Super Crop Share Price Target Tomorrow 2025 To 2030

Super Crop Safe Ltd. is an Indian company that works in the agrochemical industry. It focuses on creating and selling products like pesticides, fungicides, herbicides, and fertilizers that help farmers protect their crops and improve their yields. With a strong presence in rural markets, Super Crop has built a network to support agriculture and promote sustainable farming practices. Super Crop Share Price on NSE as of 24 April 2025 is 16.12 INR.

Super Crop Share Market Overview

- Open: 16.16

- High: 16.38

- Low: 15.80

- Previous Close: 16.05

- Volume: 30,951

- Value (Lacs): 4.99

- VWAP: 16.13

- 52 Week High: 26.44

- 52 Week Low: 11.70

- Mkt Cap (Rs. Cr.): 64

- Face Value: 2

Super Crop Share Price Chart

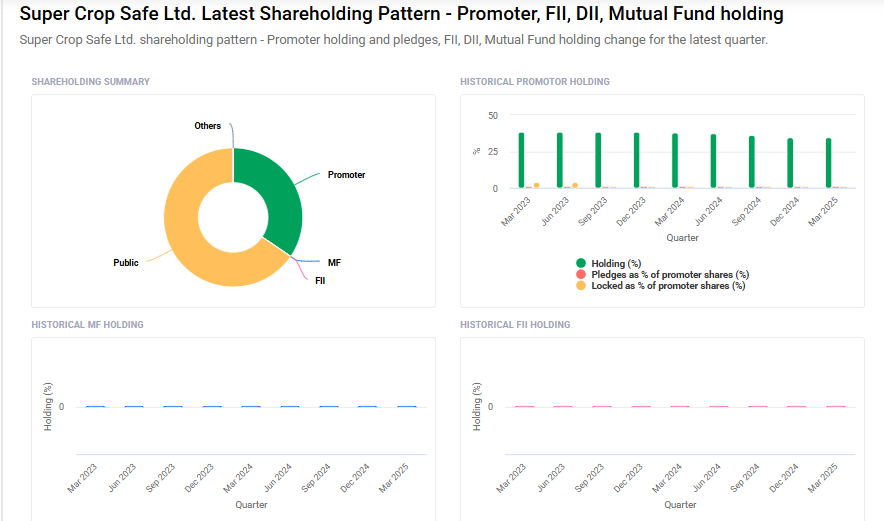

Super Crop Shareholding Pattern

- Promoters: 34.5%

- FII: 0%

- DII: 0%

- Public: 65.5%

Super Crop Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹30

- 2026 – ₹50

- 2027 – ₹70

- 2028 – ₹90

- 2030 – ₹110

Major Factors Affecting Super Crop Share Price

Here are six key factors that influence the share price of Super Crop Safe Ltd:

1. Financial Performance and Profitability

Super Crop Safe’s financial health plays a significant role in its stock valuation. The company has experienced a decline in profitability, with a net profit margin of 6.47% and a return on equity (ROE) of 4.92% as of March 2025. These figures suggest modest earnings relative to shareholder equity, which can impact investor confidence and share price.

2. Revenue Growth Trends

The company’s revenue growth has been inconsistent. Over the past five years, Super Crop Safe reported a negative sales growth rate of -13.5%, indicating challenges in expanding its market presence or product demand. Such trends can lead to cautious investor sentiment.

3. Promoter Shareholding Patterns

Changes in promoter shareholding can signal shifts in management’s confidence. Between March 2024 and March 2025, promoter holdings decreased from 37.74% to 34.52%. A declining promoter stake might raise concerns among investors about the company’s future prospects.

4. Market Capitalization and Valuation Ratios

As of April 2025, Super Crop Safe has a market capitalization of ₹65 crore, categorizing it as a small-cap company. Its Price-to-Earnings (P/E) ratio stands at 23.30, and the Price-to-Book (P/B) ratio is 2.24. These valuation metrics help investors assess whether the stock is priced appropriately relative to its earnings and book value.

5. Industry Competition and Market Position

Operating in the agrochemical sector, Super Crop Safe faces competition from larger peers like Dhanuka Agritech and Sharda Cropchem. Maintaining or improving market share amidst such competition is crucial for revenue growth and, consequently, share price appreciation.

6. Technical Indicators and Stock Volatility

Technical analysis provides insights into stock price movements. As of recent assessments, Super Crop Safe’s stock has shown a neutral to sell trend over a one-week period, indicating potential short-term volatility. Investors often consider such technical indicators when making trading decisions.

Risks and Challenges for Super Crop Share Price

Here are six key risks and challenges that could influence the share price of Super Crop Safe Ltd:

1. Declining Operating Profits

Super Crop Safe Ltd. has experienced a decrease in its operating profits, which indicates that the company’s core business activities are generating less income than before. This decline can raise concerns among investors about the company’s efficiency and profitability, potentially leading to a drop in its share price.

2. High Debt Levels

The company carries a significant amount of debt, which can be risky, especially if its earnings are not sufficient to cover interest payments. High debt can limit the company’s ability to invest in growth opportunities and may lead to financial strain, affecting investor confidence and share value.

3. Reduced Promoter Confidence

There has been a decrease in promoter shareholding in Super Crop Safe Ltd., which might signal a lack of confidence from those closely associated with the company. Such actions can be perceived negatively by the market, leading to a decline in share price as investors may interpret it as a sign of potential issues within the company.

4. Low Return on Equity (ROE)

The company’s return on equity, a measure of financial performance, is relatively low. A low ROE suggests that the company is not effectively generating profits from its shareholders’ investments, which can be a red flag for investors seeking efficient use of capital.

5. Stock Volatility

Super Crop Safe Ltd.’s stock has shown significant volatility, with notable fluctuations in its share price over short periods. Such unpredictability can make it challenging for investors to gauge the stock’s true value and may deter risk-averse investors, impacting the stock’s demand and price stability.

6. Sector-Specific Challenges

Operating in the agrochemical sector, Super Crop Safe Ltd. is susceptible to industry-specific risks such as regulatory changes, environmental concerns, and fluctuations in agricultural demand. These factors can affect the company’s operations and profitability, thereby influencing its share price.

Read Also:- BOI Share Price Target Tomorrow 2025 To 2030