Punjab and Sind Bank Share Price Target Tomorrow 2025 To 2030

Punjab & Sind Bank is a public sector bank in India, established in 1908. As of April 15, 2025, its share price is approximately ₹27.01 on the NSE and ₹27.03 on the BSE. The bank has shown a return of 16.35% over the past three years. Its market capitalization stands at ₹19,179 crore. The bank’s promoter, the President of India, holds a 98.25% stake. Punjab & Sind Bank offers various banking and financial services across India. The bank’s total assets were ₹1,54,708 crore as of December 31, 2024. Its P/E ratio is 22.77, and the P/B ratio is 1.61. The bank reported a net profit of ₹281.96 crore for the quarter ending December 31, 2024. The bank’s gross NPA stood at 4.21%, and net NPA at 1.46%. The bank declared a final dividend of ₹0.2 per share on May 10, 2024. Punjab and Sind Bank Share Price on NSE as of 15 April 2025 is 27.45 INR.

Punjab and Sind Bank Share Market Overview

- Open: 27.30

- High: 27.49

- Low: 27.06

- Previous Close: 27.01

- Volume: 438,914

- Value (Lacs): 120.61

- VWAP: 27.29

- UC Limit: 29.71

- LC Limit: 24.30

- 52 Week High: 73.64

- 52 Week Low: 25.22

- Mkt Cap (Rs. Cr.): 18,625

- Face Value: 10

Punjab and Sind Bank Share Price Chart

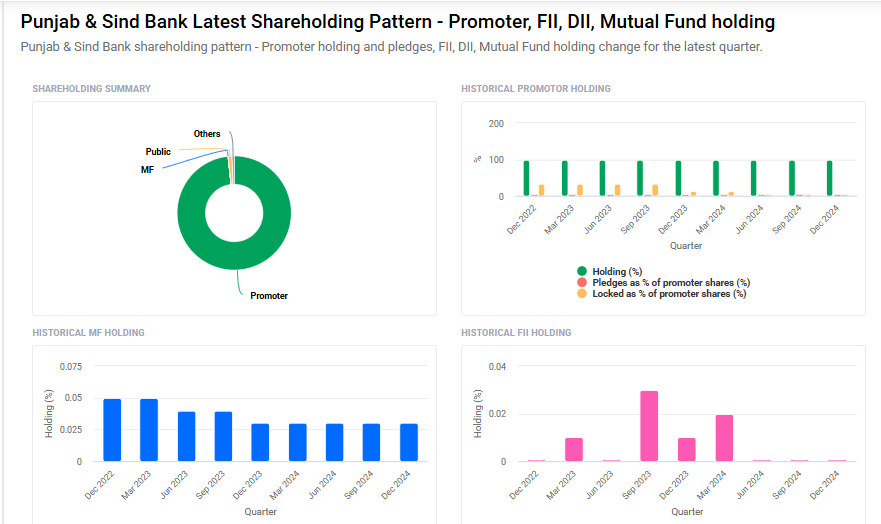

Punjab and Sind Bank Shareholding Pattern

- Promoters: 98.3%

- FII: 0%

- DII: 0.7%

- Public: 1.1%

Punjab and Sind Bank Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹75

- 2026 – ₹100

- 2027 – ₹130

- 2028 – ₹160

- 2029 – ₹190

- 2030 – ₹210

Major Factors Affecting Punjab and Sind Bank Share Price

Here are six key factors that influence the share price of Punjab & Sind Bank:

1. Financial Performance and Profitability

The bank’s financial health plays a crucial role in determining its share price. For instance, in the December 2024 quarter, Punjab & Sind Bank reported a net profit of ₹282 crore, more than doubling from ₹114 crore in the same period the previous year. This significant improvement was attributed to a decline in bad loans and an increase in total income to ₹3,269 crore from ₹2,853 crore.

2. Asset Quality and Non-Performing Assets (NPAs)

The quality of the bank’s assets, particularly the level of NPAs, affects investor confidence. As of the latest reports, the bank’s Gross NPA stood at 4.21%, and Net NPA at 1.46%, indicating a relatively healthy asset quality.

3. Capital Adequacy and Fundraising Initiatives

Maintaining adequate capital is essential for the bank’s growth and stability. Recently, Punjab & Sind Bank concluded an equity share placement at ₹38.37 per share to strengthen its capital base and market position.

4. Market Volatility and Stock Performance

The bank’s stock has experienced significant volatility. For example, the share price reached a 52-week high of ₹73.64 and a low of ₹25.22. Such fluctuations can impact investor sentiment and influence the share price.

5. Valuation Metrics

Valuation ratios like Price-to-Earnings (P/E) and Price-to-Book (P/B) provide insights into the stock’s valuation. Punjab & Sind Bank’s P/E ratio stands at 21.73, and its P/B ratio is 1.18, suggesting that the stock is valued moderately compared to its earnings and book value.

6. Macroeconomic Factors and Regulatory Environment

Broader economic conditions and regulatory policies can influence the bank’s operations and profitability. Factors such as changes in interest rates, inflation, and regulatory guidelines from the Reserve Bank of India (RBI) can impact the bank’s performance and, consequently, its share price.

Risks and Challenges for Punjab and Sind Bank Share Price

Here are six key risks and challenges that could influence the share price of Punjab & Sind Bank:

1. High Volatility in Stock Price

The bank’s share price has experienced significant fluctuations recently. For instance, it declined by 20% in one session and an additional 8.3% the following day, reflecting high volatility that can affect investor confidence.

2. Concerns Over Asset Quality

While the bank’s gross non-performing assets (NPAs) stood at 4.21% and net NPAs at 1.46%, there are concerns about the overall asset quality, especially with a restructured book of ₹1,974 crore. Any deterioration in asset quality can impact profitability and share price.

3. High Cost-to-Income Ratio

The bank’s cost-to-income ratio is at 64.5%, indicating that a significant portion of its income is consumed by operating expenses. This inefficiency can limit profitability and affect investor sentiment.

4. Market Valuation Concerns

Punjab & Sind Bank’s price-to-earnings (P/E) ratio stands at 21.50, and its price-to-book (P/B) value is 1.54. These valuation metrics suggest that the stock may be priced higher relative to its earnings and book value, potentially making it less attractive to value investors.

5. Technical Indicators Signaling Bearish Trends

Technical analysis indicates bearish trends for the stock, with recent declines and a shift from mildly bearish to bearish technical indicators. Such trends can influence short-term trading decisions and impact share price.

6. Macroeconomic and Sectoral Challenges

Broader economic factors, such as fluctuations in interest rates, inflation, and regulatory changes, can impact the banking sector. For instance, during a recent market downturn, PSU bank stocks, including Punjab & Sind Bank, experienced significant declines.

Read Also:- IndiaMART Share Price Target Tomorrow 2025 To 2030