RAMA Steel Share Price Target Tomorrow 2025 To 2030

Rama Steel Tubes Limited, established in 1974 and headquartered in New Delhi, is a prominent manufacturer and exporter of steel pipes and tubes in India. The company offers a diverse range of products, including electric resistance welded (ERW) galvanized steel pipes, mild steel black pipes, scaffolding tubes, structural hollow sections, and rigid polyvinyl chloride (PVC) pipes. With manufacturing facilities located in Sahibabad (Uttar Pradesh), Khopoli (Maharashtra), and Anantapur (Andhra Pradesh), Rama Steel Tubes has expanded its production capacity to meet growing domestic and international demand. RAMA Steel Share Price on NSE as of 22 May 2025 is 11.25 INR.

RAMA Steel Share Market Overview

- Open: 11.20

- High: 11.55

- Low: 10.55

- Previous Close: 11.11

- Volume: 14,477,849

- Value (Lacs): 1,630.21

- 52 Week High: 17.55

- 52 Week Low: 8.50

- Mkt Cap (Rs. Cr.): 1,754

- Face Value: 5

RAMA Steel Share Price Chart

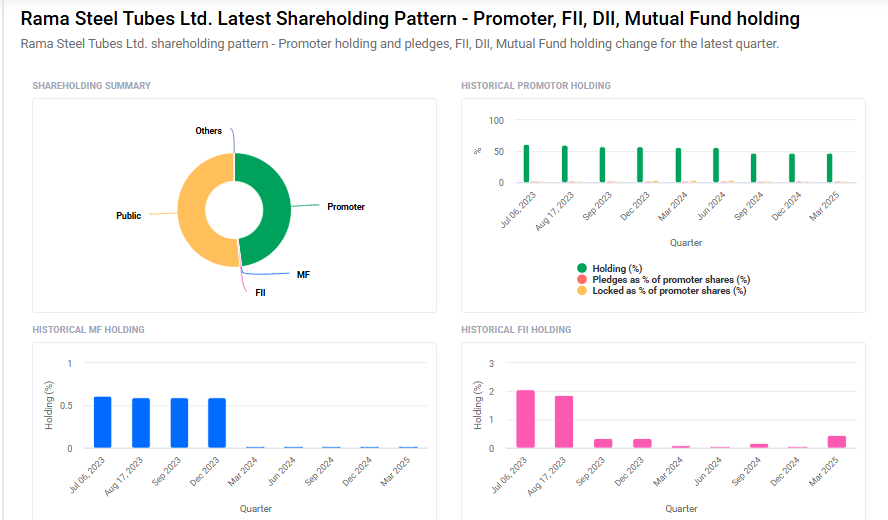

RAMA Steel Shareholding Pattern

- Promoters: 48%

- FII: 0.4%

- DII: 0%

- Public: 51.6%

RAMA Steel Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹18 |

| 2026 | ₹22 |

| 2027 | ₹26 |

| 2028 | ₹30 |

| 2029 | ₹34 |

| 2030 | ₹38 |

RAMA Steel Share Price Target 2025

RAMA Steel share price target 2025 Expected target could ₹18. Here are five key factors influencing the growth of Rama Steel Tubes Ltd’s share price target for 2025:

-

Robust Sales Volume Growth: In the second quarter of FY2025, Rama Steel Tubes reported a significant 42.32% year-over-year increase in sales volumes, reaching 50,921.67 tons. This substantial growth indicates strong market demand and effective sales strategies, which can positively impact the company’s revenue and share price.

-

Expansion into Renewable Energy Sector: The company has ventured into the renewable energy industry by partnering with Onix Renewable Ltd. to supply steel structures and single-axis trackers for solar projects. This diversification into green energy aligns with global sustainability trends and opens new revenue streams, potentially boosting investor confidence and share value.

-

Strong Historical Sales and EBIT Growth: Over the past five years, Rama Steel Tubes has achieved a sales growth of 20.37% and an EBIT (Earnings Before Interest and Taxes) growth of 29.47%. These figures reflect the company’s consistent operational efficiency and profitability, which are critical factors for share price appreciation.

-

Improving Financial Health: The company has been actively reducing its debt levels, as evidenced by a debt-to-EBITDA ratio of 4.33 and a net debt-to-equity ratio of 0.53. Lower leverage enhances financial stability and reduces risk, making the company more attractive to investors.

-

Favorable Market Conditions in Asia-Pacific: The Asia-Pacific region, which includes India, dominates the global steel tubes market, holding over 75.6% market share in 2024. The region’s robust demand from construction and infrastructure sectors provides a conducive environment for Rama Steel Tubes to expand its market presence and drive growth.

RAMA Steel Share Price Target 2030

RAMA Steel share price target 2030 Expected target could ₹38. Here are five key risks and challenges that could impact Rama Steel Tubes Ltd’s share price target by 2030:

-

Volatility in Raw Material Prices: Fluctuations in steel prices, driven by factors such as supply chain disruptions, geopolitical tensions, and economic uncertainties, can significantly affect production costs and profit margins. Such volatility poses challenges for companies like Rama Steel Tubes in maintaining consistent profitability.

-

Environmental Regulations and Compliance: Increasing environmental concerns and the imposition of strict rules concerning emissions and energy use are pivotal factors shaping the steel tubes market. Compliance with these regulations may require substantial investments in cleaner technologies and processes, impacting the company’s financial resources.

-

Market Competition and Technological Advancements: The steel industry is highly competitive, with numerous players adopting advanced technologies to enhance efficiency and product quality. Failure to keep pace with technological advancements could result in loss of market share for Rama Steel Tubes.

-

Economic Slowdowns and Infrastructure Spending: Economic downturns can lead to reduced infrastructure spending, directly affecting the demand for steel tubes and pipes. Such slowdowns could impact Rama Steel Tubes’ sales and revenue growth.

-

Dependence on Key Sectors: Rama Steel Tubes’ performance is closely tied to sectors like construction, automotive, and energy. Any significant downturn in these sectors could adversely affect the company’s business operations and financial health.

RAMA Steel Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 10.47B | -21.86% |

| Operating expense | 415.77M | -4.81% |

| Net income | 291.28M | 9.21% |

| Net profit margin | 2.78 | 39.70% |

| Earnings per share | — | — |

| EBITDA | 610.18M | 9.63% |

| Effective tax rate | 20.07% | — |

Read Also:- Central Bank Of India Share Price Target Tomorrow 2025 To 2030