Tata Chemicals Share Price Target Tomorrow 2025 To 2030

Tata Chemicals Limited is a prominent Indian multinational company specializing in both basic and specialty chemistry products. Established in 1939 in Mithapur, Gujarat, the company has grown to become a global leader in the chemical industry, with operations spanning India, North America, Europe, and Africa. Tata Chemicals’ product portfolio includes essential inorganic chemicals like soda ash, sodium bicarbonate, and salt, which are vital for industries such as glass manufacturing, detergents, pharmaceuticals, and food processing. Beyond basic chemicals, the company has ventured into specialty sectors, offering solutions in agro-sciences through its subsidiary Rallis India, nutritional sciences with prebiotic products, and material sciences focusing on advanced materials like nano zinc oxide. Tata Chemicals Share Price on NSE as of 27 May 2025 is 881.50 INR.

Tata Chemicals Share Market Overview

- Open: 879.90

- High: 886.70

- Low: 871.05

- Previous Close: 873.95

- Volume: 857,812

- Value (Lacs): 7,564.62

- 52 Week High: 1,247.35

- 52 Week Low: 756.00

- Mkt Cap (Rs. Cr.): 22,465

- Face Value: 10

Tata Chemicals Share Price Chart

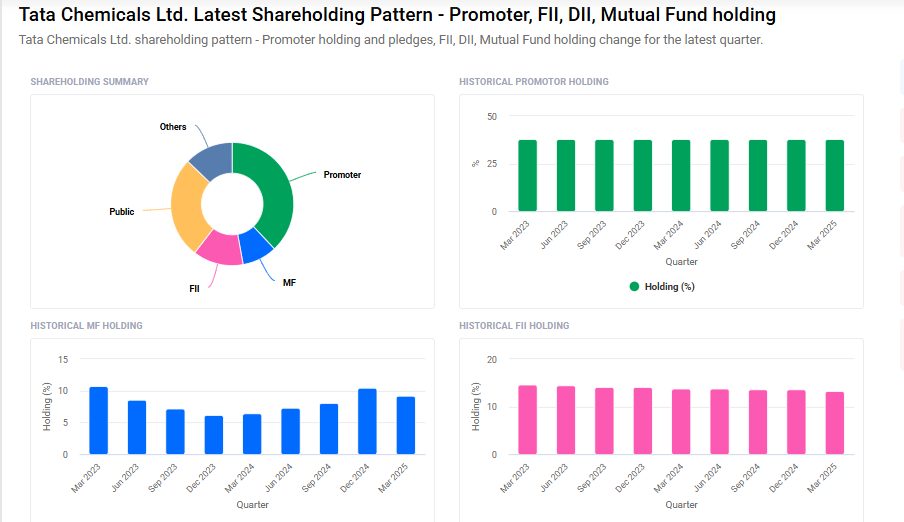

Tata Chemicals Shareholding Pattern

- Promoters: 38%

- FII: 13.3%

- DII: 22%

- Public: 26.7%

Tata Chemicals Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1250 |

| 2026 | ₹1400 |

| 2027 | ₹1650 |

| 2028 | ₹1800 |

| 2029 | ₹2050 |

| 2030 | ₹2200 |

Tata Chemicals Share Price Target 2025

Tata Chemicals share price target 2025 Expected target could ₹1250. Here are 5 key factors that could influence Tata Chemicals’ share price target for 2025:

-

Expansion in Sustainability-Driven Segments

Tata Chemicals is capitalizing on the growing demand for sustainable products, particularly in sectors like solar photovoltaics and electric vehicles. The company has expanded its soda ash and bicarbonate capacities in India and commissioned pharmaceutical-grade salt production in the UK, positioning itself to meet the increasing demand for eco-friendly chemicals. -

Robust Financial Performance

In FY2025, Tata Chemicals reported a consolidated revenue of ₹14,887 crore, reflecting strong operational performance. Analysts project an annual earnings growth rate of 41.1% and an EPS growth of 38.9%, indicating a positive outlook for the company’s profitability. -

Strategic Market Presence in India and the US

The company’s significant operations in India and the United States—two of the world’s largest chemical markets—provide a stable foundation for growth. This strategic presence allows Tata Chemicals to leverage market opportunities and mitigate regional risks. -

