Sumedha Fiscal Share Price Target Tomorrow 2025 To 2030

Sumedha Fiscal Services Limited, established in 1989 and headquartered in Kolkata, is a well-regarded financial services company in India. The company specializes in investment banking, capital markets, and wealth management, offering services such as debt syndication, financial restructuring, mergers and acquisitions, equity placement, and mutual fund distribution. Registered as a Category I Merchant Banker with SEBI, Sumedha Fiscal has expanded its presence across major Indian cities, including Mumbai, Delhi, and Bangalore. Sumedha Fiscal Share Price on BOM as of 21 April 2025 is 70.50 INR.

Sumedha Fiscal Share Market Overview

- Open: 68.10

- High: 74.00

- Low: 68.10

- Previous Close: 71.55

- Volume: 4,074

- Value (Lacs): 2.81

- VWAP: 69.18

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 113.61

- 52 Week Low: 35.99

- Mkt Cap (Rs. Cr.): 55

- Face Value: 10

Sumedha Fiscal Share Price Chart

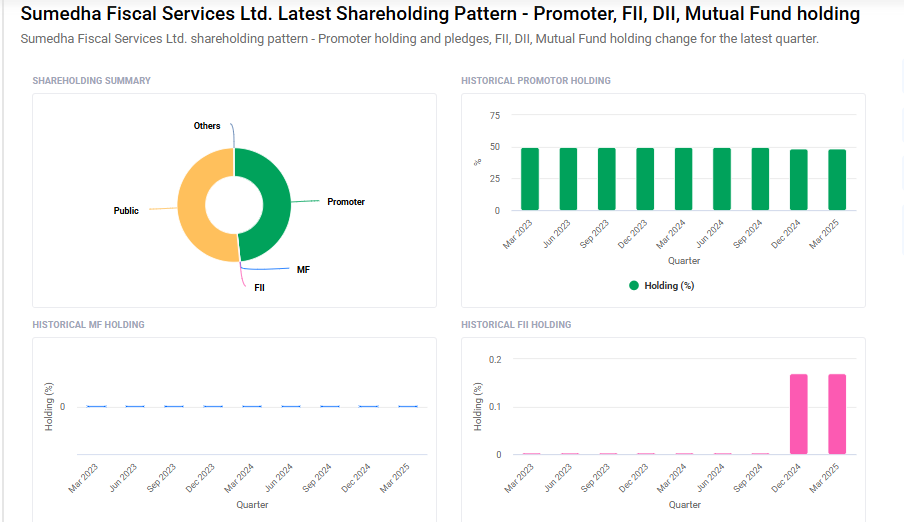

Sumedha Fiscal Shareholding Pattern

- Promoters: 48.3%

- FII: 0.2%

- DII: 0.1%

- Public: 51.4%

Sumedha Fiscal Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹115

- 2026 – ₹140

- 2027 – ₹160

- 2028 – ₹180

- 2030 – ₹200

Major Factors Affecting Sumedha Fiscal Share Price

Here are six key factors that can influence the share price of Sumedha Fiscal Services Limited:

1. Financial Performance and Profitability

The company’s financial health significantly impacts its share price. In Q3 FY2024-25, Sumedha Fiscal Services reported a net profit of ₹1.98 crore, marking a 23.75% increase compared to the same period last year. However, on a quarterly basis, both revenue and net profit declined by 51.98% and 34.87%, respectively, indicating potential volatility in earnings.

2. Market Valuation Metrics

Valuation ratios help investors assess whether a stock is overvalued or undervalued. Sumedha Fiscal’s Price-to-Earnings (P/E) ratio stands at 6.26, and its Price-to-Book (P/B) ratio is 0.94. These relatively low ratios suggest that the stock may be undervalued compared to its peers, potentially making it attractive to value investors.

3. Dividend Policy

The company’s approach to dividends can influence investor sentiment. On May 14, 2024, Sumedha Fiscal declared a 10% equity dividend, amounting to ₹1 per share. Consistent and attractive dividend payouts can enhance investor confidence and positively affect the share price.

4. Stock Volatility and Price Trends

Share price fluctuations can impact investor decisions. Over the past year, Sumedha Fiscal’s stock has experienced a 52-week high of ₹113.61 and a low of ₹43.00. Such volatility may reflect market sentiment and can influence the stock’s attractiveness to different types of investors.

5. Return on Equity (ROE) and Return on Capital Employed (ROCE)

These metrics indicate how efficiently a company utilizes its capital. Sumedha Fiscal has a Return on Equity (ROE) of 13.0% and a Return on Capital Employed (ROCE) of 15.6%, suggesting effective management and potentially enhancing investor confidence.

6. Seasonal Performance Patterns

Historical performance trends can provide insights into future movements. Data indicates that Sumedha Fiscal has delivered positive returns in April in 11 out of the past 17 years, with an average positive change of 11.14%. Such seasonal trends may influence investor expectations and trading strategies.

Risks and Challenges for Sumedha Fiscal Share Price

Here are six key risks and challenges that could impact the share price of Sumedha Fiscal Services Limited:

1. Inconsistent Financial Performance

Sumedha Fiscal has experienced fluctuations in its financial results. For instance, in Q3 FY2024-25, the company reported a net profit of ₹1.98 crore, marking a 23.75% increase compared to the same period last year. However, on a quarterly basis, both revenue and net profit declined by 51.98% and 34.87%, respectively, indicating potential volatility in earnings. Such inconsistencies can affect investor confidence and lead to share price volatility.

2. Market Volatility and Liquidity Risks

The company’s share price has shown significant volatility, with a 52-week high of ₹113.61 and a low of ₹43.00. Such fluctuations can be attributed to various factors, including market sentiment and trading volumes. Additionally, as a microcap company, Sumedha Fiscal may face liquidity challenges, making it harder for investors to buy or sell shares without impacting the price.

3. Limited Institutional Ownership

A significant portion of Sumedha Fiscal’s shares is held by non-institutional investors. This lack of institutional ownership may indicate limited interest from large investors, potentially affecting the stock’s stability and long-term growth prospects.

4. Exposure to Market Risks

The company is susceptible to various market risks, including fluctuations in interest rates, equity prices, and currency exchange rates. These factors can impact the value of its investments and overall financial performance.

5. Operational Challenges

Sumedha Fiscal has faced operational challenges, such as the resignation of key personnel, which can disrupt business continuity and affect investor sentiment. Maintaining a stable and experienced management team is crucial for the company’s success.

6. Macroeconomic Factors

Broader economic conditions, such as inflation, interest rate changes, and economic downturns, can influence the company’s performance. These macroeconomic factors can affect client investment behavior and, consequently, the company’s revenue and profitability.

Read Also:- Sarla Performance Fibers Share Price Target Tomorrow 2025 To 2030