SDC Techmedia Share Price Target Tomorrow 2025 To 2030

SDC Techmedia is a company that works in the media and entertainment industry, focusing on digital content and communication. It is involved in activities like digital marketing, advertising, and media production. The company aims to use modern technology to help other businesses promote their products and reach more people. Over time, SDC Techmedia has been trying to grow by expanding its services and improving its digital presence. SDC Techmedia Share Price on BOM as of 12 May 2025 is 6.10 INR.

SDC Techmedia Share Market Overview

- Current Price: ₹6.10

- High/Low: ₹11.7 / 5.41

- Market Cap: ₹3.96 Cr.

- Book Value: ₹2.60

- Dividend Yield: 0.00 %

- ROCE: -13.8 %

- ROE: -107 %

- Face Value: ₹ 10.0

SDC Techmedia Share Price Chart

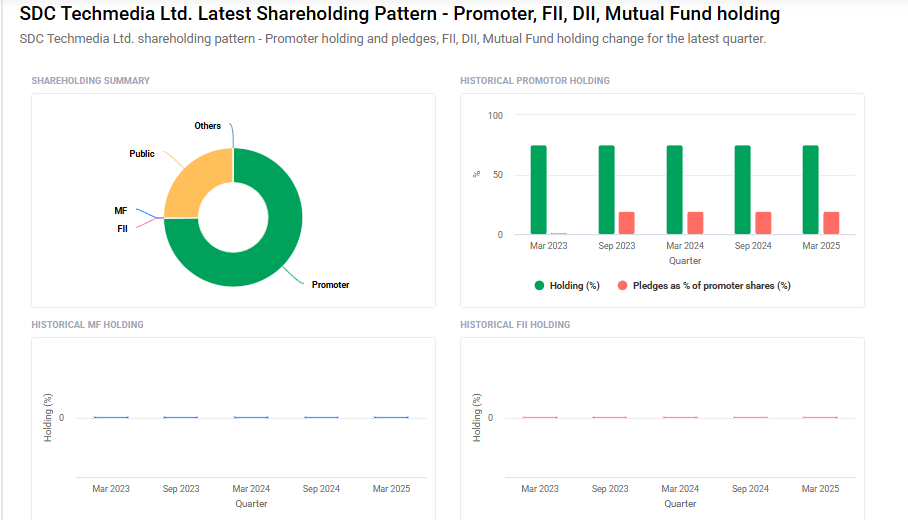

SDC Techmedia Shareholding Pattern

- Promoters: 74.9%

- FII: 0%

- DII: 0%

- Public: 25.1%

SDC Techmedia Share Price Target Tomorrow 2025 To 2030

| SDC Techmedia Share Price Target Years | SDC Techmedia Share Price |

| 2025 | ₹12 |

| 2026 | ₹16 |

| 2027 | ₹20 |

| 2028 | ₹24 |

| 2029 | ₹28 |

| 2030 | ₹32 |

SDC Techmedia Share Price Target 2025

SDC Techmedia share price target 2025 Expected target could ₹12. Here are four key factors that could influence SDC Techmedia Ltd.‘s share price target for 2025:

1. Revenue Growth Amidst Financial Challenges

In FY 2024, SDC Techmedia Ltd. reported a total revenue of approximately ₹10.37 crore. However, the company also posted a net loss of ₹0.15 crore in its last quarter. This indicates that while there is revenue generation, profitability remains a challenge. The company’s ability to convert revenue into sustainable profits will be crucial for its share price growth in 2025.

2. High Debt Levels and Financial Ratios

SDC Techmedia Ltd. has a high debt-to-equity ratio of 6.16, indicating significant leverage. Additionally, the company has a negative return on equity (ROE) of -89.83% and a negative return on capital employed (ROCE) of -10.31%. These financial metrics suggest challenges in efficiently utilizing capital and managing debt, which could impact investor confidence and share price performance.

3. Market Volatility and Stock Performance

As of April 7, 2025, SDC Techmedia’s share price stood at ₹6.10, with a 52-week high of ₹11.72 and a low of ₹5.41. The stock has experienced significant volatility, with a year-to-date return of -36.26%. Such fluctuations can affect investor sentiment and influence the stock’s attractiveness in the market.

4. Industry Position and Competitive Landscape

Operating in the media and entertainment sector, SDC Techmedia faces competition from companies like Universal Arts and Vision Corporation. The company’s ability to differentiate its offerings, innovate, and capture market share in this competitive landscape will be vital for its growth prospects and share price appreciation in 2025.

SDC Techmedia Share Price Target 2030

SDC Techmedia share price target 2030 Expected target could ₹32. Here are four potential risks and challenges that could affect the SDC Techmedia share price target for 2030:

-

Market Volatility and Economic Uncertainty: SDC Techmedia operates in a sector that is sensitive to broader market trends. Economic downturns, inflation, interest rate hikes, or global crises can significantly affect investor sentiment and reduce stock valuations.

-

Technology Disruption and Competitive Pressure: Rapid changes in media and technology could render SDC Techmedia’s current offerings obsolete. Emerging competitors with innovative products or better execution could capture market share.

-

Regulatory and Compliance Risks: Changes in digital content regulations, advertising policies, or data protection laws could impact the company’s business model, especially if it relies heavily on digital media and advertising revenues.

-

Financial Performance and Execution Risk: Failure to meet revenue, profit, or growth expectations—due to poor management, rising costs, or underperforming products—could lead to a significant drop in investor confidence and affect long-term share price growth.

Read Also:- Richa Industries Share Price Target Tomorrow 2025 To 2030