Steel Exchange Share Price Target Tomorrow 2025 To 2030

Steel Exchange India Limited (SEIL) is a prominent steel manufacturer based in Visakhapatnam, Andhra Pradesh, and is part of the Vizag Profiles Group. Established in 1999, SEIL operates one of the largest private integrated steel plants in the Telugu states of Andhra Pradesh and Telangana. The company specializes in producing Thermo-Mechanically Treated (TMT) rebars under the brand name ‘SIMHADRI TMT’, which are widely used in construction and infrastructure projects. Steel Exchange Share Price on NSE as of 9 May 2025 is 7.89 INR.

Steel Exchange Share Market Overview

- Open: 8.05

- High: 8.40

- Low: 7.70

- Previous Close: 7.92

- Volume: 1,442,646

- Value (Lacs): 113.68

- 52 Week High: 15.80

- 52 Week Low: 7.06

- Mkt Cap (Rs. Cr.): 943

- Face Value: 1

Steel Exchange Share Price Chart

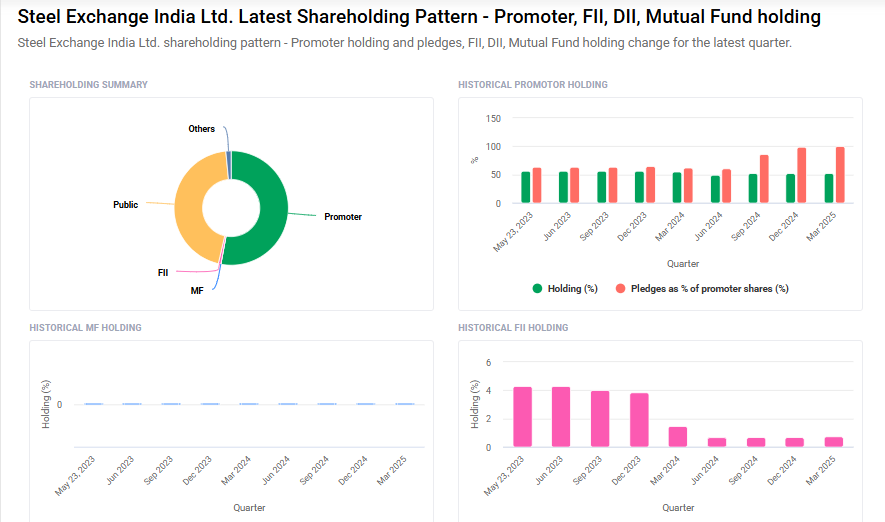

Steel Exchange Shareholding Pattern

- Promoters: 52.9%

- FII: 0.7%

- DII: 1.5%

- Public: 44.9%

Steel Exchange Share Price Target Tomorrow 2025 To 2030

| Steel Exchange Share Price Target Years | Steel Exchange Share Price |

| 2025 | ₹16 |

| 2026 | ₹20 |

| 2027 | ₹25 |

| 2028 | ₹30 |

| 2029 | ₹35 |

| 2030 | ₹40 |

Steel Exchange Share Price Target 2025

Steel Exchange share price target 2025 Expected target could ₹16. Here are four key factors that could influence Steel Exchange India Ltd.’s (SEIL) share price target for 2025:

-

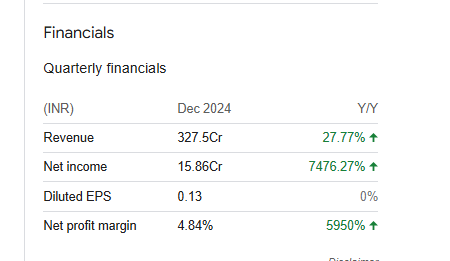

Strong Financial Performance in Q3 FY2024–25

SEIL reported a significant improvement in its financials for the third quarter of FY2024–25. The company’s revenue increased by 27.24% year-over-year to ₹327.78 crore, and net profit surged to ₹15.86 crore from ₹0.21 crore in the same period the previous year. This robust performance indicates enhanced operational efficiency and could positively impact investor sentiment. -

Fundraising Initiatives and Debt Reduction Plans

In December 2024, SEIL approved the sale of a non-core asset for ₹50 crore and announced plans to raise ₹600 crore through securities. These initiatives aim to reduce debt and fund growth, potentially strengthening the company’s balance sheet and supporting future expansion. -

Positive Outlook for India’s Steel Demand

According to CRISIL, India’s steel demand is projected to grow by 8–9% in 2025, driven by the housing and infrastructure sectors. This favorable market environment could benefit SEIL by increasing demand for its products and services. -

Integrated Manufacturing Capabilities

SEIL operates an integrated steel plant in Andhra Pradesh, encompassing sponge iron production, billet manufacturing, and TMT bar production, along with a 60 MW power generation facility. This integrated setup allows for cost efficiencies and better control over the production process, potentially enhancing profitability.

Steel Exchange Share Price Target 2030

Steel Exchange share price target 2030 Expected target could ₹40. Here are four key risks and challenges that could impact Steel Exchange India Ltd.’s (SEIL) share price target by 2030:

-

High Debt Levels and Liquidity Constraints

SEIL’s balance sheet reflects a significant debt burden, including substantial non-convertible debentures (NCDs). In FY24, the company’s interest coverage ratio was moderate at 1.18x, indicating potential challenges in servicing debt obligations. While the company has refinanced existing NCDs at lower interest rates, the ability to generate sufficient accruals remains a key monitorable. -

Intense Competition and Market Volatility

The steel industry is characterized by intense competition and susceptibility to market volatility. SEIL faces challenges from both domestic and international players, including the impact of global trade dynamics and fluctuations in raw material prices. Additionally, the company’s stock has experienced significant volatility, with a 52-week high of ₹15.80 and a low of ₹7.16, reflecting investor concerns over market conditions. -

Regulatory and Policy Risks

SEIL operates in a sector subject to stringent regulatory and policy frameworks. Changes in government policies, such as import restrictions on raw materials or environmental regulations, can impact operational costs and profitability. For instance, the imposition of country-specific quotas on low-ash metallurgical coke has affected steel production and expansion plans for some companies in the industry. -

Environmental Sustainability Challenges

The steel industry faces increasing pressure to adopt environmentally sustainable practices. SEIL’s reliance on coal-based production methods may expose the company to risks associated with carbon emissions and environmental regulations. India’s steel sector aims to reduce greenhouse gas emissions by 20% from 2005 levels by 2030, presenting challenges for companies that are heavily dependent on coal.

Steel Exchange Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 10.89B | -21.55% |

| Operating expense | 1.34B | -8.80% |

| Net income | 108.86M | 118.50% |

| Net profit margin | 1.00 | 123.58% |

| Earnings per share | — | — |

| EBITDA | 963.62M | -0.30% |

| Effective tax rate | -756.21% | — |

Read Also:- Salasar Techno Share Price Target Tomorrow 2025 To 2030