SRF Share Price Target Tomorrow 2025 To 2030

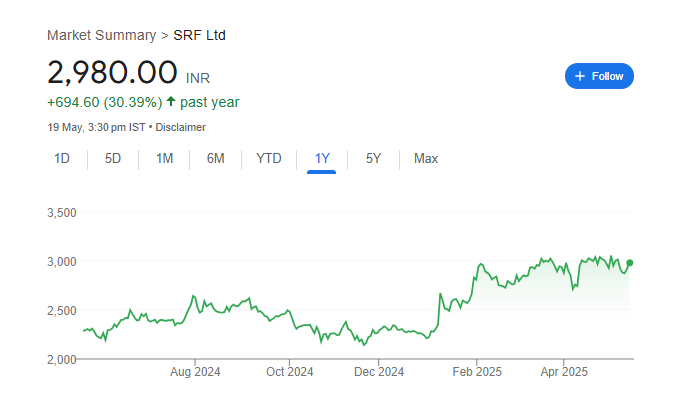

SRF Limited is a well-established Indian company that operates in several industries, including chemicals, packaging, textiles, and technical fabrics. Known for its strong focus on innovation and quality, SRF has built a solid reputation both in India and internationally. One of its key strengths lies in its specialty chemicals segment, which supplies important products to industries like agriculture, pharmaceuticals, and refrigerants. SRF Share Price on NSE as of 20 May 2025 is 2,980.00 INR.

SRF Share Market Overview

- Open: 2,919.00

- High: 3,032.00

- Low: 2,914.90

- Previous Close: 2,914.90

- Volume: 1,085,462

- Value (Lacs): 32,314.20

- 52 Week High: 3,098.50

- 52 Week Low: 2,040.00

- Mkt Cap (Rs. Cr.): 88,245

- Face Value: 10

SRF Share Price Chart

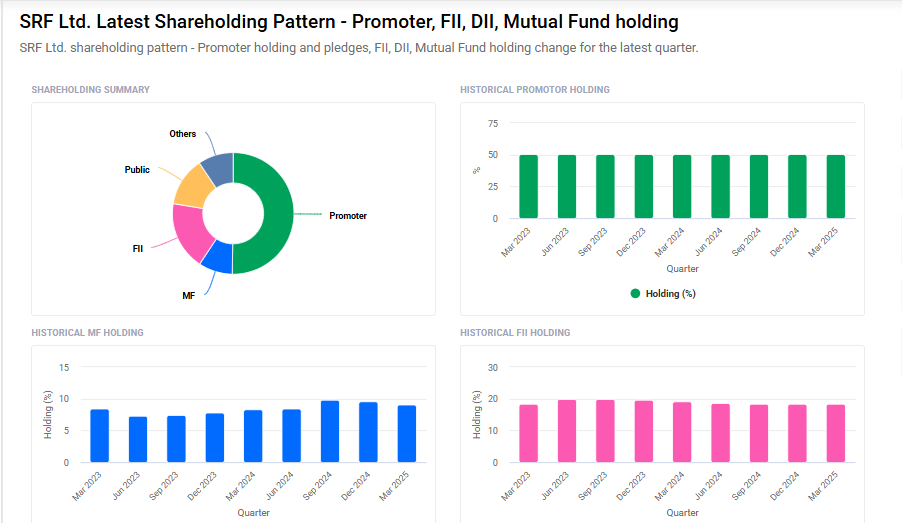

SRF Shareholding Pattern

- Promoters: 50.3%

- FII: 18.3%

- DII: 18.5%

- Public: 13%

SRF Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹3100 |

| 2026 | ₹3700 |

| 2027 | ₹3300 |

| 2028 | ₹3900 |

| 2029 | ₹4500 |

| 2030 | ₹5100 |

SRF Share Price Target 2025

SRF share price target 2025 Expected target could ₹3100. Here are four key factors influencing SRF Limited’s share price target for 2025:

1. Robust Financial Performance

SRF Limited reported a 21% year-over-year revenue growth and a 60% increase in profit before tax (PBT) in Q4 FY25, indicating strong operational efficiency and profitab

ility.

2. Strategic Expansion Initiatives

The company has approved significant expansion projects, including a new facility for advanced agrochemical intermediates at Dahej, with a proposed capacity addition of 1,000 MTPA.

3. Recovery in Key Business Segments

SRF’s refrigerant gas segment has seen a price recovery from historical lows, and the specialty chemicals segment is expected to experience margin growth driven by pricing, operating leverage, and volume growth.

4. Positive Market Sentiment and Analyst Outlook

Analysts have projected a positive outlook for SRF’s stock, with price targets reflecting confidence in the company’s growth trajectory.

SRF Share Price Target 2030

SRF share price target 2030 Expected target could ₹5100. Here are five key risks and challenges that could influence SRF Limited’s share price trajectory by 2030:

1. Prolonged Weakness in the Chemicals Segment

SRF’s chemicals division, encompassing specialty chemicals, fluorochemicals, and agrochemicals, contributes nearly half of the company’s revenue. This segment has faced sustained challenges, including weak global demand, high inventory levels, and destocking pressures. Notably, SRF reported its seventh consecutive quarterly profit decline, with a 33% drop in net profit in Q2 FY2024, primarily due to these issues.

2. Intensifying Competition from Chinese Manufacturers

The influx of low-priced Chinese products, particularly in the fluorochemicals sector, has exerted downward pressure on SRF’s pricing power and market share. For instance, China’s dumping of refrigerants has significantly impacted SRF’s fluorochemicals business, leading to a 13.6% revenue decline in the chemicals segment during a recent quarter.

3. Volatility in Raw Material Costs and Currency Fluctuations

SRF’s reliance on imported raw materials exposes it to risks associated with currency exchange rate fluctuations. A significant portion of its raw materials are sourced internationally, making the company susceptible to increases in procurement costs due to currency volatility.

4. Stock Price Volatility and Market Sentiment

Analyst forecasts indicate potential fluctuations in SRF’s stock price leading up to 2030. For example, projections suggest a possible decline of up to 29% in March 2030, followed by a 33% rebound in April. Such volatility can impact investor confidence and affect long-term investment decisions.

5. Challenges in Demand Forecasting and Technological Investments

SRF has faced challenges in accurately forecasting product demand, leading to missed opportunities compared to competitors. Additionally, the company’s investment in technology has not kept pace with its growth vision, potentially hindering process integration and efficiency.

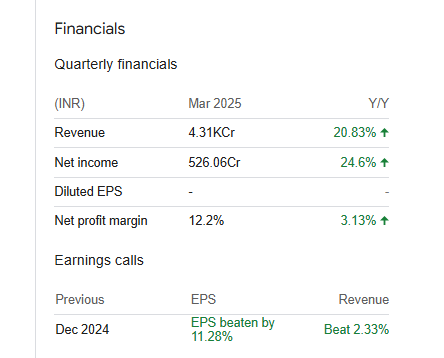

SRF Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 146.93B | 11.83% |

| Operating expense | 35.76B | -14.56% |

| Net income | 12.51B | -6.36% |

| Net profit margin | 8.51 | -16.32% |

| Earnings per share | 42.20 | -6.35% |

| EBITDA | 28.38B | 11.19% |

| Effective tax rate | 26.58% | — |

Read Also:- CG Power Share Price Target Tomorrow 2025 To 2030