Premium Capital Share Price Target Tomorrow 2025 To 2030

Premium Capital is a growing financial company that provides services like personal loans, business financing, and investment guidance. The company is focused on helping people and small businesses make smart financial decisions and reach their goals. With a customer-friendly approach and simple processes, Premium Capital aims to make financial services more accessible and trustworthy. Premium Capital Share Price on BOM as of 13 May 2025 is 5.90 INR.

Premium Capital Share Market Overview

- Open: 5.90

- High: 5.90

- Low: 5.90

- Previous Close: 5.62

- Volume: 1,290

- Value (Lacs): 0.08

- VWAP: 5.90

- 52 Week High: 5.90

- 52 Week Low: 3.82

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Premium Capital Share Price Chart

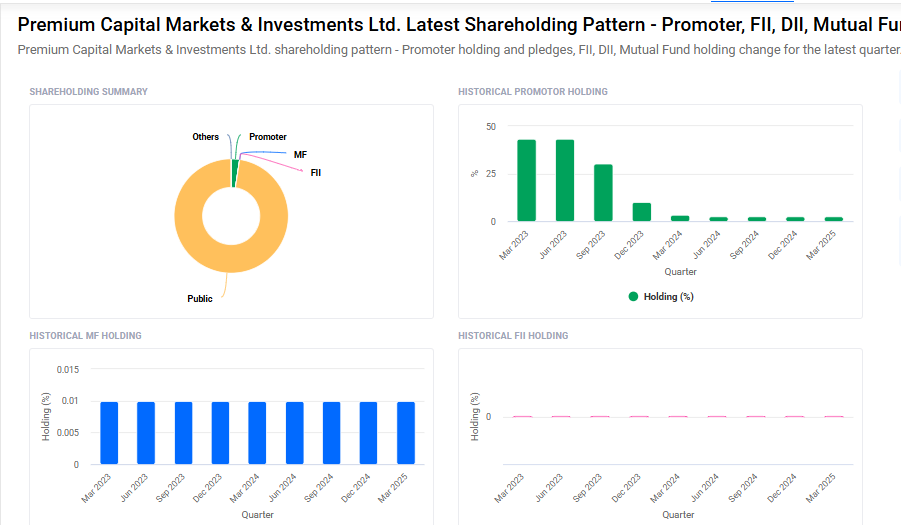

Premium Capital Shareholding Pattern

- Promoters: 2.4%

- FII: 0%

- DII: 0%

- Public: 97.6%

Premium Capital Share Price Target Tomorrow 2025 To 2030

| Premium Capital Share Price Target Years | Premium Capital Share Price |

| 2025 | ₹7 |

| 2026 | ₹10 |

| 2027 | ₹15 |

| 2028 | ₹20 |

| 2029 | ₹25 |

| 2030 | ₹30 |

Premium Capital Share Price Target 2025

Premium Capital share price target 2025 Expected target could ₹7. Here are 4 key factors affecting growth for Premium Capital’s share price target in 2025:

-

Growth in Financial Services and Investment Demand: As more individuals and businesses seek financial planning, loans, and investment opportunities, Premium Capital can benefit from increased demand for its financial products and advisory services.

-

Interest Rate Trends and Monetary Policy: Changes in interest rates directly impact lending and investment returns. Favorable interest rate environments can improve margins and attract more clients, boosting company performance.

-

Digital Transformation and Fintech Adoption: Premium Capital’s ability to adopt digital tools and platforms for better customer service and operational efficiency will be a key driver of growth and competitiveness.

-

Regulatory Environment and Compliance: A stable and supportive regulatory framework can help the company expand smoothly, while stricter compliance requirements may increase operational costs but also raise trust in its services.

Premium Capital Share Price Target 2030

Premium Capital share price target 2030 Expected target could ₹30. Here are 4 key risks and challenges that could affect Premium Capital’s share price target for 2030:

-

Regulatory Changes and Compliance Costs: Financial companies are highly regulated, and any changes in laws or stricter compliance requirements may increase operational costs and limit business flexibility.

-

Economic Slowdowns and Market Volatility: A weak economy or unstable financial markets can reduce demand for loans, investments, and financial services, directly affecting Premium Capital’s revenue and growth potential.

-

Rising Competition in Financial Services: The financial sector is becoming increasingly competitive, with new fintech startups and digital platforms offering similar services. This could pressure Premium Capital to innovate constantly and maintain competitive pricing.

-

Credit and Default Risks: If a significant number of clients fail to repay loans or investments underperform, it could harm the company’s financial stability and investor confidence over the long term.

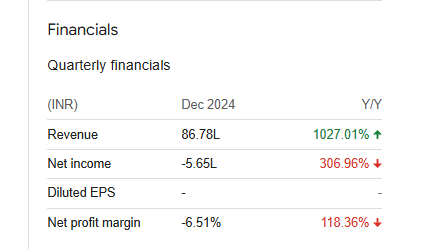

Premium Capital Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 8.85M | 4,870.22% |

| Operating expense | 3.11M | 1,034.31% |

| Net income | -2.80M | -2,756.12% |

| Net profit margin | -31.64 | 42.54% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | — | — |

Read Also:- Gopal Iron Stl Share Price Target Tomorrow 2025 To 2030