Olectra Greentech Share Price Target Tomorrow 2025 To 2030

Olectra Greentech Limited is a pioneering Indian company specializing in electric mobility and green energy solutions. Headquartered in Hyderabad, it holds the distinction of being India’s first manufacturer of pure electric buses, offering a range of models tailored for urban and intercity transportation needs. Beyond electric buses, Olectra also produces electric trucks and composite polymer insulators, serving both the transportation and power distribution sectors. Olectra Greentech Share Price on NSE as of 22 May 2025 is 1,270.90 INR.

Olectra Greentech Share Market Overview

- Open: 1,270.00

- High: 1,281.50

- Low: 1,253.00

- Previous Close: 1,263.10

- Volume: 249,889

- Value (Lacs): 3,172.09

- 52 Week High: 1,960.00

- 52 Week Low: 989.95

- Mkt Cap (Rs. Cr.): 10,419

- Face Value: 4

Olectra Greentech Share Price Chart

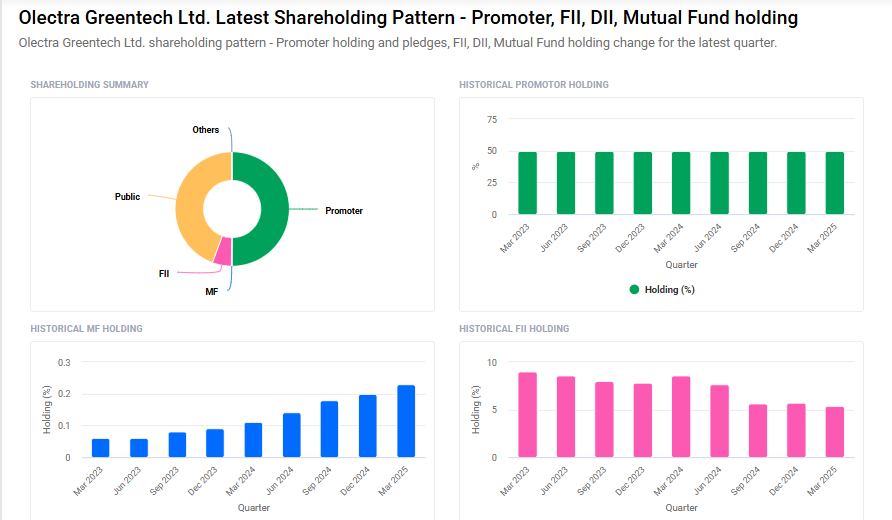

Olectra Greentech Shareholding Pattern

- Promoters: 50%

- FII: 5.4%

- DII: 0.5%

- Public: 44.2%

Olectra Greentech Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1960 |

| 2026 | ₹2410 |

| 2027 | ₹2840 |

| 2028 | ₹3270 |

| 2029 | ₹3600 |

| 2030 | ₹4030 |

Olectra Greentech Share Price Target 2025

Olectra Greentech share price target 2025 Expected target could ₹1960. Here are five key factors influencing the growth of Olectra Greentech Ltd’s share price target for 2025:

-

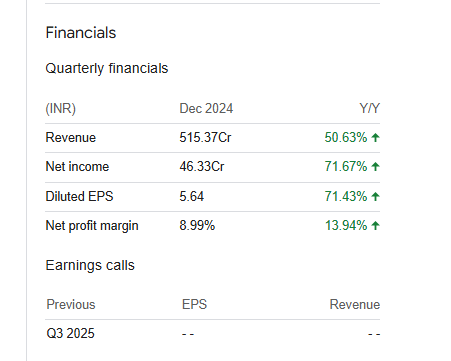

Robust Revenue and Profit Growth: In Q3 FY2025, Olectra Greentech reported a remarkable 48.32% year-over-year increase in revenue, reaching ₹518.20 crore. This growth was driven by a 50.63% rise in revenue from operations. Additionally, the company’s net profit margins improved from 7.71% to 8.94%, reflecting enhanced operational efficiency.

-

Expansion of Production Capacity: To meet the growing demand, Olectra is scaling up its production capabilities. The company is ramping up its installed capacity to about 5,000 electric buses annually by FY2026. This expansion is supported by a significant capital expenditure plan, including a debt of ₹500 crore to fund the growth.

-

Strong Order Book and Strategic Partnerships: Olectra has secured a substantial order book exceeding 10,200 electric buses. Notably, the company placed an order for over 2,000 electric bus chassis from BYD, comprising models like the K9, C9, and K7. These strategic partnerships and orders position Olectra to capitalize on the increasing demand for electric public transportation.

-

Favorable Government Policies and Market Trends: The Indian government’s initiatives, such as the FAME-II scheme and the National Electric Bus Programme (NEBP), are accelerating the adoption of electric vehicles. These policies, along with advancements in battery technology and infrastructure, are creating a conducive environment for Olectra’s growth in the electric bus segment.

-

Positive Market Share and Industry Positioning: In March 2025, Olectra Greentech captured a 27.4% market share in India’s electric bus market, selling 76 units. This consistent performance underscores the company’s strong positioning in the industry and its ability to maintain a significant share amid growing competition.

Olectra Greentech Share Price Target 2030

Olectra Greentech share price target 2030 Expected target could ₹4030. Here are five key risks and challenges that could impact Olectra Greentech Ltd’s share price target by 2030:

-

Execution Risks and Financial Strain: Olectra’s ambitious plans to ramp up production capacity to 10,000 units annually involve significant capital expenditure. This expansion, coupled with reliance on debt financing, could strain the company’s financial health if not managed efficiently. Delays or cost overruns in scaling operations may adversely affect profitability.

-

Intensifying Market Competition: The Indian electric bus market is witnessing increased competition from both established players and new entrants. Companies like Switch Mobility and JBM Auto are expanding their footprints, which could pressure Olectra’s market share and margins. Staying ahead in technology and cost-effectiveness will be crucial.

-

Dependence on Government Policies: Olectra’s growth is closely tied to government initiatives like the FAME-II scheme and the National Electric Bus Programme. Any changes or reductions in these policies could impact demand for electric buses, affecting the company’s order book and revenue streams.

-

Supply Chain and Technological Challenges: The company’s reliance on specific technologies, such as BYD’s Blade battery, and the need for a robust supply chain pose risks. Disruptions in component availability or technological obsolescence could hinder production and delivery schedules, impacting customer satisfaction and financial performance.

-

Creditworthiness of Clients: A significant portion of Olectra’s clientele comprises state transport undertakings (STUs), which often have weak credit profiles. Delays in payments or defaults by these entities could affect the company’s cash flow and financial stability. Implementing effective payment security mechanisms is essential to mitigate this risk.

Olectra Greentech Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 11.54B | 5.81% |

| Operating expense | 1.97B | 22.81% |

| Net income | 768.33M | 17.13% |

| Net profit margin | 6.66 | -10.82% |

| Earnings per share | 9.36 | 17.15% |

| EBITDA | 1.64B | 17.86% |

| Effective tax rate | 25.64% | — |

Read Also:- Campus Share Price Target Tomorrow 2025 To 2030