Rising Demand in the Pharmaceutical Sector

An increasing demand for pharmaceutical-grade chemicals, such as high-purity sodium bicarbonate, is boosting Tata Chemicals’ growth prospects. The expansion of the life sciences sector contributes to this trend, enhancing the company’s revenue streams. -

Digital Transformation and Operational Efficiency

Tata Chemicals is implementing digital initiatives using platforms like SAP S/4HANA to automate processes, reduce manual efforts, and enhance data accuracy. These advancements aim to improve operational efficiency and support scalable growth.

Tata Chemicals Share Price Target 2030

Tata Chemicals share price target 2030 Expected target could ₹2200. Here are five key risks and challenges that could influence Tata Chemicals’ share price target by 2030:

-

Exposure to Currency Fluctuations

With significant international operations, Tata Chemicals is susceptible to currency exchange rate volatility. Adverse movements in exchange rates can impact the company’s financial performance, especially in markets like the U.S. and Europe. -

Market Volatility and Demand Fluctuations

The chemical industry is sensitive to economic cycles. Downturns in sectors such as automotive and construction can reduce the demand for chemicals, affecting Tata Chemicals’ revenues and profitability. -

Raw Material Price Instability

The company’s profits can be impacted by changes in the prices of raw materials, which are often unstable. Fluctuating input costs can squeeze margins and affect overall financial health. -

Regulatory and Environmental Compliance Risks

The chemical industry faces strict environmental and safety regulations. Changes in these rules can increase operational costs or disrupt production processes, posing challenges to Tata Chemicals’ operations. -

Intensifying Global Competition

Tata Chemicals faces tough competition from global and emerging market companies. This competitive landscape can impact its pricing power and market share, necessitating continuous innovation and efficiency improvements.

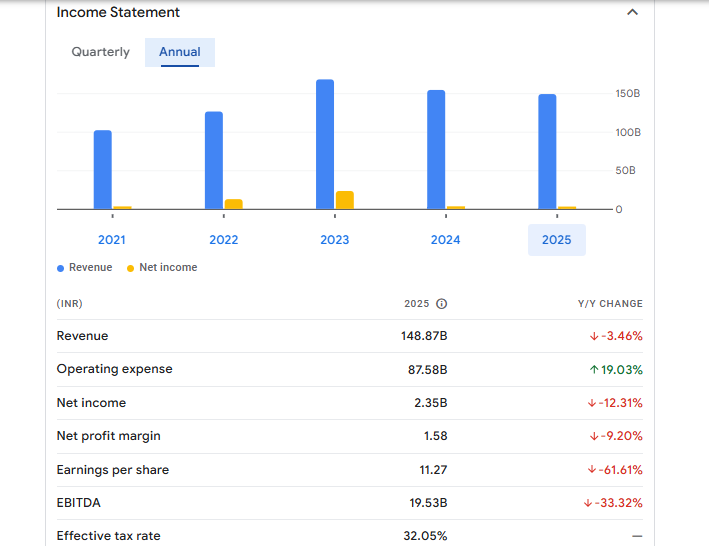

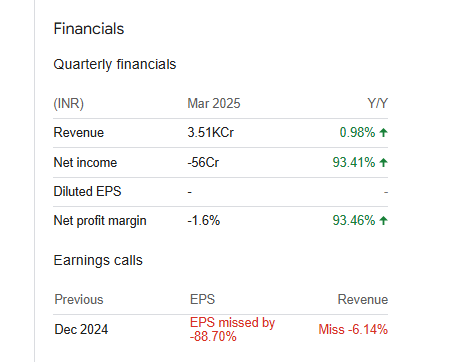

Tata Chemicals Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 148.87B | -3.46% |

| Operating expense | 87.58B | 19.03% |

| Net income | 2.35B | -12.31% |

| Net profit margin | 1.58 | -9.20% |

| Earnings per share | 11.27 | -61.61% |

| EBITDA | 19.53B | -33.32% |

| Effective tax rate | 32.05% | — |

Read Also:- Yes Bank Share Price Target Tomorrow 2025 To 2030