Patanjali Share Price Target Tomorrow 2025 To 2030

Patanjali Foods Limited, formerly known as Ruchi Soya Industries, is a prominent Indian company in the fast-moving consumer goods (FMCG) sector. Established in 1986 and headquartered in Indore, Madhya Pradesh, the company has a rich history in the edible oils and food processing industry. In 2019, it was acquired by Patanjali Ayurved, a move that marked a significant shift in its business trajectory. Patanjali Share Price on NSE as of 29 April 2025 is 1,928.50 INR.

Patanjali Share Market Overview

- Open: 1,965.00

- High: 1,972.60

- Low: 1,926.90

- Previous Close: 1,967.00

- Volume: 774,571

- Value (Lacs): 14,962.39

- 52 Week High: 2,011.00

- 52 Week Low: 931.20

- Mkt Cap (Rs. Cr.): 69,961

- Face Value: 2

Patanjali Share Price Chart

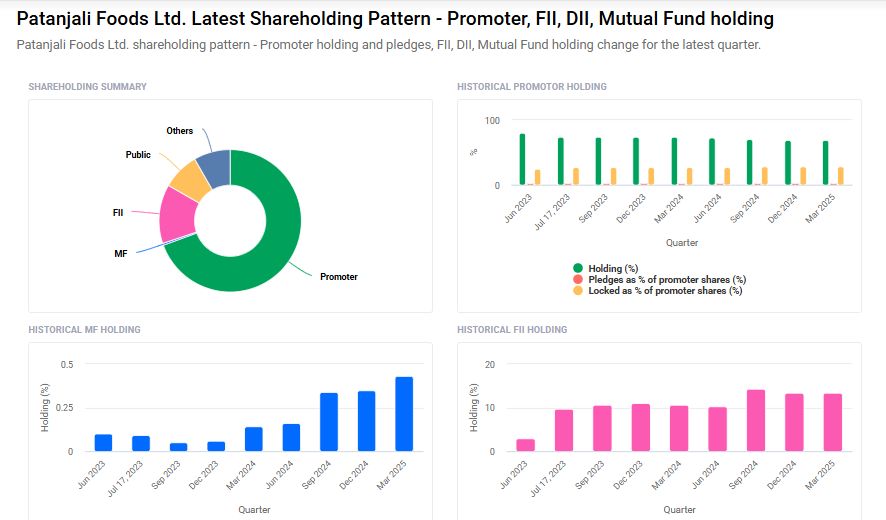

Patanjali Shareholding Pattern

- Promoters: 69.5%

- FII: 13.4%

- DII: 8.7%

- Public: 8.4%

Patanjali Share Price Target Tomorrow 2025 To 2030

| Patanjali Share Price Target Years | Patanjali Share Price |

| 2025 | ₹2011 |

| 2026 | ₹2700 |

| 2027 | ₹3400 |

| 2028 | ₹4000 |

| 2029 | ₹4700 |

| 2030 | ₹5400 |

Patanjali Share Price Target 2025

Here are four key factors that could influence the growth of Patanjali Foods Ltd’s share price by 2025:

1. Strong Financial Performance

Patanjali Foods has demonstrated impressive financial growth, with a projected compound annual growth rate (CAGR) of 10% in revenue over the next three years. Additionally, the company’s operating income and net income are expected to grow at CAGRs of 41% and 46%, respectively. These robust financial metrics indicate a solid foundation for future growth.

2. Expansion of Product Portfolio

The company’s strategic acquisition of the home and personal care (HPC) business has strengthened its product offerings. This move is anticipated to drive substantial growth in both revenues and EBITDA, aligning with Patanjali Foods’ vision to expand its Foods and FMCG business segments.

3. Infrastructure Development

Patanjali’s investment in infrastructure, such as the ₹1,500 crore mega food processing plant in Nagpur, is set to enhance its production capabilities. The facility, with a capacity of processing 800 tonnes of fruits and vegetables per day, is expected to boost the company’s supply chain efficiency and meet growing consumer demand.

