Paytm Share Price Target Tomorrow 2025 To 2030

Paytm is a popular digital payment and financial services company in India. It started in 2010 as a mobile recharge platform but quickly grew to offer a wide range of services like bill payments, money transfers, shopping, and even ticket bookings. Over the years, Paytm has become a trusted name for millions of users who prefer cashless transactions. The company also provides financial products such as insurance, loans, and savings options through its app. Paytm Share Price on NSE as of 19 May 2025 is 850.70 INR.

Paytm Share Market Overview

- Open: 858.30

- High: 862.90

- Low: 847.70

- Previous Close: 857.20

- Volume: 2,916,695

- Value (Lacs): 24,860.45

- 52 Week High: 1,062.95

- 52 Week Low: 310.00

- Mkt Cap (Rs. Cr.): 54,372

- Face Value: 1

Paytm Share Price Chart

Paytm Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹ 1065 |

| 2026 | ₹1560 |

| 2027 | ₹ 2020 |

| 2028 | ₹ 2500 |

| 2029 | ₹3080 |

| 2030 | ₹ 3560 |

Paytm Share Price Target 2025

Paytm share price target 2025 Expected target could ₹₹ 1065. Here are five key factors influencing Paytm’s share price target for 2025:

-

Profitability Milestones and Cost Management: Paytm is projected to achieve EBITDA breakeven by FY27, supported by a 26% revenue CAGR from FY25 to FY27. The company has implemented cost-control measures, leading to a contribution margin increase to 56.1% and positive EBITDA before ESOP costs.

-

Expansion in Lending and Merchant Services: Paytm is focusing on scaling its loan distribution, particularly through merchant lending. This strategy, backed by strong lender partnerships, is expected to drive profitability and enhance cross-selling opportunities.

-

Regulatory Developments: Regulatory actions have significantly impacted Paytm. The Reserve Bank of India’s directive to wind down Paytm Payments Bank led to a decline in monthly transacting users from 100 million to 70 million. Although the National Payments Corporation of India later allowed Paytm to onboard new UPI users, the company still awaits a payment aggregator license, which remains a key regulatory hurdle.

-

Revitalization of Mobile Wallet Services: In response to the zero-MDR UPI ecosystem, Paytm is revamping its mobile wallet operations to enhance monetization. This includes offering value-added services and targeting semi-urban and rural areas where UPI infrastructure is less robust.

-

Analyst Price Targets and Market Sentiment: Analyst price targets for Paytm in 2025 vary, with estimates ranging from ₹705 to ₹1,250. The median target is around ₹947.33, reflecting a neutral to cautiously optimistic market sentiment.

Paytm Share Price Target 2030

Paytm share price target 2030 Expected target could ₹3560. Here are five key risks and challenges that could influence Paytm’s share price trajectory by 2030:

1. Regulatory Scrutiny and Compliance Challenges

Paytm has faced significant regulatory interventions, notably from the Reserve Bank of India (RBI). In January 2024, the RBI directed Paytm Payments Bank to cease accepting deposits and onboarding new customers due to persistent non-compliance issues. Such actions have disrupted core operations and raised concerns about the company’s adherence to regulatory norms.

2. Intensifying Competition in the Fintech Sector

The digital payments landscape in India is highly competitive, with strong players like PhonePe and Google Pay leading the UPI transaction space. Paytm’s market share in UPI transactions has lagged behind these competitors, posing challenges to its growth and profitability.

3. Profitability and Monetization Constraints

Despite a vast user base, Paytm struggles with monetizing its services effectively. The zero-MDR (Merchant Discount Rate) regime on UPI transactions limits revenue generation from its payments business, necessitating alternative monetization strategies.

4. Operational and Technological Risks

As a technology-driven company, Paytm is susceptible to operational risks, including cybersecurity threats and technical glitches. Any significant disruption can erode customer trust and impact the company’s reputation and financial performance.

5. Dependence on External Partnerships

Paytm’s business model relies heavily on partnerships with financial institutions for services like lending and insurance. Changes in these partnerships or regulatory policies affecting them can have a substantial impact on Paytm’s service offerings and revenue streams.

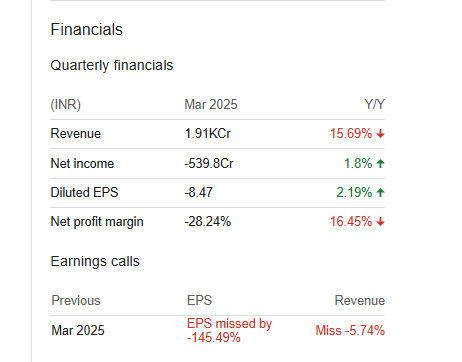

Paytm Financials Statement

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 19.12B | -15.69% |

| Operating expense | 8.82B | 14.28% |

| Net income | -5.40B | 1.80% |

| Net profit margin | -28.24 | -16.45% |

| Earnings per share | -0.28 | 96.91% |

| EBITDA | -707.50M | 71.81% |

| Effective tax rate | -0.48% | — |

Read Also:- Broadcom Share Price Target Tomorrow 2025 To 2030