Orchid Pharma Share Price Target Tomorrow 2025 To 2030

Orchid Pharma Limited is a prominent pharmaceutical company based in Chennai, India, established in 1992. The company specializes in the development, manufacturing, and marketing of active pharmaceutical ingredients (APIs), particularly cephalosporin antibiotics, which are used to treat various bacterial infections. Orchid Pharma has a significant global presence, exporting its products to over 75 countries, and is recognized as one of the top producers of cephalosporin bulk actives worldwide. The company operates across multiple therapeutic areas, including anti-infectives, anti-inflammatory, central nervous system, and cardiovascular segments. Orchid Pharma Share Price on NSE as of 29 May 2025 is 669.00 INR.

Orchid Pharma Share Market Overview

- Open: 704.20

- High: 705.70

- Low: 669.00

- Previous Close: 704.20

- Volume: 306,294

- Value (Lacs): 2,049.11

- 52 Week High: 1,997.40

- 52 Week Low: 669.00

- Mkt Cap (Rs. Cr.): 3,393

- Face Value: 10

Orchid Pharma Share Price Chart

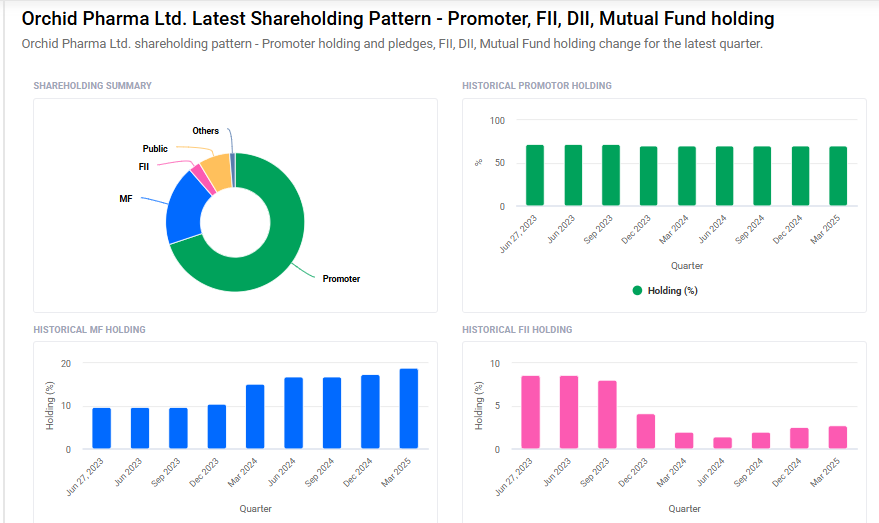

Orchid Pharma Shareholding Pattern

- Promoters: 69.8%

- FII: 2.7%

- DII: 20.1%

- Public: 7.4%

Orchid Pharma Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹2000 |

| 2026 | ₹2200 |

| 2027 | ₹2400 |

| 2028 | ₹2600 |

| 2029 | ₹2800 |

| 2030 | ₹3000 |

Orchid Pharma Share Price Target 2025

Orchid Pharma share price target 2025 Expected target could ₹2000. Here are five key factors that could influence Orchid Pharma’s share price target by 2025:

-

Strong Revenue and Earnings Growth

Orchid Pharma is forecasted to grow its earnings and revenue by 31.6% and 26.1% per annum, respectively, with an expected EPS growth of 27.7% per annum. This robust growth trajectory positions the company favorably in the pharmaceutical sector. -

Strategic Merger with Dhanuka Laboratories

The planned merger with Dhanuka Laboratories by FY26 is anticipated to enhance operational efficiencies and expand Orchid Pharma’s product portfolio, potentially driving higher revenues and profitability. -

Positive Analyst Outlook and Valuation

Analysts have set a consensus price target of ₹1,437.67 for Orchid Pharma, indicating a significant upside from the current market price. This optimistic outlook reflects confidence in the company’s growth prospects. -

Expansion in Cephalosporin API Segment

Orchid Pharma’s focus on the Cephalosporins-based active pharmaceutical ingredients (API) business, primarily used in antibacterial and anti-inflammatory formulations, positions it well to capitalize on the growing demand in this segment. -

Successful US FDA Facility Inspection

The completion of the US FDA facility inspection without significant observations enhances Orchid Pharma’s credibility and paves the way for increased exports to regulated markets, potentially boosting revenues.

Orchid Pharma Share Price Target 2030

Orchid Pharma share price target 2030 Expected target could ₹3000. Here are five key risks and challenges that could impact Orchid Pharma’s share price target by 2030:

-

Regulatory Compliance and Quality Control

Orchid Pharma has faced regulatory scrutiny in the past. For instance, in February 2025, the USFDA issued seven minor observations during a facility inspection. While these were not major violations, any future compliance issues could lead to operational disruptions, product recalls, or restrictions on market access, particularly in stringent markets like the US and EU. -

Intense Market Competition

The pharmaceutical industry is highly competitive, with numerous players offering similar products. Orchid Pharma’s focus on cephalosporin-based antibiotics places it in direct competition with both domestic and international firms. Maintaining market share and pricing power in such an environment requires continuous innovation and cost-effective operations. -

Dependence on Key Partnerships

Orchid Pharma’s strategic collaborations, such as the partnership with Cipla for the distribution of the Cefepime-Enmetazobactam antibiotic, are crucial for its market reach. Any disruptions or changes in these partnerships could affect the company’s distribution capabilities and revenue streams. -

Supply Chain Vulnerabilities

The global pharmaceutical supply chain is susceptible to geopolitical tensions, trade restrictions, and raw material shortages. Such disruptions can lead to increased production costs and delays in product delivery, impacting Orchid Pharma’s ability to meet market demand and maintain profitability. -

Research and Development Challenges

Developing new drugs and obtaining regulatory approvals is a time-consuming and costly process. Orchid Pharma’s growth prospects depend on its ability to innovate and bring new products to market. Any setbacks in research and development efforts could hinder the company’s long-term growth and competitiveness.

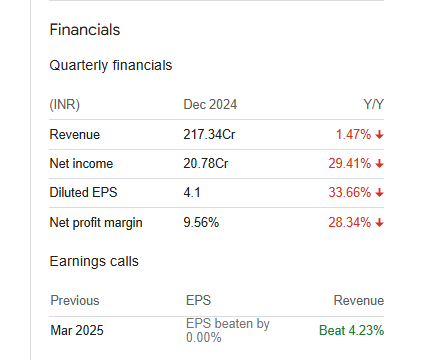

Orchid Pharma Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 8.19B | 23.05% |

| Operating expense | 2.39B | 1.23% |

| Net income | 921.67M | 98.99% |

| Net profit margin | 11.25 | 61.64% |

| Earnings per share | 14.49 | — |

| EBITDA | 1.09B | 30.59% |

| Effective tax rate | -3.50% | — |

Read Also:- Adani Wilmar Share Price Target Tomorrow 2025 To 2030