Power Grid Share Price Target Tomorrow 2025 To 2030

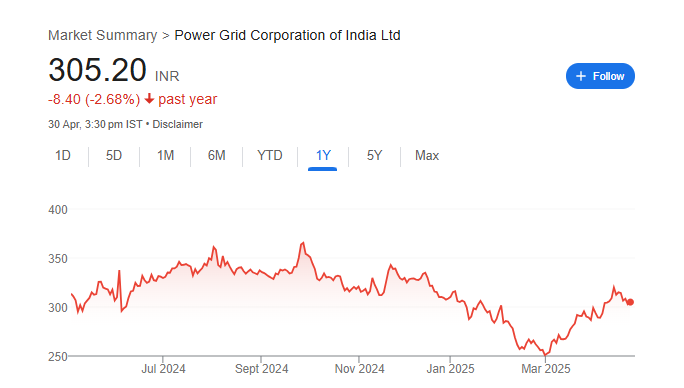

Power Grid Corporation of India Ltd. (POWERGRID) is one of India’s largest state-owned companies in the power transmission sector. Established in 1989, it plays a crucial role in transmitting electricity across the country. POWERGRID operates an extensive network of power lines and substations, covering about 45% of India’s electricity transmission. It helps to deliver power from generation stations to homes, businesses, and industries. Power Grid Share Price on NSE as of 1 May 2025 is 305.20 INR.

Power Grid Share Market Overview

- Open: 304.45

- High: 310.00

- Low: 301.90

- Previous Close: 302.95

- Volume: 17,619,987

- Value (Lacs): 54,172.65

- VWAP: 307.79

- UC Limit: 333.20

- LC Limit: 272.65

- 52 Week High: 366.25

- 52 Week Low: 247.30

- Mkt Cap (Rs. Cr.): 285,947

- Face Value: 10

Power Grid Share Price Chart

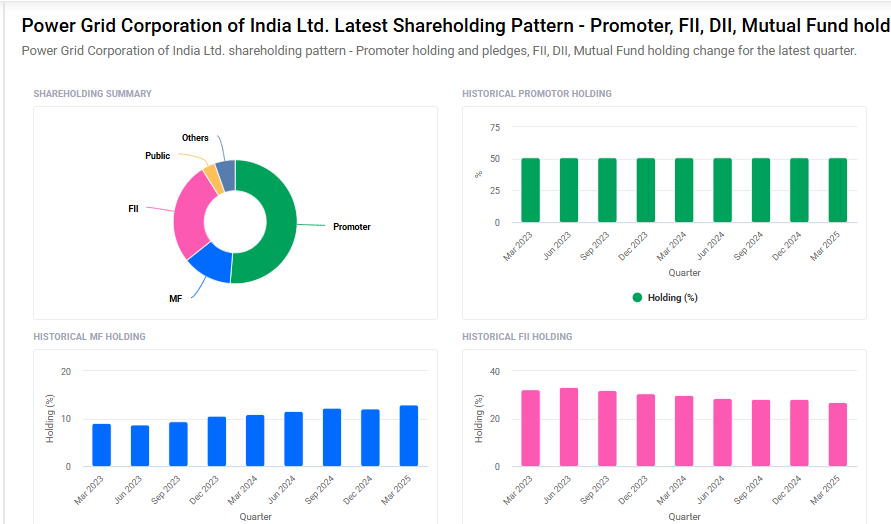

Power Grid Shareholding Pattern

- Promoters: 51.3%

- FII: 26.8%

- DII: 18.4%

- Public: 3.5%

Power Grid Share Price Target Tomorrow 2025 To 2030

| Power Grid Share Price Target Years | Power Grid Share Price |

| 2025 | ₹370 |

| 2026 | ₹390 |

| 2027 | ₹410 |

| 2028 | ₹430 |

| 2029 | ₹450 |

| 2030 | ₹470 |

Power Grid Share Price Target 2025

Power Grid share price target 2025 Expected target could ₹370. Here are four key factors influencing the growth of Power Grid Corporation of India Ltd. (POWERGRID):

1. Rising Electricity Demand Amid Climate Challenges

India is projected to experience a 9–10% surge in peak electricity demand in 2025, driven by increasing temperatures and more frequent heatwaves. This heightened demand underscores the critical role of POWERGRID in ensuring reliable power transmission across the nation.

2. Strategic Capital Expenditure and Renewable Energy Integration

POWERGRID has outlined ambitious capital expenditure plans of ₹18,000 crore for FY24–25, focusing on expanding transmission infrastructure and integrating renewable energy sources. These initiatives align with India’s net-zero goals and are expected to enhance the company’s growth prospects.

3. Stable Financial Profile and Predictable Revenue Streams

Fitch Ratings affirms POWERGRID’s robust financial profile, highlighting its stable regulatory environment and predictable revenue streams. Despite increased capital expenditures, the company’s financial health is expected to remain strong, supporting sustained growth.

4. Dominant Market Position in Power Transmission

POWERGRID transmits approximately 45% of India’s total power and owns 86% of the inter-state transmission system. This dominant position provides a competitive edge, enabling the company to capitalize on the growing demand for electricity and infrastructure development.

Power Grid Share Price Target 2030

Power Grid share price target 2030 Expected target could ₹470. Here are four key Risks and Challenges that could affect Power Grid Corporation of India Ltd. (POWERGRID) :

-

Regulatory and Policy Changes

As a government-owned entity, POWERGRID’s operations are heavily influenced by regulatory policies. Any changes in tariffs, government incentives, or infrastructure policies could impact its revenue and profitability. -

Capital Expenditure and Debt Levels

POWERGRID’s ambitious expansion plans require substantial capital investment. High levels of debt taken to fund infrastructure projects could increase financial risks, especially if the expected returns on investment don’t materialize or if interest rates rise. -

Competition from Private Players in Transmission

Although POWERGRID holds a dominant position in India’s power transmission sector, the entry of private companies into the transmission space could create competition, potentially affecting market share and pricing power. -

Delays in Infrastructure Projects

Delays in the completion of transmission projects or slow adoption of renewable energy integration could disrupt revenue generation and hinder the company’s growth potential, affecting long-term market performance.

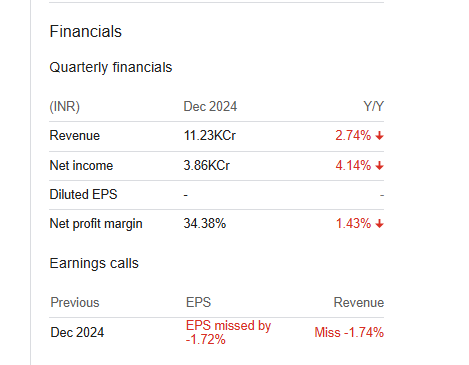

Power Grid Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 458.43B | 0.53% |

| Operating expense | 177.70B | –0.81% |

| Net income | 155.73B | 0.99% |

| Net profit margin | 33.97 | 0.47% |

| Earnings per share | 17.25 | 4.64% |

| EBITDA | 402.17B | -0.10% |

| Effective tax rate | 15.88% | — |

Read Also:- TV18 Share Price Target Tomorrow 2025 To 2030