SBI Share Price Target Tomorrow 2025 To 2030

State Bank of India (SBI) is one of the largest and most influential banks in India, with a strong presence in both retail and corporate banking. As a government-owned entity, it enjoys a level of stability that many private banks do not, but it also faces challenges related to public sector constraints. The bank’s share price is influenced by various factors, such as its asset quality, economic conditions, government policies, and overall market trends. SBI Share Price on NSE as of 23 April 2025 is 821.30 INR.

SBI Share Market Overview

- Open: 821.15

- High: 835.50

- Low: 814.00

- Previous Close: 816.70

- Volume: 25,117,557

- Value (Lacs): 206,566.79

- 52 Week High: 912.00

- 52 Week Low: 680.00

- Mkt Cap (Rs. Cr.): 733,960

- Face Value: 1

SBI Share Price Chart

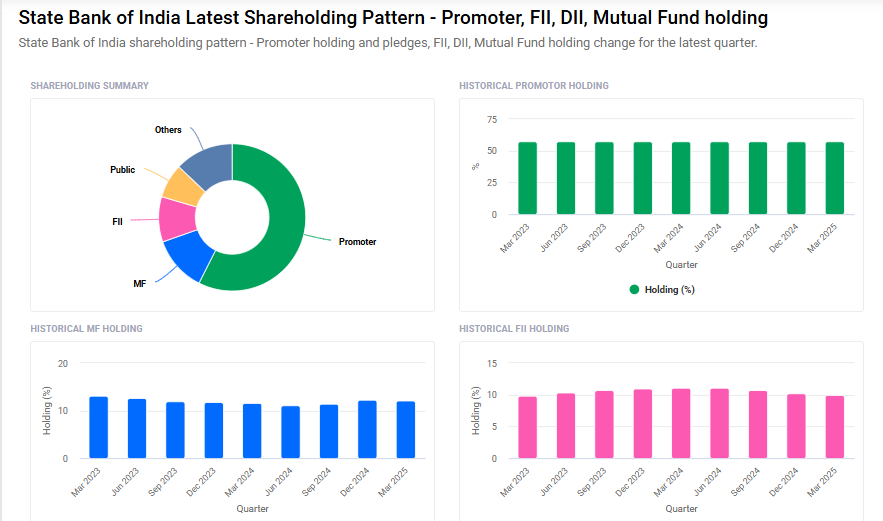

SBI Shareholding Pattern

- Promoters: 57.4%

- FII: 9.9%

- DII: 25.1%

- Public: 7.5%

SBI Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹920

- 2026 – ₹970

- 2027 – ₹1020

- 2028 – ₹1070

- 2030 – ₹1120

Major Factors Affecting SBI Share Price

Here are six key factors that influence the share price of State Bank of India (SBI):

1. Strong Loan Growth

SBI has demonstrated robust loan growth, with domestic loans increasing by 14.06% and corporate loans by 14.86% in the recent quarter. This expansion indicates the bank’s active lending activities, which can positively impact its revenue and, consequently, its share price.

2. Improved Asset Quality

The bank’s asset quality has seen improvement, with the gross non-performing assets (NPA) ratio declining to 2.07%. A lower NPA ratio suggests better credit management and reduced risk of loan defaults, which can enhance investor confidence and support the share price.

3. Net Interest Margin (NIM) Trends

SBI’s net interest margin, a key profitability metric, experienced a slight decline to 3.27% from 3.43% in the previous year. While still healthy, changes in NIM can influence the bank’s earnings and, in turn, its share price.

4. Capital Raising and Investor Confidence

SBI’s successful capital-raising efforts, such as issuing bonds, have bolstered investor confidence. These initiatives indicate the bank’s proactive approach to strengthening its financial position, which can positively affect its share price.

5. Macroeconomic Factors

SBI’s performance is influenced by broader economic conditions, including GDP growth, interest rates set by the Reserve Bank of India, and overall financial market trends. Favorable economic indicators can support the bank’s growth and positively impact its share price.

6. Regulatory Environment

As a public sector bank, SBI is subject to government policies and regulatory changes. For instance, its classification as a Domestic Systemically Important Bank (D-SIB) requires it to maintain higher capital buffers, affecting its operations and potentially influencing its share price.

Risks and Challenges for SBI Share Price

Here are six key risks and challenges that could influence the share price of State Bank of India (SBI):

1. Asset Quality Concerns

SBI has experienced a slight increase in its slippage ratio, rising by approximately 17 basis points year-on-year to 0.58% in Q3 FY24. Additionally, the bank’s restructuring book remains substantial at ₹18,880 crore, indicating ongoing concerns regarding asset quality. These factors could impact investor confidence and affect the bank’s financial stability.

2. Economic Slowdown Impact

A potential economic slowdown could lead to higher non-performing assets (NPAs), especially from large corporate exposures. This could destabilize SBI’s balance sheet and hurt profitability if economic conditions deteriorate.

3. Government Ownership Constraints

As a public sector bank, SBI’s strategic decisions may be influenced by government policies and regulations. This could constrain the bank’s ability to pursue more profitable ventures or respond swiftly to market dynamics, potentially affecting its growth prospects.

4. Market Volatility

SBI’s stock has shown mixed performance, including declines amid broader market challenges. For instance, on April 9, 2025, the stock declined by 3.06%, reflecting underperformance compared to the broader market.

5. Pressure on Return on Assets (RoA)

Analysts have expressed concerns about the sustainability of SBI’s return on assets (RoA). Goldman Sachs projects a moderation to sub-1% in FY26 from 1% in FY24, citing increasing credit costs and widening gaps between loan and deposit growth.

6. Regulatory Scrutiny

Being a systemically important bank, SBI faces heightened regulatory scrutiny. Changes in regulations or non-compliance can adversely affect the bank’s operations and reputation, potentially impacting its share price.

Read Also:- Bajaj Housing Share Price Target Tomorrow 2025 To 2030