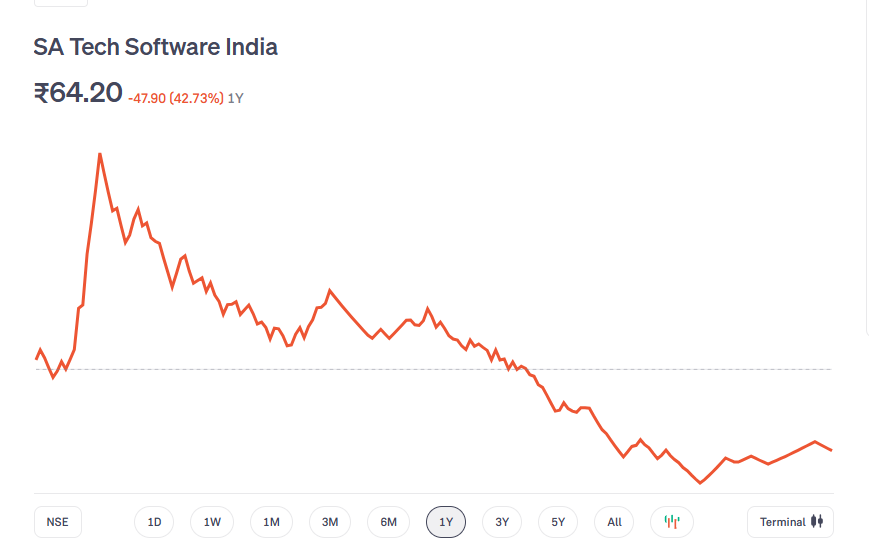

SA Tech Software Share Price Target Tomorrow 2025 To 2030

SA Tech Software India Limited, established in 2012 and headquartered in Pune, is a dynamic IT consulting firm specializing in cutting-edge technologies. As a subsidiary of the California-based SA Technologies Inc., the company offers a wide range of services including Generative AI, Machine Learning, IoT, Data Analytics, Cloud Services, DevOps, UI/UX Design, and Mobile App Development. SA Tech Software Share Price on NSE as of 8 May 2025 is 64.20 INR.

SA Tech Software Share Market Overview

- Open: 59.00

- High: 59.90

- Low: 57.50

- Previous Close: 65.50

- 52 Week High: 250.00

- 52 Week Low: 45.00

- Mkt Cap (Rs. Cr.): 84

- Face Value: 10.00

SA Tech Software Share Price Chart

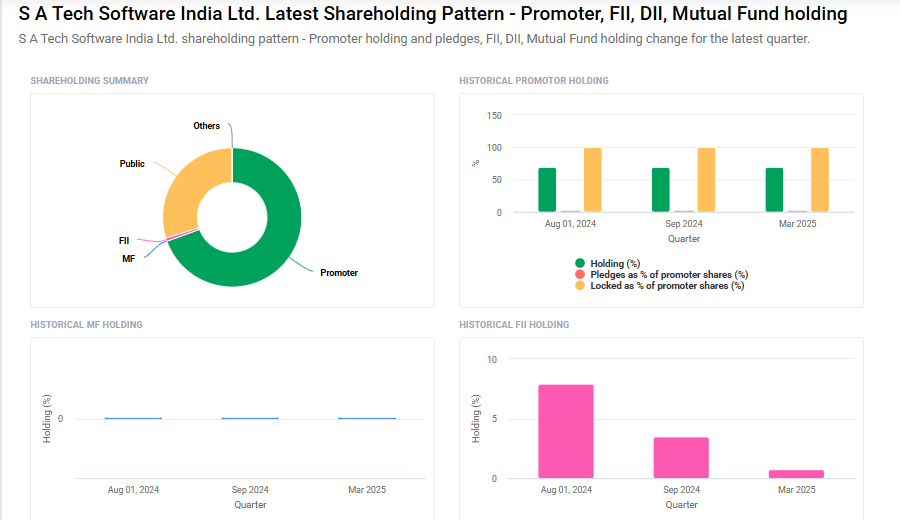

SA Tech Software Shareholding Pattern

- Promoters: 69.5%

- FII: 0.8%

- DII: 0%

- Public: 29.8%

SA Tech Software Share Price Target Tomorrow 2025 To 2030

| SA Tech Software Share Price Target Years | SA Tech Software Share Price |

| 2025 | ₹250 |

| 2026 | ₹300 |

| 2027 | ₹350 |

| 2028 | ₹400 |

| 2029 | ₹450 |

| 2030 | ₹500 |

SA Tech Software Share Price Target 2025

SA Tech Software share price target 2025 Expected target could ₹250. Here are four key factors that could influence SA Tech Software India’s share price target by 2025:

1. Robust Revenue and Profit Growth

SA Tech Software India has demonstrated significant financial growth, with revenue increasing from ₹56.39 crore in FY23 to ₹71.88 crore in FY24. Additionally, the company’s net profit surged by 244.1% year-over-year, reaching ₹4 crore in FY24. This impressive performance reflects the company’s effective strategies and market expansion efforts.

2. Efficient Capital Utilization

The company’s Return on Capital Employed (ROCE) peaked at 32.8% in March 2024, indicating strong capital efficiency. This suggests that SA Tech Software India is effectively utilizing its capital to generate profits, which is a positive sign for investors.

3. Strategic Partnerships and Global Presence

SA Tech Software India is a subsidiary of SA Technologies Inc., USA, and has established partnerships with major tech companies, becoming a Microsoft Gold Partner and a Google Cloud Partner. These collaborations enhance the company’s credibility and provide access to a broader client base, supporting its growth trajectory.

4. Favorable Industry Outlook

According to NASSCOM, India’s technology sector is expected to grow by 5.1% in FY25, driven by engineering research and development and the expansion of global capacity centers. As a player in the IT consulting and services industry, SA Tech Software India stands to benefit from this positive industry trend.

SA Tech Software Share Price Target 2030

SA Tech Software share price target 2030 Expected target could ₹500. Here are four key Risks and Challenges that could impact SA Tech Software India’s share price target by 2030:

1. Fluctuating Sales Cycles and Revenue Volatility

SA Tech Software India’s revenue streams are susceptible to fluctuations due to varying sales cycles influenced by external factors. These inconsistencies can lead to unpredictable revenue patterns, posing challenges in financial forecasting and stability.

2. Operational Risks from IT System Failures

The company’s operations heavily rely on robust IT systems. Any failures or lapses, whether due to system malfunctions or human errors, can result in operational disruptions, potential liabilities, and damage to the company’s reputation.

3. Challenges in Adapting to Rapid Technological Advancements

The IT consulting sector is characterized by rapid technological changes. SA Tech Software India must continuously adapt to emerging technologies to remain competitive. Failure to do so may render existing infrastructure obsolete and affect the company’s market position.

4. Macroeconomic and Geopolitical Uncertainties

Global economic slowdowns and geopolitical tensions, such as trade wars and policy changes, can impact the IT services sector. These factors may lead to reduced client spending and affect the company’s growth prospects.

Read Also:- Freshworks Share Price Target Tomorrow 2025 To 2030