RVNL Share Price Target Tomorrow 2025 To 2030

Rail Vikas Nigam Limited (RVNL) is a government-owned company under the Ministry of Railways in India. It was set up to help with the fast development of railway infrastructure across the country. RVNL works on important projects like laying new railway lines, doubling tracks, electrifying routes, and building bridges and stations. The company plays a big role in improving train services and making travel smoother and faster for passengers. In recent years, RVNL has also started taking part in metro and high-speed rail projects. RVNL Share Price on NSE as of 26 May 2025 is 397.75 INR.

RVNL Share Market Overview

- Open: 406.95

- High: 407.15

- Low: 395.05

- Previous Close: 404.90

- Volume: 7,734,773

- Value (Lacs): 30,834.67

- 52 Week High: 647.00

- 52 Week Low: 305.00

- Mkt Cap (Rs. Cr.): 83,119

- Face Value: 10

RVNL Share Price Chart

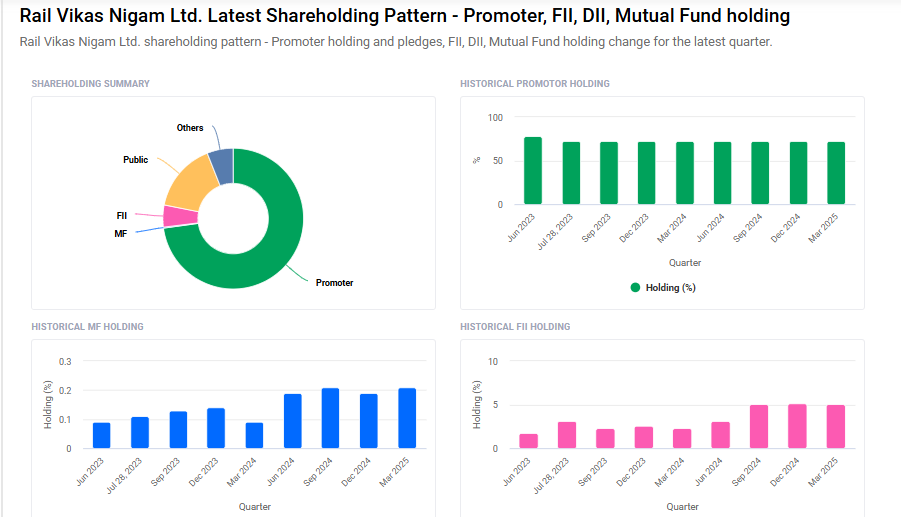

RVNL Shareholding Pattern

- Promoters: 72.8%

- FII: 5.1%

- DII: 6.2%

- Public: 15.9%

RVNL Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹650 |

| 2026 | ₹700 |

| 2027 | ₹750 |

| 2028 | ₹800 |

| 2029 | ₹850 |

| 2030 | ₹900 |

RVNL Share Price Target 2025

RVNL share price target 2025 Expected target could ₹650. Here are five key factors that could influence Rail Vikas Nigam Limited (RVNL)’s share price growth by 2025:

1. Robust Order Book and Project Wins

RVNL has secured significant contracts, including a ₹160 crore overhead electrification project from Central Railway. Such project acquisitions enhance revenue visibility and bolster investor confidence.

2. Strategic Expansion into Metro and High-Speed Rail Projects

The company’s diversification into metro rail and high-speed rail sectors positions it to capitalize on India’s urban infrastructure development, potentially leading to increased revenues and market share.

3. Government Support and Infrastructure Initiatives

As a central public sector undertaking under the Ministry of Railways, RVNL benefits from government policies aimed at enhancing railway infrastructure, including electrification and modernization efforts.

4. Strong Financial Performance and Earnings Growth

Analysts project a double-digit profit growth of approximately 19% over the next couple of years, indicating a positive outlook for RVNL’s financial health and operational efficiency.

5. Positive Market Sentiment and Investor Confidence

Despite recent share price corrections, RVNL has demonstrated significant returns over the past few years, reflecting strong investor interest and confidence in the company’s growth trajectory.

RVNL Share Price Target 2030

RVNL share price target 2030 Expected target could ₹900. Here are five key risks and challenges that could impact Rail Vikas Nigam Limited (RVNL) and its share price outlook by 2030:

1. Project Execution Delays and Cost Overruns

RVNL’s profitability is closely tied to the timely completion of infrastructure projects. Delays or cost overruns in large-scale railway projects can lead to increased expenses and reduced margins, potentially affecting investor confidence and share price performance.

2. Intensifying Competition in the Infrastructure Sector

The shift towards competitive bidding for railway projects has increased competition in the sector. This heightened competition can pressure RVNL’s profit margins and market share, especially if competitors offer more cost-effective solutions.

3. Regulatory and Policy Changes

As a government-owned entity, RVNL is subject to regulatory and policy decisions. Changes in government policies, funding allocations, or regulatory frameworks can impact project approvals, timelines, and overall business operations, introducing uncertainty into long-term planning.

4. Environmental, Social, and Governance (ESG) Concerns

RVNL has been assessed with a “Severe” ESG risk rating, indicating significant exposure to environmental and social risks. Poor ESG performance can affect the company’s reputation, investor appeal, and may lead to increased scrutiny from stakeholders.

5. Financial Performance Fluctuations

Recent financial reports indicate a decline in RVNL’s net profit and consolidated income, reflecting challenges in maintaining consistent financial performance. Such fluctuations can influence investor sentiment and may lead to volatility in the company’s share price.

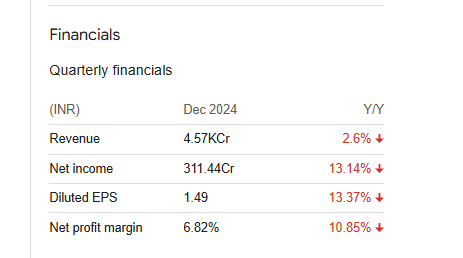

RVNL Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 218.89B | 7.93% |

| Operating expense | 3.50B | 3.64% |

| Net income | 15.74B | 17.33% |

| Net profit margin | 7.19 | 8.61% |

| Earnings per share | 7.55 | — |

| EBITDA | 13.65B | 10.72% |

| Effective tax rate | 23.34% | — |

Read Also:- NTPC Share Price Target Tomorrow 2025 To 2030