Radhagobind Comm Share Price Target Tomorrow 2025 To 2030

Radhagobind Commercial Limited is a publicly listed company in India, established in 1981 and headquartered in Kolkata, West Bengal. Originally named Tejmangal Commercial Company Limited, the company rebranded to its current name in July 2013. Operating primarily in the textile industry, Radhagobind Commercial specializes in trading fabrics, including embroidery fancy sarees, H.L. fabrics, and textile dress materials. Radhagobind Comm Share Price on BOM as of 12 May 2025 is 2.54 INR.

Radhagobind Comm Share Market Overview

- Open: 2.54

- High: 2.54

- Low: 2.54

- Previous Close: 2.67

- Volume: 567

- Value (Lacs): 0.01

- VWAP: 2.54

- 52 Week High: 5.11

- 52 Week Low: 1.90

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Radhagobind Comm Share Price Chart

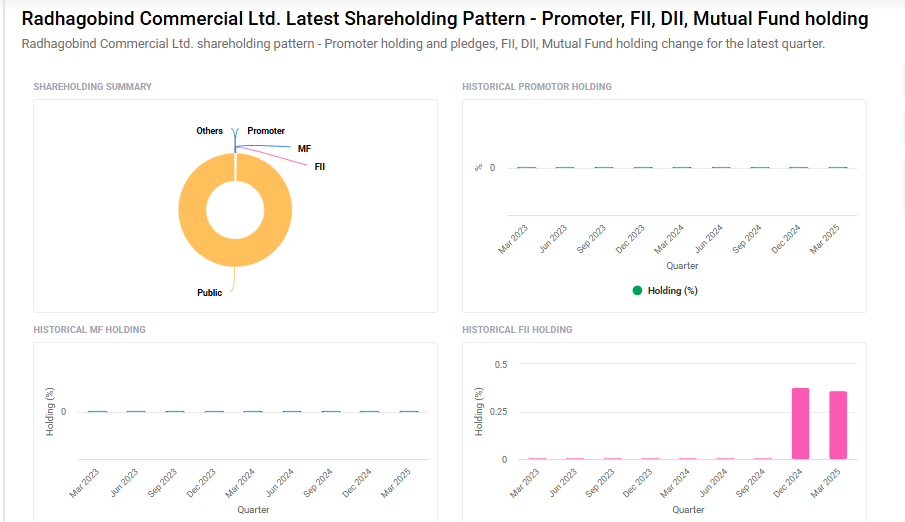

Radhagobind Comm Shareholding Pattern

- Promoters: 0%

- FII: 0.4%

- DII: 0%

- Public: 99.6%

Radhagobind Comm Share Price Target Tomorrow 2025 To 2030

| Radhagobind Comm Share Price Target Years | Radhagobind Comm Share Price |

| 2025 | ₹6 |

| 2026 | ₹10 |

| 2027 | ₹14 |

| 2028 | ₹18 |

| 2029 | ₹22 |

| 2030 | ₹26 |

Radhagobind Comm Share Price Target 2025

Radhagobind Comm share price target 2025 Expected target could ₹6. Here are four key factors that could affect the growth and share price target of Radhagobind Commercial Limited by 2025:

-

Business Diversification and Revenue Streams: The company’s ability to diversify its business operations and generate stable revenue from multiple sources will be crucial for sustainable growth and investor confidence.

-

Market Demand and Industry Trends: Growth will depend heavily on demand for the products or services it deals in, especially if it’s tied to sectors like trading, real estate, or finance. Shifts in market preferences or economic cycles can directly impact performance.

-

Financial Health and Profit Margins: The company’s profitability, debt levels, and overall financial management will influence its ability to reinvest in growth, pay dividends, and attract investors.

-

Regulatory and Economic Environment: Changes in government policies, taxation, or industry-specific regulations could impact operations and future growth prospects, especially in sectors like trading and finance.

Radhagobind Comm Share Price Target 2030

Radhagobind Comm share price target 2030 Expected target could ₹26.

Here are four risks and challenges that could affect the Radhagobind Commercial share price target by 2030:

-

Economic and Market Volatility: Radhagobind Commercial’s growth could be heavily impacted by economic downturns, fluctuations in market conditions, or changes in consumer spending, especially if its business is tied to industries sensitive to economic cycles.

-

Regulatory and Compliance Risks: Changes in government regulations, tax policies, or business laws could increase operational costs, limit growth potential, or affect the company’s ability to do business in certain markets.

-

Competition and Market Saturation: Increased competition from other firms offering similar products or services could limit Radhagobind Commercial’s market share, putting pressure on pricing and profit margins.

-

Management and Strategic Execution: The company’s future will depend on effective management decisions, especially in navigating industry trends and adapting to new business models. Poor execution of expansion strategies could result in slower growth or financial losses.

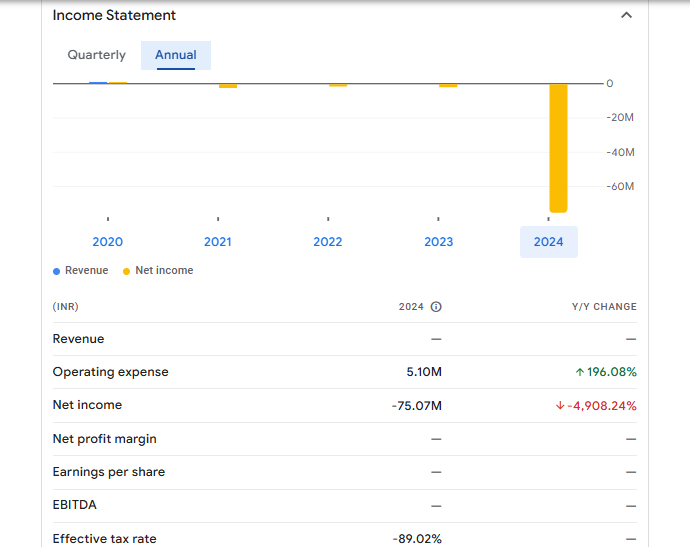

Radhagobind Comm Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | — | — |

| Operating expense | 5.10M | 196.08% |

| Net income | -75.07M | -4,908.24% |

| Net profit margin | — | — |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 25.26% | — |

Read Also:- Decorous Investment Share Price Target Tomorrow 2025 To 2030