Piramal Pharma Share Price Target Tomorrow 2025 To 2030

Piramal Pharma is a well-established pharmaceutical company based in India and part of the larger Piramal Group. The company has a strong presence in over 100 countries worldwide, providing a variety of healthcare products and services. Piramal Pharma is known for its three major business segments: Piramal Pharma Solutions (PPS), which offers contract development and manufacturing services for the pharmaceutical industry; Piramal Critical Care, which focuses on critical care medicines like anesthetics; and its India Consumer Healthcare division, which provides over-the-counter healthcare products in the Indian market. Piramal Pharma Share Price on NSE as of 19 April 2025 is 219.73 INR.

Piramal Pharma Share Market Overview

- Open: 221.79

- High: 223.13

- Low: 219.20

- Previous Close: 221.84

- Volume: 1,650,492

- Value (Lacs): 3,637.85

- VWAP: 221.52

- UC Limit: 266.20

- LC Limit: 177.47

- 52 Week High: 307.90

- 52 Week Low: 136.10

- Mkt Cap (Rs. Cr.): 29,220

- Face Value: 10

Piramal Pharma Share Price Chart

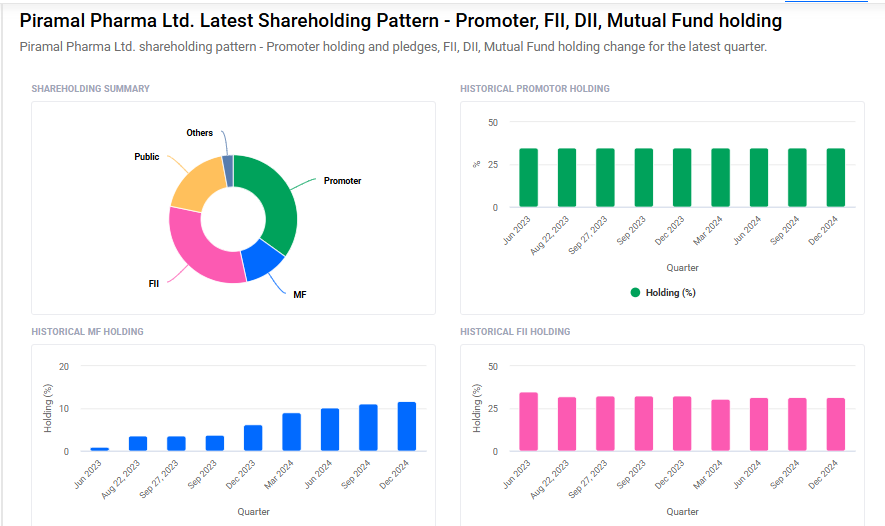

Piramal Pharma Shareholding Pattern

- Promoters: 35%

- FII: 31.7%

- DII: 14.1%

- Public: 19.3%

Piramal Pharma Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹310

- 2026 – ₹400

- 2027 – ₹480

- 2028 – ₹560

- 2030 – ₹620

Major Factors Affecting Piramal Pharma Share Price

1. Growth in the CDMO Business

Piramal Pharma’s Contract Development and Manufacturing Organization (CDMO) division is a significant contributor to its revenue. Analysts project a compound annual growth rate (CAGR) of over 17% for this segment, driven by strong demand and a robust pipeline of projects . This growth can positively impact the company’s earnings and, consequently, its share price.

2. Valuation Metrics

As of April 2025, Piramal Pharma’s price-to-earnings (P/E) ratio stands at 556, significantly higher than the industry average of 35 . Such high valuation metrics may indicate that the stock is overvalued, which could lead to price corrections if the company’s performance doesn’t meet investor expectations.

3. Analyst Ratings and Target Prices

Analyst firms like JM Financial have initiated coverage on Piramal Pharma with a ‘Buy’ rating and a target price of ₹340, suggesting a potential upside of 36% . Positive analyst recommendations can boost investor confidence and drive the stock price higher.

4. Financial Performance

In the quarter ending September 30, 2024, Piramal Pharma reported a total income of ₹2,302.86 crore, marking a 16.86% increase from the previous quarter . Consistent revenue growth signals financial health and can attract investors, supporting a higher share price.

5. Market Sentiment

The broader market sentiment towards the pharmaceutical sector can influence Piramal Pharma’s stock price. Positive developments, such as favorable government policies or increased healthcare spending, can lead to a bullish outlook for the sector, benefiting companies like Piramal Pharma.

6. Regulatory Approvals and Product Launches

Successful regulatory approvals and the launch of new products can significantly impact Piramal Pharma’s revenue streams. For instance, the commercialization of a new asset with a revenue potential of over USD 100 million can enhance the company’s financial prospects and positively affect its share price.

Risks and Challenges for Piramal Pharma Share Price

1. High Debt Levels

Piramal Pharma carries a significant amount of debt, with a net debt-to-equity ratio of 55.4%. This high leverage means the company must allocate a considerable portion of its earnings to interest payments, which can strain financial resources and potentially affect profitability. Additionally, the company’s interest coverage ratio stands at 1.5x, indicating that earnings before interest and taxes (EBIT) are just sufficient to cover interest expenses, leaving little room for financial flexibility.

2. Regulatory Challenges

The company has faced regulatory scrutiny, including receiving a Form 483 from the US FDA with six observations related to its Turbhe facility. Although the company addressed these concerns, such issues can lead to delays in product approvals and impact revenue streams. Additionally, the company has experienced stock volatility due to these regulatory challenges, which can affect investor confidence.

3. Valuation Concerns

Piramal Pharma’s price-to-earnings (P/E) ratio is significantly higher than the industry average, suggesting that the stock may be overvalued. Such high valuations can make the stock susceptible to price corrections if the company’s performance does not meet investor expectations.

4. Market Sentiment and Profitability

Despite strong long-term growth prospects, Piramal Pharma has faced stock fluctuations and a decline in quarterly profits. Concerns about high debt levels and low return on equity have contributed to a shift in market sentiment, leading to stock downgrades and affecting share price performance.

5. Share Dilution

The company increased the number of shares in circulation by 11% over the past year by issuing new shares. This dilution can reduce earnings per share and potentially lower the value of existing shares, impacting shareholder value.

6. Currency and Execution Risks

Piramal Pharma’s international operations expose it to foreign currency fluctuations, which can affect profitability. Moreover, the company has faced challenges related to high debt burdens and execution risks, which can impact its ability to deliver on growth plans and affect investor confidence.

Read Also:- SKIL Infrastructure Share Price Target Tomorrow 2025 To 2030