Pfizer Share Price Target From 2025 to 2030

Pfizer Share Price Target From 2025 to 2030: Investment in the stock market is founded on the assumption of open knowledge about the way a company works, its balance sheet, its past performance in business, and the way it can expand in the future. A company such as Pfizer, a drug manufacturer and industry giant, has been a blue chip for an institutional investor and retail investor. The healthcare industry is of more concern to the modern world, especially since the current period is in a post-pandemic environment, and a suitor like Pfizer is still a viable investment option.

In this detailed report, we’ll explore the recent performance of Pfizer Ltd., its fundamental and technical indicators, ownership structure, and share price targets from 2025 to 2030. By the end of this article, you’ll have a well-rounded understanding of whether Pfizer stock aligns with your investment strategy.

Company Overview and Market Position

Pfizer Ltd. is the Indian subsidiary of Pfizer Inc., the multinational drug company. The firm has emerged as a house-hold name in the manufacturing and marketing of an array of healthcare drugs and goods, i.e., cardiovascular, anti-infective, and central nervous system.

Why Pfizer Reigns Supreme in the Pharma Sector:

- Brand Image: Pfizer is a recognized name globally with a track record of innovativeness.

- Strong Pipeline of Products: The firm is constantly introducing new molecules and diversifying its portfolio of drugs.

- Awareness on Health: Improvement in healthcare awareness and use of preventive medicine is driving the long-term growth of the pharma industry.

- Support of the Government: Greater emphasis on public health and accessibility is creating a pro-market environment for pharma participants.

Latest Performance of the Stock Market

The share price of Pfizer Ltd. has been extremely volatile over the last year. Let’s go through its market figures:

- Current Price: ₹3,941.05

- 52-Week High: ₹6,451.15

- 52-Week Low: ₹3,701.00

- Market Capitalisation: ₹18,340 Crores

- P/E Ratio (TTM): 29.79

- Industry P/E: 4.89

- EPS (TTM): ₹134.55

- Dividend Yield: 0.87%

- Book Value: ₹819.90

- Face Value: ₹10

The stock is near 52-week low, so it may be an undervaluation or active stage of correction. Since its P/E ratio is significantly higher than industry, the investors will need to analyze growth opportunity against valuations.

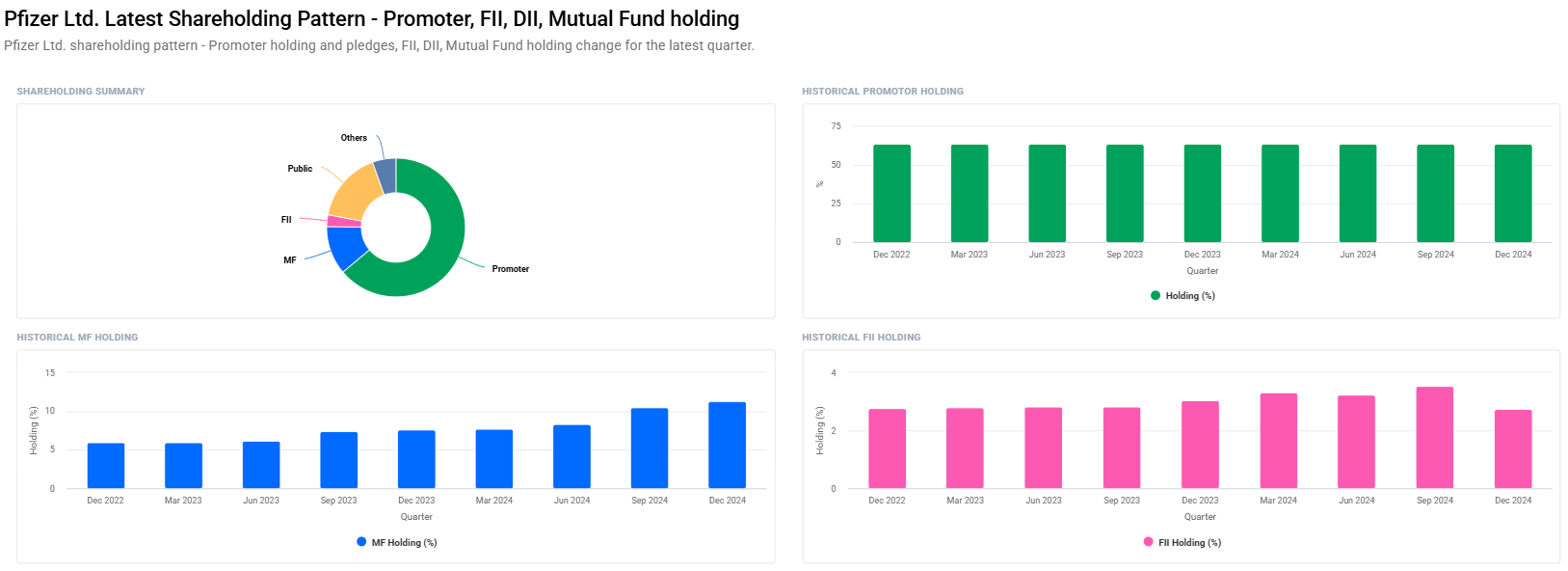

Ownership Structure and Institutional Sentiment

The shareholding pattern analysis gives signals of investor confidence:

