Raitel Share Price Target Tomorrow 2025 To 2030

RailTel Corporation of India Ltd. is a prominent public sector enterprise under the Ministry of Railways, recognized as a “Navratna” PSU. Established in 2000, RailTel aims to modernize the existing telecom system for train control, operation, and safety, while also generating additional revenue by creating a nationwide broadband and multimedia network. The company owns a Pan-India optic fiber network, covering over 61,000 route kilometers and encompassing more than 6,100 railway stations across the country. This extensive network facilitates a range of services, including broadband internet, data center services, and managed telecom services. Raitel Share Price on NSE as of 24 April 2025 is 319.95 INR.

Raitel Share Market Overview

- Open: 318.00

- High: 321.25

- Low: 309.30

- Previous Close: 317.45

- Volume: 1,684,785

- Value (Lacs): 5,382.89

- 52 Week High: 617.80

- 52 Week Low: 265.50

- Mkt Cap (Rs. Cr.): 10,253

- Face Value: 10

Raitel Share Price Chart

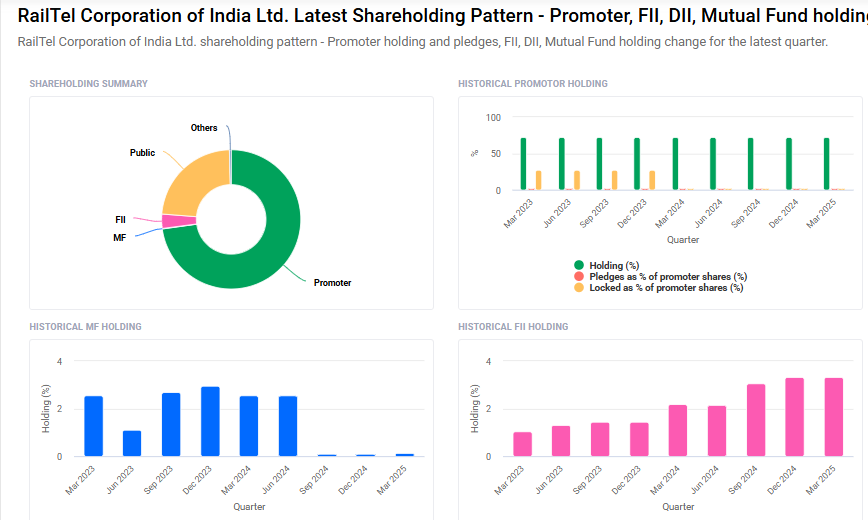

Raitel Shareholding Pattern

- Promoters: 72.8%

- FII: 3.3%

- DII: 0.5%

- Public: 23.4%

Raitel Share Price Target Tomorrow 2025 To 2030

| Raitel Share Price Target Years | Raitel Share Price |

| 2025 | ₹620 |

| 2026 | ₹650 |

| 2027 | ₹680 |

| 2028 | ₹710 |

| 2029 | ₹740 |

| 2030 | ₹770 |

Raitel Share Price Target 2025

Here are four key factors that could influence the growth and share price of RailTel Corporation of India Ltd. by 2025:

1. Strategic Government Contracts

RailTel has recently secured significant government contracts, such as a ₹25 crore agreement with HPCL for providing MPLS/ILL services over five years . Additionally, the company won a ₹288 crore Kavach tender, enhancing its revenue visibility and strengthening its position in the public sector . These contracts are expected to contribute positively to RailTel’s financial growth.

2. Expansion in Digital Infrastructure

With the increasing demand for digital transformation in India, RailTel is expanding its portfolio in IT and digital solutions. The company’s focus on providing telecom services, data centers, and integrated IT infrastructure positions it well to capitalize on the country’s digital growth.

3. Analyst Price Targets

Analyst predictions for RailTel’s share price in 2025 vary. Some forecasts suggest a target price around ₹280 , while others estimate a range between ₹380 and ₹549 . These projections indicate potential for growth, but also reflect differing opinions on the company’s future performance.

4. Financial Performance and Market Sentiment

RailTel’s financial metrics, such as a PE ratio of 38.47 and a return on equity averaging around 12% over the past five years, demonstrate solid performance . However, market sentiment can be influenced by broader economic factors and investor perceptions, which may impact the share price regardless of the company’s fundamentals.

Raitel Share Price Target 2030

Here are four key risks and challenges that could influence RailTel Corporation of India Ltd.’s share price target by 2030:

1. Volatile Stock Performance

RailTel’s stock has experienced significant fluctuations. Over the past year, the share price declined by 6.47%, with a 16.80% drop year-to-date and a 27.39% decrease over the last six months. Such volatility can impact investor confidence and affect long-term growth prospects.

2. Market Sentiment and Analyst Outlook

Analyst opinions on RailTel’s stock are mixed. Some forecasts suggest a potential downside, with average target prices indicating a decrease from current levels. This cautious outlook may influence investor decisions and stock performance.

3. Dependence on Government Contracts

RailTel’s revenue is significantly tied to government contracts. While recent orders, such as the ₹25 crore contract with HPCL and the ₹288 crore Kavach tender, bolster its portfolio, any delays or cancellations in such projects could adversely affect financial stability.

4. Competitive Industry Landscape

The telecom and IT infrastructure sectors are highly competitive. RailTel faces challenges from both public and private entities offering similar services. Maintaining a competitive edge requires continuous innovation and investment, which can strain resources.

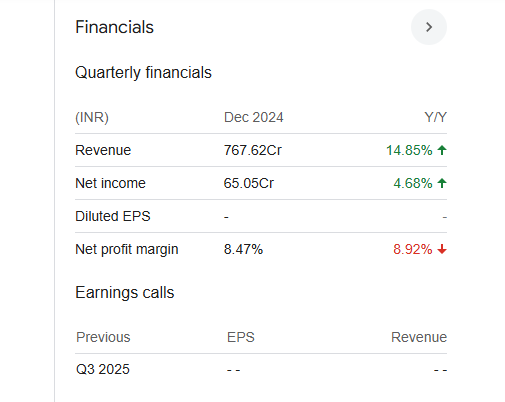

Raitel Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 25.68B | 30.78% |

| Operating expense | 1.88B | -0.31% |

| Net income | 2.46B | 30.22% |

| Net profit margin | 9.59 | -0.42% |

| Earnings per share | 6.84 | 14.83% |

| EBITDA | 4.47B | 24.15% |

| Effective tax rate | 24.96% | — |

Read Also:- MCX Share Price Target Tomorrow 2025 To 2030