4. Positive Market Sentiment

Analysts have shown confidence in Patanjali Foods’ growth prospects. For instance, Jefferies has maintained a ‘Buy’ rating on the company, setting a target price of ₹2,030, indicating an 18% upside from the last traded price. Such endorsements reflect positive market sentiment and investor confidence in the company’s future performance.

Patanjali Share Price Target 2030

Here are 4 risks and challenges that could affect Patanjali Foods Ltd’s share price by 2030:

1. Dependence on Brand Reputation

Patanjali’s growth largely depends on its strong brand image, which is linked to trust, quality, and affordability. Any damage to its reputation, due to product quality issues, regulatory concerns, or public controversies, could hurt consumer trust and negatively impact its sales and share price.

2. Intense Competition

The FMCG and food industry is highly competitive, with major players like Hindustan Unilever, Dabur, and Nestlé consistently fighting for market share. If Patanjali fails to keep up with innovation, pricing, or customer preferences, it could lose its competitive edge, slowing its growth over time.

3. Raw Material Price Fluctuations

Patanjali relies heavily on agricultural products and natural ingredients. Any rise in raw material costs due to inflation, poor harvests, or supply chain disruptions can increase production expenses and pressure profit margins, which may impact the company’s stock performance.

4. Regulatory and Legal Risks

Changing government policies regarding food safety, health regulations, or advertising standards could create challenges for Patanjali. Legal disputes or strict new rules could limit the company’s operations, delay product launches, or even lead to financial penalties, affecting its long-term growth.

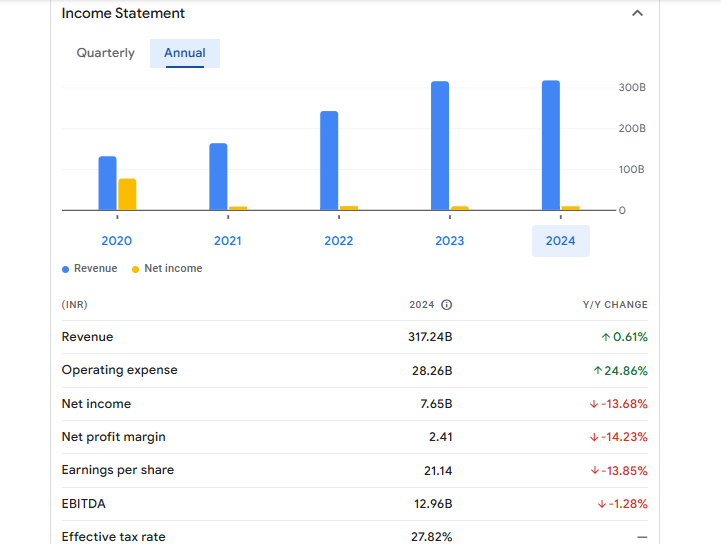

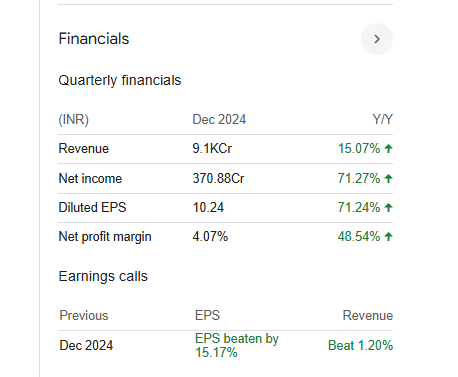

Patanjali Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 317.24B | 0.61% |

| Operating expense | 28.26B | 24.86% |

| Net income | 7.65B | -13.68% |

| Net profit margin | 2.41 | -14.23% |

| Earnings per share | 21.14 | -13.85% |

| EBITDA | 12.96B | -1.28% |

| Effective tax rate | 27.82% | — |

Read Also:- Integra Essentia Ltd Share Price Target Tomorrow 2025 To 2030