Pratap Snacks Share Price Target Tomorrow 2025 To 2030

Prataap Snacks Ltd., headquartered in Indore, Madhya Pradesh, is a prominent Indian snack food company renowned for its flagship brand, Yellow Diamond. Established in 2003, the company has grown to become one of India’s leading snack manufacturers, offering a diverse range of products including potato chips, extruded snacks, traditional namkeens, and sweet treats under the Rich Feast brand. Pratap Snacks Share Price on NSE as of 15 April 2025 is 1,258.00 INR.

Pratap Snacks Share Market Overview

- Open: 1,225.00

- High: 1,269.00

- Low: 1,183.00

- Previous Close: 1,163.55

- Volume: 311,640

- Value (Lacs): 3,920.43

- VWAP: 1,240.46

- UC Limit: 1,396.30

- LC Limit: 930.90

- 52 Week High: 1,269.00

- 52 Week Low: 746.70

- Mkt Cap (Rs. Cr.): 3,003

- Face Value: 5

Pratap Snacks Share Price Chart

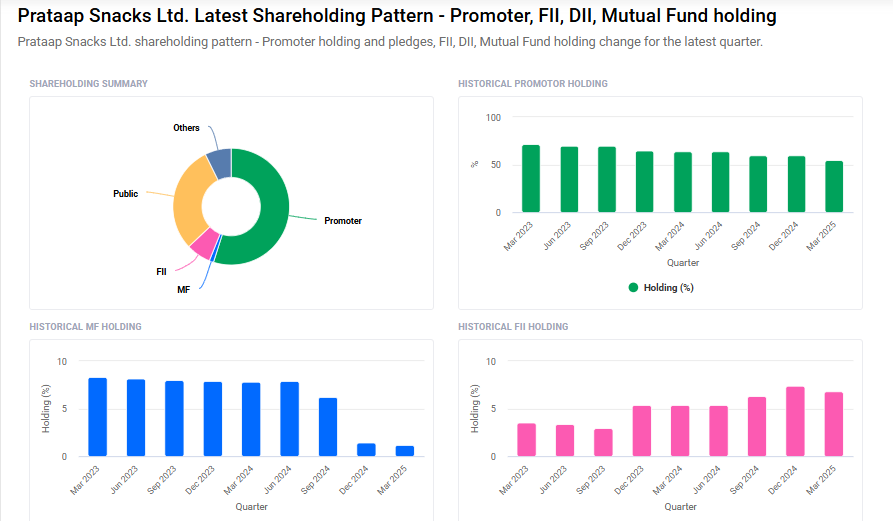

Pratap Snacks Shareholding Pattern

- Promoters: 54.9%

- FII: 6.8%

- DII: 8.5%

- Public: 29.7%

Pratap Snacks Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1270

- 2026 – ₹1600

- 2027 – ₹1900

- 2028 – ₹2200

- 2030 – ₹2500

Major Factors Affecting Pratap Snacks Share Price

Here are six key factors influencing the share price of Prataap Snacks Ltd:

1. Strategic Stake Acquisition

In September 2024, Prataap Snacks announced a significant development where Authum Investment & Infrastructure and Mahi Madhusudan Kela agreed to acquire a 46.9% stake in the company for ₹8.5 billion. This move has positively impacted investor sentiment and contributed to a rise in the share price.

2. Financial Performance and Profit Margins

Despite facing inflationary pressures, Prataap Snacks reported a modest revenue growth of 2% year-on-year in Q2 FY25, reaching ₹441 crore. However, the company’s EBITDA declined to ₹19.2 crore, indicating challenges in maintaining profit margins amidst rising costs.

3. Market Valuation and Ratios

As of April 15, 2025, Prataap Snacks’ stock is trading at a price-to-book (P/B) ratio of 3.73, which is relatively high compared to industry standards. Additionally, the company’s return on equity (ROE) stands at 4.55%, suggesting that while the company is profitable, its efficiency in generating returns for shareholders could be improved.

4. Ownership and Promoter Changes

Over the past three years, there has been a decrease in promoter holding by 12%, which may raise concerns about the commitment of the company’s leadership. Such changes in ownership structures can influence investor confidence and affect the stock price.

5. Dividend Policy

Prataap Snacks has maintained a consistent dividend payout ratio of approximately 20.5%, offering a dividend yield of around 0.16%. This policy provides a steady income stream to investors and can make the stock more attractive, especially in uncertain market conditions.

6. Market Sentiment and Stock Volatility

The stock has experienced fluctuations in its share price, with a 52-week high of ₹1,195 and a low of ₹746.70. Such volatility can be influenced by various factors, including market trends, investor perceptions, and external economic conditions. Investors should be aware of these dynamics when considering investments in Prataap Snacks.

Risks and Challenges for Pratap Snacks Share Price

Here are six key risks and challenges that could impact the share price of Prataap Snacks Ltd:

1. Declining Profit Margins

In the third quarter of FY25, Prataap Snacks reported a decline in EBITDA to ₹19.2 crore, indicating challenges in maintaining profitability amidst rising costs and inflationary pressures.

2. High Valuation Ratios

The company’s price-to-book (P/B) ratio stands at 3.73, which is relatively high compared to industry standards. Additionally, the return on equity (ROE) is 4.55%, suggesting that while the company is profitable, its efficiency in generating returns for shareholders could be improved.

3. Fluctuating Stock Performance

Prataap Snacks’ stock has experienced fluctuations in its share price, with a 52-week high of ₹1,195 and a low of ₹746.70. Such volatility can be influenced by various factors, including market trends, investor perceptions, and external economic conditions.

4. Ownership and Promoter Changes

Over the past three years, there has been a decrease in promoter holding by 12%, which may raise concerns about the commitment of the company’s leadership. Such changes in ownership structures can influence investor confidence and affect the stock price.

5. Exceptional Losses

The company faced an exceptional loss of ₹34.34 crore due to a fire incident, which impacted its financial performance. Such unforeseen events can disrupt operations and negatively affect investor sentiment.

6. Analyst Outlook

Analysts have a mixed outlook on Prataap Snacks’ stock. While some recommend holding the stock, others see potential for growth, with price targets ranging up to ₹1,950. The average consensus target is around ₹1,546.90, suggesting a possible upside from current levels.

Read Also:- Tech Mahindra Share Price Target Tomorrow 2025 To 2030