Effective tax rate | 24.20% | — |

Read Also:- Infosys Share Price Target Tomorrow 2025 To 2030