Rallis India Share Price Target Tomorrow 2025 To 2030

Rallis India is a well-known company in the agrochemical sector and is part of the trusted Tata Group. It mainly focuses on providing high-quality products like crop protection chemicals, plant growth nutrients, and seeds to farmers across India and several global markets. The company plays a key role in supporting Indian agriculture by helping improve crop yields and ensuring sustainable farming practices. Rallis India has a strong research and development base, which helps it stay innovative and offer better solutions to farmers. Rallis India Share Price on NSE as of 21 April 2025 is 237.80 INR.

Rallis India Share Market Overview

- Open: 226.00

- High: 241.74

- Low: 224.03

- Previous Close: 225.44

- Volume: 1,339,781

- Value (Lacs): 3,193.64

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 378.70

- 52 Week Low: 196.00

- Mkt Cap (Rs. Cr.): 4,635

- Face Value: 1

Rallis India Share Price Chart

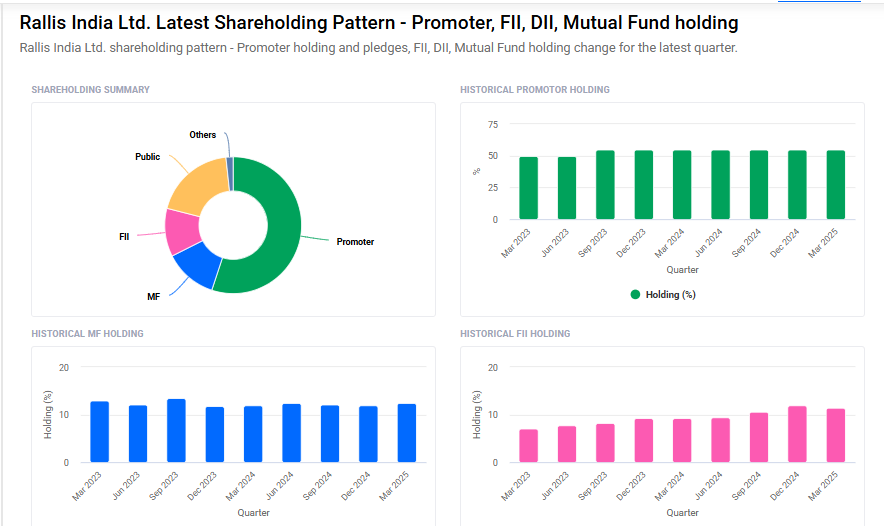

Rallis India Shareholding Pattern

- Promoters: 55.1%

- FII: 11.4%

- DII: 14.2%

- Public: 19.3%

Rallis India Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹380

- 2026 – ₹420

- 2027 – ₹460

- 2028 – ₹500

- 2030 – ₹540

Major Factors Affecting Rallis India Share Price

Here are six key factors that can influence the share price of Rallis India Limited;

1. Agricultural Demand and Monsoon Patterns

Rallis India’s performance is closely tied to the agricultural sector. Favorable monsoon conditions can boost crop production, increasing the demand for agrochemicals and benefiting the company. Conversely, poor rainfall can reduce agricultural activities, negatively impacting sales and potentially leading to a decline in the share price.

2. Raw Material Costs and Profit Margins

The cost of raw materials plays a significant role in Rallis India’s profitability. An increase in these costs can squeeze profit margins, leading to lower earnings. For instance, elevated material costs have previously impacted the company’s revenue growth and margins, which can affect investor confidence and the stock price.

3. Financial Performance and Earnings Reports

Investors closely monitor Rallis India’s financial results. Consistent revenue growth and profitability can lead to a positive outlook and higher share prices. However, reports of poor sales growth or declining profits, such as a 5.95% sales growth over the past five years, may raise concerns and negatively impact the stock.

4. Analyst Ratings and Market Sentiment

Analyst recommendations can influence investor decisions. For example, a ‘reduce’ rating by HSBC due to industry challenges led to a decline in Rallis India’s share price. Positive ratings and optimistic forecasts can boost investor confidence and drive the stock price up.

5. Ownership Structure and Promoter Confidence

Rallis India is a subsidiary of Tata Chemicals Limited, which holds a 55% stake in the company. This strong promoter backing can instill confidence among investors. However, any changes in the ownership structure or promoter shareholding can influence market perceptions and affect the share price.

6. Valuation Metrics and Investor Perception

Investors often assess valuation metrics like the Price-to-Earnings (P/E) ratio to determine if a stock is overvalued or undervalued. As of April 2025, Rallis India’s P/E ratio stood at 34.33, slightly below the industry median. Such valuations can influence investment decisions and impact the stock price.

Risks and Challenges for Rallis India Share Price

Here are six key risks and challenges that can affect the share price of Rallis India Limited:

1. Dependence on Monsoon and Weather Conditions

Rallis India’s business is closely linked to agriculture, which in turn depends on good monsoon rains. If the monsoon is weak or unpredictable, farmers may reduce their spending on agricultural inputs like seeds and pesticides. This can directly impact the company’s sales and revenue, leading to pressure on the share price.

2. Volatility in Raw Material Prices

Rallis India uses various raw materials to produce agrochemicals and seeds. If the prices of these materials increase sharply, it can raise the cost of production and reduce profit margins. If the company is unable to pass on these costs to customers, its earnings may be affected, which can negatively impact investor confidence and the share price.

3. Regulatory and Environmental Risks

The agrochemical industry is subject to strict regulations, both in India and in international markets. Any changes in laws related to the use of pesticides, chemical safety, or environmental standards can pose a challenge. Delays in product approvals or bans on certain chemicals may reduce product availability and hurt the company’s performance.

4. Intense Market Competition

Rallis India operates in a highly competitive market where many domestic and international players are offering similar products. If competitors offer better prices, quality, or service, it could result in a loss of market share for Rallis. This increased pressure on performance can reflect poorly in the company’s stock valuation.

5. Global Economic and Political Uncertainty

Though Rallis India mainly serves the Indian market, it also exports products. Changes in global trade policies, currency fluctuations, or political tensions in key export destinations can affect its international business. These uncertainties can influence investor sentiment and may lead to short-term volatility in the share price.

6. Slow Innovation and R&D Challenges

Innovation is important in the agrochemical sector to meet changing agricultural needs and environmental norms. If Rallis India fails to invest adequately in research and development or lags behind in launching new and effective products, it could lose its competitive edge. This could result in slower growth, which might worry investors and impact the share price.

Read Also:- Lupin Share Price Target Tomorrow 2025 To 2030