Suzlon Share Price Target Tomorrow 2025 To 2030

Suzlon Energy is one of India’s leading renewable energy companies, well known for its wind power solutions. Founded in 1995, the company has played an important role in promoting clean and green energy across India and abroad. Suzlon designs, builds, and maintains wind turbines that help generate electricity using the natural power of the wind. Suzlon Share Price on NSE as of 28 May 2025 is 65.38 INR.

Suzlon Share Market Overview

- Open: 64.90

- High: 66.00

- Low: 63.61

- Previous Close: 64.37

- Volume: 125,848,116

- Value (Lacs): 82,292.08

- 52 Week High: 86.04

- 52 Week Low: 43.40

- Mkt Cap (Rs. Cr.): 89,415

- Face Value: 2

Suzlon Share Price Chart

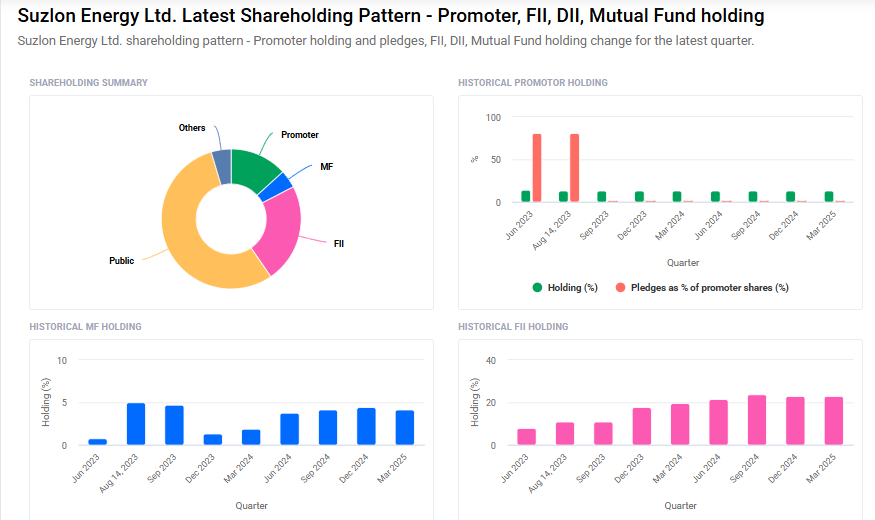

Suzlon Shareholding Pattern

- Promoters: 13.3%

- FII: 23%

- DII: 8.7%

- Public: 55%

Suzlon Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹90 |

| 2026 | ₹110 |

| 2027 | ₹130 |

| 2028 | ₹150 |

| 2029 | ₹170 |

| 2030 | ₹190 |

Suzlon Share Price Target 2025

Suzlon share price target 2025 Expected target could ₹90. Here are 5 key factors affecting the growth of Suzlon Energy’s share price target for 2025:

-

Rising Demand for Renewable Energy

India’s strong push for clean and green energy—targeting 500 GW of renewable capacity by 2030—provides a favorable environment for Suzlon, a leading player in wind energy. Increased demand for wind power projects could significantly boost Suzlon’s order book and revenue. -

Debt Reduction and Financial Restructuring

Suzlon has taken significant steps to reduce its debt and improve its balance sheet. Continued financial discipline and a stronger capital structure enhance investor confidence and provide more room for expansion. -

New Project Wins and Capacity Expansion

Recent wins of large-scale wind power projects, including from public and private sector entities, suggest strong momentum. Expanding manufacturing and installation capacity can help Suzlon scale operations and meet growing demand more efficiently. -

Government Policies and Incentives

Policies supporting renewable energy, such as tax benefits, subsidies, and favorable bidding terms under India’s energy transition strategy, will continue to be a major driver of growth for Suzlon and other green energy companies. -

Technological Advancements and Cost Efficiency

Improvements in turbine design, efficiency, and digital monitoring systems are enabling Suzlon to offer more competitive and reliable solutions. Enhancing operational efficiency and reducing costs per megawatt installed will further support growth and profitability.

Suzlon Share Price Target 2030

Suzlon share price target 2030 Expected target could ₹190. Here are five key risks and challenges that could impact Suzlon Energy’s share price target by 2030:

-

Regulatory and Policy Uncertainties

Suzlon’s operations are significantly influenced by government policies and incentives related to renewable energy. Any unfavorable changes in tariffs, subsidies, or regulatory frameworks could adversely affect the company’s profitability and growth prospects. -

Commodity Price Volatility

The company’s manufacturing costs are susceptible to fluctuations in the prices of raw materials such as steel, copper, and rare earth elements. Significant increases in these input costs can compress profit margins and impact financial performance. -

Intensifying Global Competition

The renewable energy sector is witnessing increasing competition from both domestic and international players, particularly from countries like China. This heightened competition can lead to pricing pressures and reduced market share for Suzlon. -

Infrastructure and Grid Integration Challenges

The expansion of wind energy projects requires robust infrastructure and seamless grid integration. Delays or inadequacies in grid infrastructure development can hinder project execution and revenue realization for Suzlon. -

Technological Disruptions and Innovation Pace

The renewable energy industry is rapidly evolving with technological advancements. Suzlon must continuously invest in research and development to keep pace with innovations. Failure to do so could result in technological obsolescence and loss of competitive edge.

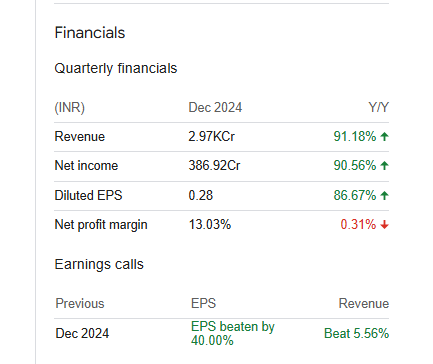

Suzlon Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 64.97B | 9.25% |

| Operating expense | 16.64B | 5.05% |

| Net income | 6.60B | -76.82% |

| Net profit margin | 10.16 | -78.79% |

| Earnings per share | 0.54 | — |

| EBITDA | 9.70B | 34.32% |

| Effective tax rate | -0.13% | — |

Read Also:- MMTC Share Price Target Tomorrow 2025 To 2030