- Promoters: 63.92% (no change)

- Retail and Others: 16.54%

- Mutual Funds: Increased from 10.43% to 11.30%

- Other Domestic Institutions: 5.49%

- Foreign Institutional Investors (FII/FPI): Down from 3.54% to 2.74%

Although the decline in FII/FPI holding is extremely small, mutual funds and domestic institutions are on the rise, which is the confidence of long-term domestic players.

Technical Analysis – What Do the Charts Say?

Technical indicators indicate Pfizer Ltd. as a weak-to-neutral trend now:

- Momentum Score: 36.76 (Neutral)

- MACD: -59.0 (Bearish)

- MACD Signal: -62.5 (Bearish)

- RSI (14): 32.9 (Near oversold zone)

- ADX: 14.8 (Weak trend)

- ROC (21-day): -3.9 (Negative momentum)

- ROC (125-day): -30.75 (Bearish long-term momentum)

- MFI: 43.8 (Neutral liquidity)

- ATR: 125.93 (Moderate volatility)

Interpretation

All technical charts are showing weak trend. RSI around 30 means that the stock is at oversold level, and contrarian investors prefer to buy there. To change the trend, break above ₹4,000–₹4,200 would be needed.

Pfizer Share Price Forecast for 2025 until 2030

Understand from company fundamentals, long-term growth drivers, and market sentiment, the following may be a likely year-by-year share price target for Pfizer Ltd.:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹6700 |

| 2026 | ₹9700 |

| 2027 | ₹12700 |

| 2028 | ₹15700 |

| 2029 | ₹18700 |

| 2030 | ₹21700 |

These projections are based on a mix of good fundamentals, sector tailwinds, and sustained past performance by Pfizer.

Investment Strategy – Buy Pfizer Stock or Not?

For Short-Term Investors (1-2 Years)

- Risk: High

- Strategy: Wait for trend reversal and breakout above ₹4,200.

- Exit Target: ₹6,700

For Medium-Term Investors (3-5 Years)

- Risk: Moderate

- Strategy: Buy dips; huge growth opportunities in healthcare after the pandemic.

- Exit Target: ₹12,700

For Long-Term Investors (5+ Years)

- Risk: Low

- Strategy: Potential compounding in the long run; buying and holding for steady returns.

- Exit Target: ₹21,700

Risks and Challenges

While there are growth opportunities of Pfizer Ltd. with positive aspects, the investors must remember the following risks:

- Regulatory Risk: Government regulatory policy change, price regulation of drugs, or prohibition of specific drugs can affect revenues.

- Competitive Pressure: High R&D expense and competition from foreign pharma companies.

- Market Volatility: Healthcare sector stocks are prone to macroeconomic as well as policy-driven shocks.

- FII Confidence Deteriorating: FII holding decline in recent past can be an example of short-term prudence.

FAQs – Pfizer Share Price Prediction

Q1: Is Pfizer Ltd. a good investment stock in 2025?

A: Yes, from its healthy fundamentals, pharma’s explosive local demand, and growing healthcare awareness, Pfizer is the right stock to invest in for the long term.

Q2: How is Pfizer’s share price target in 2026?

A: It would be approximately ₹9,700 with consistent earnings and product growth.

Q3: Why is Pfizer stock at a 52-week low?

A: The stock would correct on account of overall market sentiment, technical weakness, and conservatism among investors. But then a long-term investor’s buying opportunity.

Q4: Why is Pfizer Ltd. special among the pharma stocks?

A: Stable brand name, worldwide support, diversified product base, and stable finances are the strengths of Pfizer.

Q5: Can ₹21,700 be achievable for Pfizer in 2030?

A: With stable profitability, new drug releases, and increasing local market share, barring any surprise economic or regulatory setbacks, Pfizer can comfortably touch ₹21,700 by 2030.

Q6: How has the company’s dividend performance been?

A: Pfizer has provided a consistent dividend yield of around 0.87%, and it’s a great one for investors seeking moderate returns combined with growth.

Q7: Where is Pfizer investing to drive future growth?

A: Pfizer is investing in chronic disease, specialty pharma, biosimilars, and digital health solutions to drive future growth.

Pfizer Ltd. is a safe bet amongst Indian pharma stocks. Short-term bearish technicals and volatility are indeed concerns, but the stable margins of the company, strong product pipeline, and increasing domestic demand make way for a near-term bullish thesis.

Whether you are a conservative investor looking for safety or a long-term growth investor looking for high returns, Pfizer is an investment one cannot miss. Buying this stock during correction phases and holding it for the long term can fetch ginormous returns by 2030.