Paradeep Phosphates Share Price Target From 2025 to 2030

Paradeep Phosphates Share Price Target From 2025 to 2030: Investment in the stock market demands detailed knowledge about a business company, its business model, fundamentals, technicals, and long-term growth outlook of a business company. One such share that has fetched genuine interest of retail as well as institutional investors is Paradeep Phosphates Ltd. (PPL). Having fertilizer and agrochemical business as its core segment, Paradeep Phosphates stands to benefit the most from India’s increasing agricultural demands, food security programs, and increasing requirement for quality, nutrient-based fertilizers.

Here we are sharing with you a comprehensive review of Paradeep Phosphates Ltd., its present market performance, finances, ownership pattern, technicals, and future share price targets between 2025-2030. You will have the final idea by the time you read this article whether PPL is a future wealth creator or not.

Company Overview and Market Position

Paradeep Phosphates Ltd. is India’s biggest fertiliser company and manufacturer and retailer of complex fertilisers such as DAP (Di-Ammonium Phosphate), NPK, etc. and other agro nutrients. Paradeep is a strategic site at Paradeep, Odisha, with a strategic location having easy access to ports to have easy access to raw materials as well as export markets.

The key growth drivers are:

India’s agrarian dependence: More than 50% of the nation is dependent on agriculture, and thus there is always an ever-growing high demand for fertilizers.

- Government subsidy schemes: Successive government subsidy schemes for fertilizers lower their cost and create persistent demand.

- Food security necessity: High population density with restricted land necessitates nutrient-rich fertilizers to maximize crop yield.

- Import substitution: India’s shift towards indigenization in fertilizer production is rewarding for Indian companies such as PPL.

Current Market Performance and Key Financial Parameters

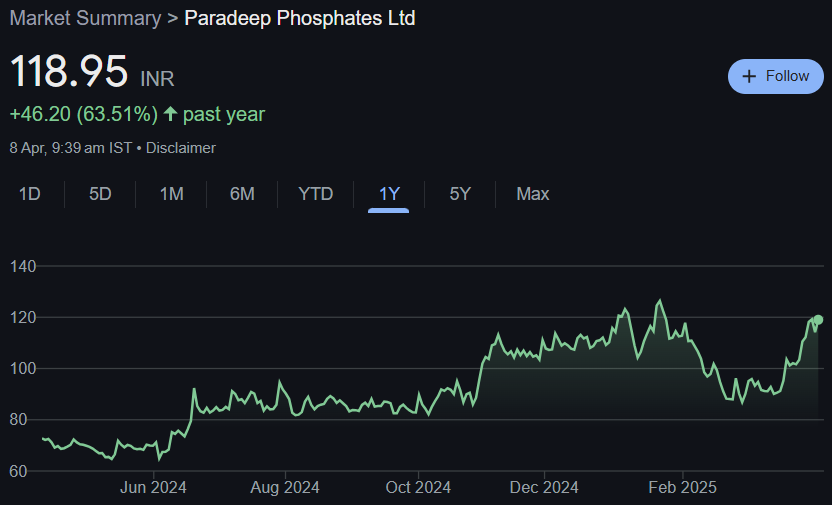

As of the most recent available data:

- Today’s Market Price: ₹119.04

- 52-Week High: ₹128.29

- 52-Week Low: ₹61.95

- Market Capitalisation: ₹9,314 Crore

- P/E Ratio (TTM): 23.49

- Industry P/E: 20.79

- Dividend Yield: 0.44%

- Return on Equity: 22.53%

- EPS (TTM): ₹5.07

- Book Value: ₹46.12

- P/B Ratio: 2.48

- Debt-to-Equity Ratio: 1.16

These figures indicate a company that is basically sound, with good return on equity and earnings per share. P/E ratio higher than the industry average indicates optimistic expectations of growth in the market. Other than that, PPL’s stock has increased over 63% in the last year, indicating optimism from investors.

