RCF Share Price Target Tomorrow 2025 To 2030

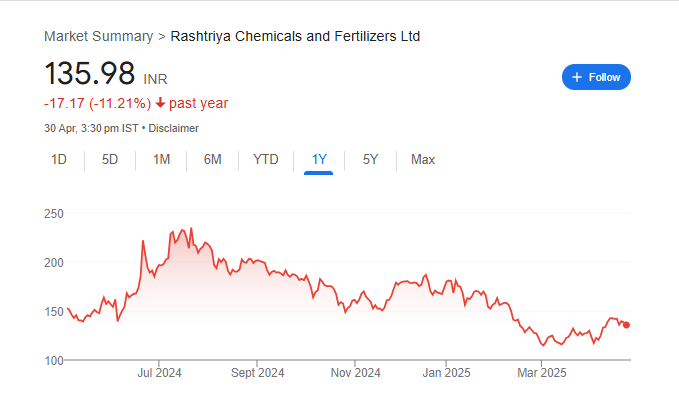

Rashtriya Chemicals and Fertilizers Limited (RCF) is a government-owned company based in India that plays a key role in the country’s agricultural sector. It mainly produces fertilizers and industrial chemicals that help farmers grow healthy crops and improve food production. RCF is known for products like urea and complex fertilizers, which are used widely across the country. The company is supported by the Indian government and contributes to various agricultural and rural development programs. RCF Share Price on NSE as of 2 May 2025 is 135.98 INR.

RCF Share Market Overview

- Open: 138.00

- High: 141.41

- Low: 135.35

- Previous Close: 138.47

- Volume: 2,257,092

- Value (Lacs): 3,080.03

- 52 Week High: 245.00

- 52 Week Low: 110.80

- Mkt Cap (Rs. Cr.): 7,528

- Face Value: 10

RCF Share Price Chart

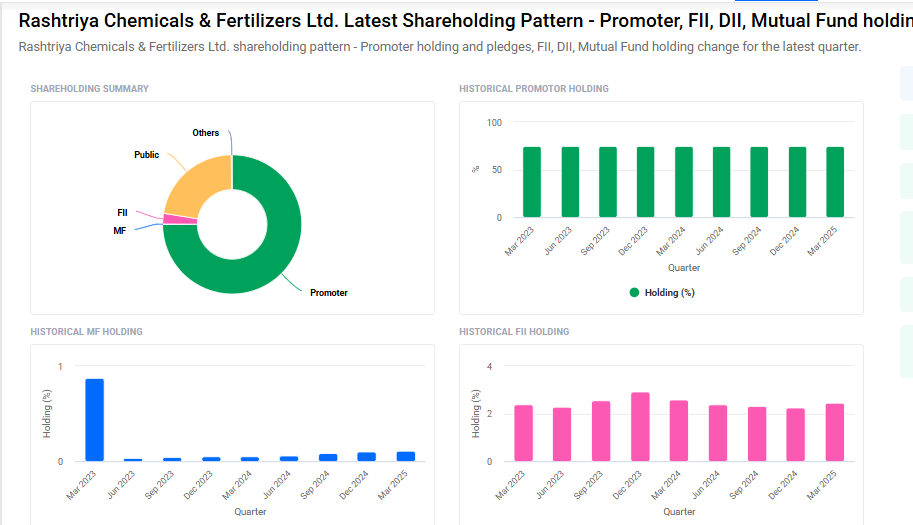

RCF Shareholding Pattern

- Promoters: 75%

- FII: 2.5%

- DII: 0.3%

- Public: 22.2%

RCF Share Price Target Tomorrow 2025 To 2030

| RCF Share Price Target Years | RCF Share Price |

| 2025 | ₹250 |

| 2026 | ₹270 |

| 2027 | ₹290 |

| 2028 | ₹310 |

| 2029 | ₹330 |

| 2030 | ₹350 |

RCF Share Price Target 2025

RCF share price target 2025 Expected target could ₹250. Here are four key factors that could influence the growth of Rashtriya Chemicals & Fertilizers Ltd (RCF):

1. Government Support and Policy Initiatives

RCF benefits from strong government backing, with a consistent promoter holding of 75% as of March 2025 . Additionally, favorable policies, such as subsidies for fertilizers and initiatives promoting agricultural growth, can positively impact the company’s revenue and profitability.

2. Operational Performance and Earnings Growth

The company’s financial performance has shown improvement, with a net profit of ₹225.28 crore reported in 2024 . Such earnings growth can enhance investor confidence and contribute to share price appreciation.

3. Market Demand and Sectoral Trends

RCF operates in the fertilizers sector, which is influenced by agricultural demand and monsoon patterns. An increase in agricultural activities and favorable monsoon conditions can lead to higher demand for fertilizers, benefiting RCF’s sales and market position.

4. Technical Indicators and Market Sentiment

Technical analysis indicates a bullish trend for RCF’s stock, with projections suggesting a potential price range of ₹155–₹160 in the near term, supported by strong RSI and MACD momentum . Positive market sentiment and technical indicators can attract investors and drive share price growth.

RCF Share Price Target 2030

RCF share price target 2030 Expected target could ₹350. Here are four key Risks and Challenges that could impact RCF (Rashtriya Chemicals & Fertilizers Ltd):

1. Dependence on Government Subsidies

RCF relies heavily on government subsidies for a major portion of its revenue. Any delays in subsidy payments or changes in government policy could negatively impact its cash flow and financial stability, posing risks to long-term growth.

2. Fluctuation in Raw Material Prices

The company depends on the import of raw materials like natural gas and phosphoric acid. Volatility in global commodity prices or supply chain disruptions could increase input costs and hurt profitability.

3. Regulatory and Environmental Challenges

As a chemical and fertilizer producer, RCF is subject to strict environmental regulations. Future tightening of environmental norms could lead to increased compliance costs or operational constraints, affecting business efficiency.

4. Limited Diversification and Market Competition

RCF faces competition from both public and private fertilizer producers. Its relatively limited diversification beyond core fertilizer products may hinder its ability to withstand competitive pressures and adapt to changing market demands.

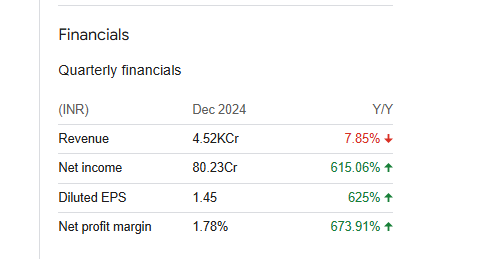

RCF Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 169.81B | -20.84% |

| Operating expense | 63.13B | -18.15% |

| Net income | 2.25B | -76.69% |

| Net profit margin | 1.33 | -70.44% |

| Earnings per share | — | — |

| EBITDA | 5.12B | -67.37% |

| Effective tax rate | 25.20% | — |

Read Also:- Moil Share Price Target Tomorrow 2025 To 2030