Premier Energies Share Price Target Tomorrow 2025 To 2030

Premier Energies Limited is a prominent Indian company specializing in solar energy solutions. Established in 1995 and headquartered in Hyderabad, the company has grown to become one of India’s leading integrated manufacturers of solar photovoltaic cells and modules. With state-of-the-art manufacturing facilities in Telangana, Premier Energies boasts a significant production capacity, contributing to the nation’s renewable energy sector. Beyond manufacturing, the company offers comprehensive services including engineering, procurement, and construction (EPC) for solar power projects, as well as operation and maintenance (O&M) services. Premier Energies is also involved in developing solar power projects, reflecting its commitment to sustainable energy solutions. Premier Energies Share Price on NSE as of 25 April 2025 is 1,035.70 INR.

Premier Energies Share Market Overview

- Open: 1,067.00

- High: 1,067.00

- Low: 1,034.05

- Previous Close: 1,068.70

- Volume: 1,289,073

- Value (Lacs): 13,370.91

- 52 Week High: 1,388.00

- 52 Week Low: 450.00

- Mkt Cap (Rs. Cr.): 46,756

- Face Value: 1

Premier Energies Share Price Chart

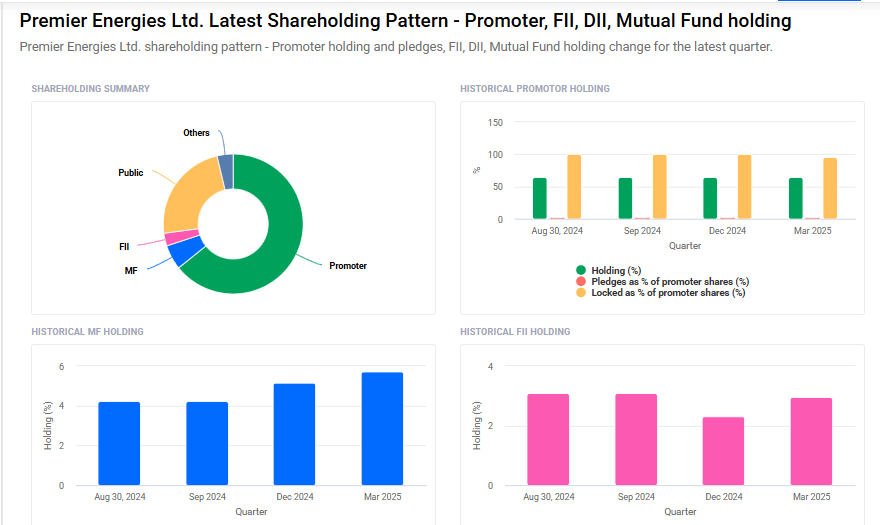

Premier Energies Shareholding Pattern

- Promoters: 64.3%

- FII: 3%

- DII: 8.7%

- Public: 24.1%

Premier Energies Share Price Target Tomorrow 2025 To 2030

| Premier Energies Share Price Target Years | Premier Energies Share Price |

| 2025 | ₹1390 |

| 2026 | ₹1500 |

| 2027 | ₹1700 |

| 2028 | ₹1900 |

| 2029 | ₹2100 |

| 2030 | ₹2300 |

Premier Energies Share Price Target 2025

Here are four key factors that could influence the growth of Premier Energies’ share price by 2025:

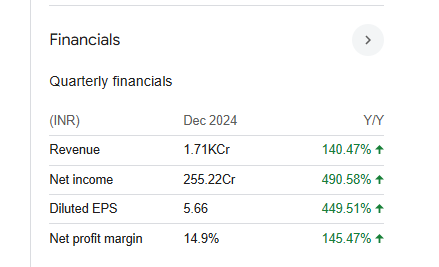

1. Strong Revenue and Earnings Growth

Premier Energies has demonstrated impressive financial performance, with revenue growing at an average annual rate of 25% over the next three years, outpacing the semiconductor industry’s 17% growth forecast in Asia. Additionally, the company’s earnings per share (EPS) have shown significant growth, increasing from ₹3.11 to ₹5.66, marking an 82% rise. These figures indicate strong financial health, which can positively influence investor confidence and share price.

2. International Expansion through U.S. Joint Venture

Premier Energies has partnered with Canada’s Heliene to establish a 1-gigawatt solar cell manufacturing facility in Minneapolis, Minnesota. This joint venture aims to meet the growing demand for domestically produced solar equipment in the U.S., aligning with the Biden administration’s efforts to strengthen local solar manufacturing. The facility is expected to commence production by the second quarter of 2026.

3. Robust Financial Metrics and Profitability

The company boasts a strong financial profile, with a Return on Capital Employed (ROCE) of 25.2% and a Return on Equity (ROE) of 43.7%. These metrics reflect efficient use of capital and strong profitability, which are attractive to investors and can support share price growth.

4. Favorable Market Conditions and Analyst Outlook

Analysts have set varying price targets for Premier Energies’ stock, reflecting different perspectives on its growth prospects. For instance, some forecasts suggest a share price target ranging from ₹1,228 to ₹1,388 by 2025, indicating potential upside from current levels. Such optimistic projections can influence investor sentiment and drive share price appreciation.

Premier Energies Share Price Target 2030

Here are four risks and challenges that could impact the Premier Energies share price target by 2030:

1. Dependence on Government Policies

Premier Energies’ success is closely tied to renewable energy policies and subsidies from the government. If there are delays in policy support or changes in tax benefits or incentives, it may affect the company’s future growth and earnings, which could influence its share price.

2. High Competition in the Solar Industry

The solar energy sector is growing fast, but it is also becoming more competitive. Many new and established companies are entering the market. If Premier Energies is not able to keep up with innovation, pricing, or quality, it could lose market share, affecting its long-term performance and stock value.

3. Raw Material and Supply Chain Issues

Solar panel manufacturing depends on key materials like silicon and other components, often sourced globally. If there are disruptions in the supply chain or sharp increases in raw material prices, it could raise production costs and reduce profit margins, which might impact investor confidence.

4. Technological Shifts and Upgrades

The renewable energy space is evolving quickly. New and more efficient technologies could replace existing methods. If Premier Energies does not invest in upgrading its technology or fails to adapt, it may fall behind, which could become a risk to its long-term growth and share price.

Premier Energies Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 3.55B | 120.07% |

| Operating expense | 344.13B | 96.23% |

| Net income | 2.31B | 1,906.79% |

| Net profit margin | 7.36 | 917.78% |

| Earnings per share | — | — |

| EBITDA | 4.88B | 384.32% |

| Effective tax rate | 20.05% | — |

Read Also:- BPCL Share Price Target Tomorrow 2025 To 2030