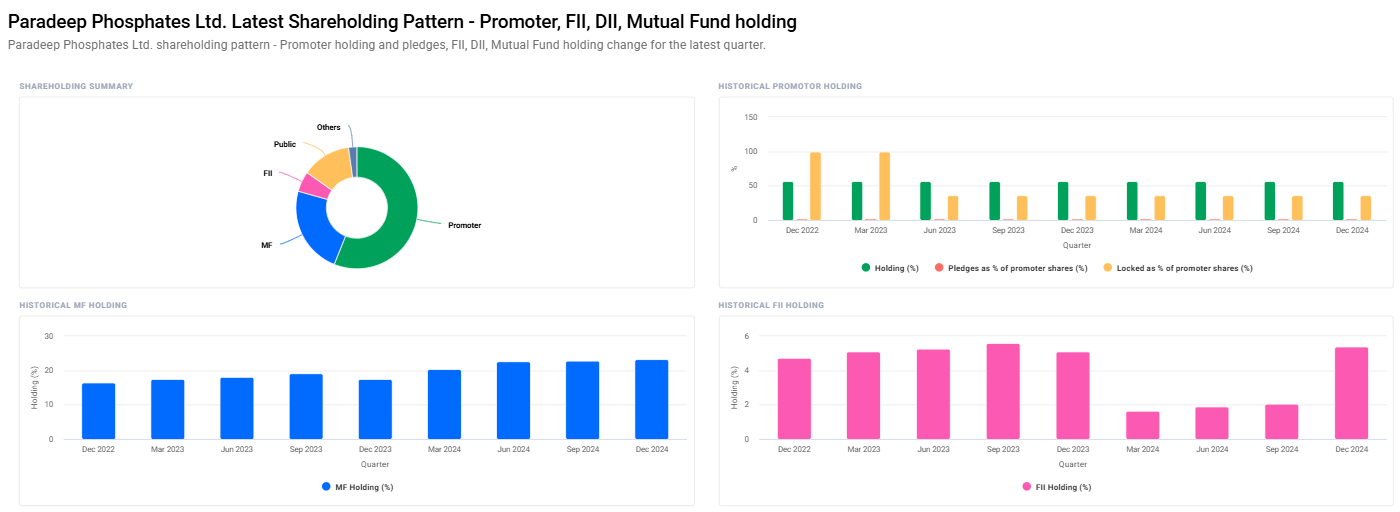

Pattern of Ownership and Institutional Holdings

One of the positive pointers to the potential of a stock is its owners. Here is the latest shareholding pattern:

- Promoters: 56.05%

- Mutual Funds: 23.29%

- Retail and Others: 13.00%

- Foreign Institutional Investors (FII/FPI): 5.40%

- Other Domestic Institutions: 2.25%

Key Trends:

- Promoters decreased holding marginally, i.e., stability but perhaps some diversification.

- FIIs rose up holding from 2.05% to 5.40%, and foreign institutional investor numbers doubled from 56 to 110.

- Mutual Funds have raised their holding and schemes, which is good news for domestic institutional confidence in the company.

Increasing diversified institutional investment and this is good for long-term investor confidence.

Technical Analysis – Bullish Signs Ahead?

Day Technical Indicators:

- Momentum Score: 64.3 (Moderately Strong)

- MACD (12, 26, 9): 4.8 (Bullish crossover)

- RSI (14): 65 (Approaching overbought zone)

- ADX: 27.3 (Indicates developing trend)

- ROC (21): 19.1 (Positive momentum)

- MFI: 84.2 (Overbought level – possible near-term pullback)

- ATR: 6.1 (Volatility relatively stable)

- ROC (125): 39.0 (Long-term uptrend established)

All these together indicate a medium-to long-term bullish position. MACD and RSI indicate short-term momentum, and the high MFI indicates short-term correction or consolidation possible.

Market Depth and Liquidity

- Buy Order Quantity: 42.48%

- Sell Order Quantity: 57.52%

- Volume Traded: 9.72 lakh shares

- Total Traded Value: ₹11.39 Cr

While there was a bit more selling pressure, the stock is liquid and heavily traded, hence easy entry and exit for investors.

Share Price Target of Paradeep Phosphates (2025-2030)

Along with its strong fundamentals, technicals, and industry tailwinds, the following is the estimated share price target of Paradeep Phosphates Ltd. for the next couple of years:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹130 |

| 2026 | ₹200 |

| 2027 | ₹270 |

| 2028 | ₹340 |

| 2029 | ₹410 |

| 2030 | ₹480 |

Horizon-based Investment Strategy

Short-Term Investors (1-2 Years)

- Risk Level: Moderate

- Strategy: Search for pullbacks at below ₹115 to accumulate.

- Exit Target: ₹130 to ₹150

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate to Low

- Strategy: SIP route or accumulate on dips.

- Exit Target: ₹270 to ₹340

Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Hold to get compounding returns and dividends.

- Exit Target: ₹480 or higher by 2030

Risks and Challenges

No investment is risk-free. These are some possible issues:

- Government Policy Dependence: Abrupt changes in subsidy schemes can affect margins.

- Commodity Price Volatility: Raw material prices for fertilizer production inputs (e.g., phosphoric acid, ammonia) are volatile.

- Global Economic Conditions: Export markets can slow down with global economic turmoil.

- Environmental Regulations: Tight regulations may result in higher compliance expenses.

Final Verdict – Is Paradeep Phosphates a Buy?

Paradeep Phosphates Ltd. is well-positioned in one of India’s most vital industries agriculture. Its good financials, institutional buying expansion, and positive technical indications make it an excellent long-term investment opportunity.

Though cyclical corrections due to short-term fluctuations are inevitable at times, value-hunting investors seeking a steady growth stock with long-term worth potential can consider Paradeep Phosphates Ltd. as part of their diversified portfolio.

Frequently Asked Questions (FAQs)

Q1: Is Paradeep Phosphates Ltd. a good buy in 2025?

Yes, with its solid fundamentals, increasing institutional buying, and positive technical signals, it is an easy buy for medium- and long-term investment.

Q2: What is the target price of Paradeep Phosphates in 2026?

With growth expectations and market scenario, the target in 2026 is ₹200.

Q3: Why is the MFI (Money Flow Index) of the stock so high?

High MFI means high buying pressure. But if it crosses 80, then it is also an indication of an overbought condition and short-term pullback.

Q4: Is mutual fund buying interest in Paradeep Phosphates?

Yes, FII/FPI interest has also gone up from 22.85% to 23.29%, and the schemes too have gone up.

Q5: What is the fate of FII/FPI interest now?

FIIs have raised the holding to 5.40% from 2.05%, and FII investor numbers have risen to 110 from 56, showing higher confidence.

Q6: Why should Paradeep Phosphates be considered a good long-term investment?

Its good business location, rich equity yield, rising domestic and overseas demand, and rising output potential justify it as a strong long-term investment.

If you are looking for a sound in principle, growth share in the fertiliser sector with good long term opportunities, then Paradeep Phosphates Ltd. is certainly worth a shot. With every investment, make sure to continue to keep a watch on quarterly numbers and macroeconomical factors for constant assurance.