Sarla Performance Fibers Share Price Target Tomorrow 2025 To 2030

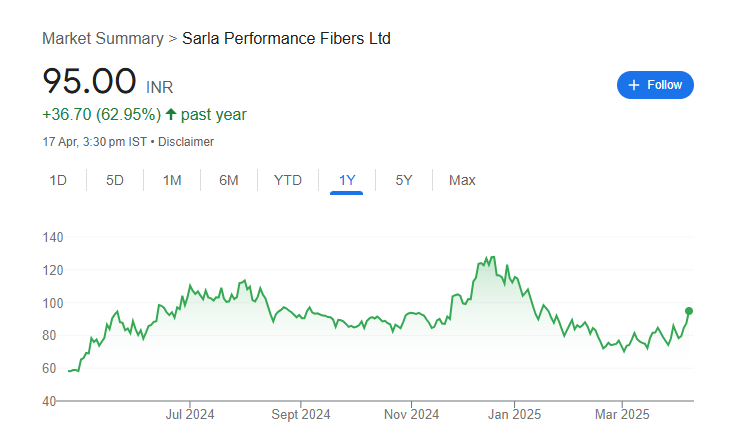

Sarla Performance Fibers Limited is a prominent Indian textile manufacturer, specializing in high-quality polyester and nylon yarns. Established in 1993 and headquartered in Mumbai, the company has evolved from producing basic yarns to offering over 250 specialized products, including textured, twisted, dyed, and high-tenacity yarns, as well as sewing threads. These products cater to various industries such as apparel, automotive, and medical textiles. Sarla operates through multiple state-of-the-art manufacturing facilities across India and has expanded its presence internationally, including a facility in South Carolina, USA. Sarla Performance Fibers Share Price on NSE as of 21 April 2025 is 95.00 INR.

Sarla Performance Fibers Share Market Overview

- Open: 94.10

- High: 98.50

- Low: 92.00

- Previous Close: 93.75

- Volume: 397,834

- Value (Lacs): 378.54

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 132.30

- 52 Week Low: 55.00

- Mkt Cap (Rs. Cr.): 794

- Face Value: 1

Sarla Performance Fibers Share Price Chart

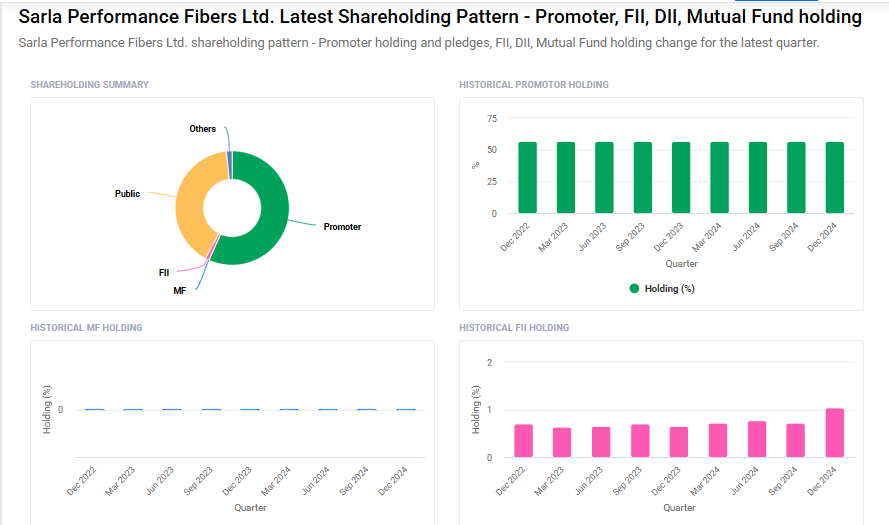

Sarla Performance Fibers Shareholding Pattern

- Promoters: 56.7%

- FII: 1%

- DII: 1.6%

- Public: 40.6%

Sarla Performance Fibers Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹135

