Shivansh Finserv Share Price Target Tomorrow 2025 To 2030

Shivansh Finserve Limited, established in 1984 and headquartered in Ahmedabad, Gujarat, is a financial services company catering to both corporate and individual clients across India. The company offers a diverse range of financial products, including home, reconstruction, advance, and vehicle loans, as well as services like working capital facilities, overdraft arrangements, and bill discounting. Originally known as Manasarovar Financial Services Limited, it adopted its current name in May 2015 to reflect its evolving business focus. Shivansh Finserv Share Price on BOM as of 10 May 2025 is 5.50 INR.

Shivansh Finserv Share Market Overview

- Open: 5.30

- High: 5.50

- Low: 5.30

- Previous Close: 5.50

- Volume: 12,933

- Value (Lacs): 0.71

- VWAP: 5.46

- UC Limit: 6.60

- LC Limit: 4.40

- 52 Week High: 7.49

- 52 Week Low: 3.57

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Shivansh Finserv Share Price Chart

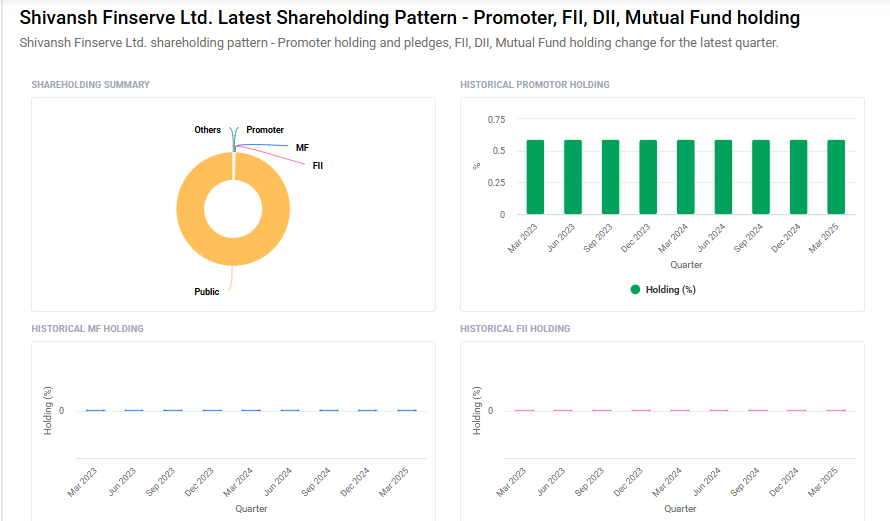

Shivansh Finserv Shareholding Pattern

- Promoters: 0.6%

- FII: 0%

- DII: 0%

- Public: 99.4%

Shivansh Finserv Share Price Target Tomorrow 2025 To 2030

| Shivansh Finserv Share Price Target Years | Shivansh Finserv Share Price |

| 2025 | ₹8 |

| 2026 | ₹10 |

| 2027 | ₹12 |

| 2028 | ₹15 |

| 2029 | ₹18 |

| 2030 | ₹20 |

Shivansh Finserv Share Price Target 2025

Shivansh Finserv share price target 2025 Expected target could ₹8. Here are four key factors that could influence Shivansh Finserve Ltd.‘s share price target for 2025:

1. Significant Revenue Growth

In Q1 FY2024–25, Shivansh Finserve reported a revenue of ₹0.39 crore, marking a substantial 129.41% increase compared to the same period in the previous year. This growth indicates a positive trajectory in the company’s financial performance, which could bolster investor confidence.

2. Diversified Financial Services Portfolio

The company offers a range of financial services, including home, reconstruction, advance, and vehicle loans. This diversification allows Shivansh Finserve to cater to various customer segments, potentially enhancing its market reach and revenue streams.

3. Improved Profitability Metrics

Shivansh Finserve reported no net profit or loss in the quarter ended June 2024, compared to a net loss of ₹0.08 crore in the same quarter of the previous year. This improvement suggests better cost management and operational efficiency, which are crucial for long-term growth.

4. Positive Investor Sentiment

The company’s stock has shown notable movements, with instances of significant price increases, such as a 15.97% rise observed in early April 2025. Such trends reflect growing investor interest, which can contribute to upward momentum in share prices.

Shivansh Finserv Share Price Target 2030

Shivansh Finserv share price target 2030 Expected target could ₹20. Here are four key risks and challenges that could impact Shivansh Finserve Ltd.‘s share price target by 2030:

1. Inconsistent Financial Performance

Shivansh Finserve has exhibited fluctuating financial results, with a notable net loss of ₹0.08 crore in the quarter ended June 2024. Such inconsistencies in profitability may raise concerns among investors regarding the company’s long-term financial stability.

2. Limited Market Capitalization

As a small-cap company with a market capitalization of ₹3.43 crore, Shivansh Finserve may face challenges in accessing capital for expansion and may be more susceptible to market volatility compared to larger firms.

3. High Valuation Metrics

The company’s Price-to-Earnings (P/E) ratio stands at -47.14, indicating that it is currently not profitable. Such high valuation metrics without corresponding earnings can be a red flag for potential investors.

4. Lack of Risk Management Policy

Shivansh Finserve has acknowledged the absence of a formal risk management policy, which could expose the company to unforeseen operational and financial risks.

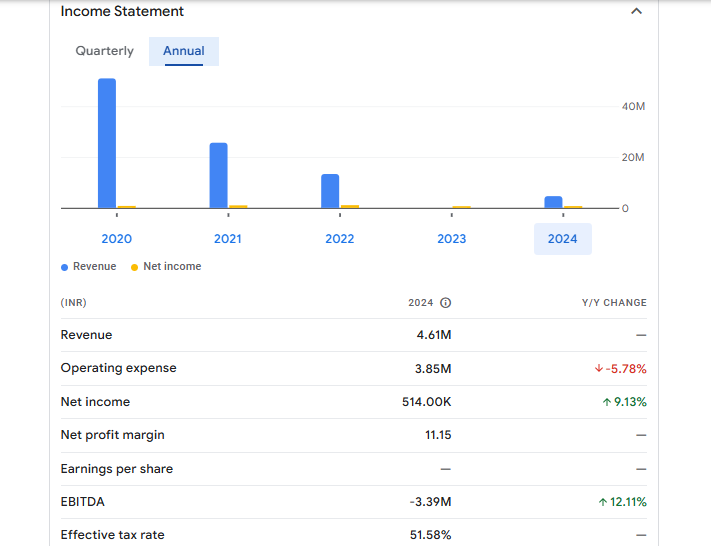

Shivansh Finserv Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 4.61M | — |

| Operating expense | 3.85M | -5.78% |

| Net income | 514.00K | 9.13% |

| Net profit margin | 11.15 | — |

| Earnings per share | — | — |

| EBITDA | -3.39M | 12.11% |

| Effective tax rate | 51.58% | — |

Read Also:- Time Technoplast Share Price Target Tomorrow 2025 To 2030