- 2026 – ₹175

- 2027 – ₹120

- 2028 – ₹160

- 2030 – ₹200

Major Factors Affecting Sarla Performance Fibers Share Price

Here are six key factors that can influence the share price of Sarla Performance Fibers Limited:

1. Financial Performance and Profitability

Sarla Performance Fibers has demonstrated consistent financial growth. For instance, in FY 2023, the company reported revenues of ₹387.40 crore, an EBITDA of ₹66.69 crore, and a Profit After Tax (PAT) of ₹21.38 crore. Such steady financial performance can boost investor confidence and positively impact the share price.

2. Market Valuation and Intrinsic Value

As of April 2025, the intrinsic value of Sarla Performance Fibers’ stock is estimated at ₹75.19, while the market price stands at ₹95.15, indicating an overvaluation of approximately 21% . Perceptions of overvaluation may lead to cautious investor behavior, influencing the stock’s market performance.

3. Debt Levels and Financial Stability

The company has a healthy interest coverage ratio of 9.52, suggesting that it can comfortably meet its interest obligations . Maintaining manageable debt levels contributes to financial stability, which is favorable for the share price.

4. Return on Equity (ROE) and Capital Efficiency

Sarla Performance Fibers has a Return on Equity (ROE) of 7.64% and a Return on Capital Employed (ROCE) of 10.64% . These metrics indicate efficient utilization of shareholders’ funds to generate profits, making the stock more attractive to investors.

5. Dividend Policy

The company has a low dividend payout ratio of 11.8% over the last three years . While this suggests that the company is retaining earnings for growth, some investors may prefer higher dividend payouts, which can influence investment decisions and affect the share price.

6. Industry Demand and Market Dynamics

Sarla Performance Fibers operates in the synthetic textiles industry, serving sectors like apparel, automotive, and furnishings. The company’s performance is influenced by industry demand and market dynamics. Any changes in consumer preferences or economic conditions can impact the company’s revenue and, consequently, its share price.

Risks and Challenges for Sarla Performance Fibers Share Price

Here are six key risks and challenges that could impact the share price of Sarla Performance Fibers Limited:

1. Overvaluation Concerns

As of April 2025, the intrinsic value of Sarla Performance Fibers’ stock is estimated at ₹75.44, while the market price stands at ₹95.15, indicating an overvaluation of approximately 21% . Such a discrepancy between intrinsic value and market price may lead to cautious investor behavior, influencing the stock’s market performance.

2. Debt Levels and Financial Stability

The company has a debt-to-equity ratio of 0.28, suggesting a low level of debt . While this indicates financial stability, any significant increase in debt levels could raise concerns about the company’s ability to service its obligations, potentially affecting its share price.

3. Limited Profit Margins

Sarla Performance Fibers operates with a gross profit margin of 51.3%. While this is a positive indicator, the company’s overall profitability may be constrained by factors such as rising raw material costs, labor expenses, and competitive pricing pressures, which could impact its net profit margins and, consequently, its share price.

4. Market Competition

The company faces competition from both domestic and international players in the textile industry. Intense competition can lead to pricing pressures, reduced market share, and challenges in maintaining profitability, all of which could negatively affect the share price.

5. Operational Risks

Sarla Performance Fibers is exposed to various operational risks, including changes in technology, labor turnover, and supply chain disruptions . These factors can impact production efficiency, increase costs, and affect the company’s ability to meet market demand, potentially influencing its financial performance and share price.

6. Economic and Regulatory Factors

The company’s performance is subject to macroeconomic conditions, such as inflation, interest rates, and economic growth, as well as regulatory changes in the textile industry. Adverse economic conditions or unfavorable regulatory changes can impact consumer demand, increase operational costs, and affect profitability, leading to potential fluctuations in the share price.

Read Also:- Geekay Wire Share Price Target Tomorrow 2025 To 2030