TATA ELXSI Share Price Target Tomorrow 2025 To 2030

Tata Elxsi is a part of the Tata Group and is known for its innovative work in design and technology services. The company helps businesses around the world create smarter products and digital experiences, especially in areas like automotive, media, healthcare, and telecom. With its strong focus on engineering, artificial intelligence, and user experience design, Tata Elxsi supports brands in building next-generation solutions. TATA ELXSI Share Price on NSE as of 20 May 2025 is 6,240.00 INR.

TATA ELXSI Share Market Overview

- Open: 6,229.50

- High: 6,275.50

- Low: 6,175.50

- Previous Close: 6,212.00

- Volume: 145,251

- Value (Lacs): 9,070.92

- 52 Week High: 9,200.00

- 52 Week Low: 4,700.00

- Mkt Cap (Rs. Cr.): 38,896

- Face Value: 10

TATA ELXSI Share Price Chart

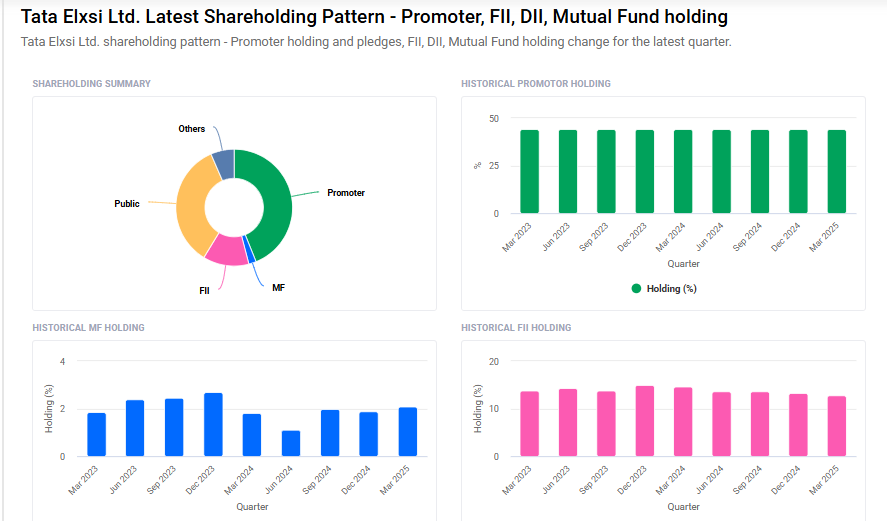

TATA ELXSI Shareholding Pattern

- Promoters: 43.9%

- FII: 12.7%

- DII: 8.5%

- Public: 34.8%

TATA ELXSI Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹9100 |

| 2026 | ₹9500 |

| 2027 | ₹10,000 |

| 2028 | ₹10,500 |

| 2029 | ₹11,000 |

| 2030 | ₹11,500 |

TATA ELXSI Share Price Target 2025

TATA ELXSI share price target 2025 Expected target could ₹9100. Here are five key factors influencing Tata Elxsi’s share price target for 2025:

1. Strategic Partnerships in Automotive Software

Tata Elxsi’s collaboration with Mercedes-Benz Research and Development India (MBRDI) aims to enhance vehicle software engineering and accelerate the development of software-defined vehicles (SDVs). This partnership signifies a significant expansion in Tata Elxsi’s automotive software capabilities, potentially boosting its revenue and market share in the automotive sector.

2. Advancements in Emerging Technologies

The company’s focus on emerging technologies such as artificial intelligence (AI), 5G, and augmented/virtual reality (AR/VR) positions it to capitalize on the growing demand for digital transformation across industries. These technologies are expected to drive smarter decision-making and enhance customer experiences, contributing to Tata Elxsi’s growth.

3. Diversified Industry Portfolio

Tata Elxsi serves a diverse range of industries, including automotive, media and entertainment, healthcare, and telecom. This diversification allows the company to mitigate risks associated with industry-specific downturns and tap into multiple revenue streams.

4. Robust Financial Performance

In FY25, Tata Elxsi reported operating revenue of ₹3,729 crores with a profit before tax (PBT) margin of 26.3%. The company also achieved a healthy quarter-on-quarter growth of 3.5% in constant currency terms in Q4 FY25, indicating strong operational efficiency and financial health.

5. Positive Market Sentiment and Analyst Outlook

Analysts have projected a positive outlook for Tata Elxsi’s stock, with price targets reflecting confidence in the company’s growth trajectory. For instance, forecasts suggest the share price could reach between ₹8,030.27 and ₹8,703.05 by the end of 2025, indicating strong investor confidence.

TATA ELXSI Share Price Target 2030

TATA ELXSI share price target 2030 Expected target could ₹11,500. Here are five key risks and challenges that could influence Tata Elxsi’s share price trajectory by 2030:

1. High Valuation and Market Correction Risk

As of May 2025, Tata Elxsi’s stock is trading at a price-to-earnings (P/E) ratio of approximately 49.3, significantly higher than the industry average of 31.33. Such elevated valuations may not be sustainable, especially if earnings growth does not meet expectations, potentially leading to market corrections.

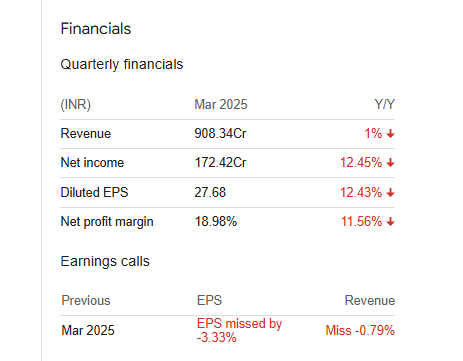

2. Revenue Volatility and Earnings Misses

The company has experienced fluctuations in revenue growth, with a reported 5.3% quarter-on-quarter decline in Q4 FY25. Additionally, earnings per share (EPS) and revenues have occasionally missed analyst expectations, indicating potential challenges in maintaining consistent financial performance.

3. Macroeconomic and Geopolitical Uncertainties

Tata Elxsi’s significant exposure to international markets, including Europe and the US, makes it susceptible to global economic slowdowns and geopolitical tensions. Such factors can impact client budgets and demand for the company’s services, affecting revenue streams.

4. Intensifying Competition in the Tech Industry

The technology sector is highly competitive, with numerous players offering similar services. Tata Elxsi faces competition from both established firms and emerging startups, which may pressure margins and necessitate continuous innovation to maintain market share.

5. Dependency on Key Clients and Sectors

A significant portion of Tata Elxsi’s revenue is derived from specific clients and sectors, such as automotive and media. Any downturn or disruption in these sectors could disproportionately affect the company’s financial performance.

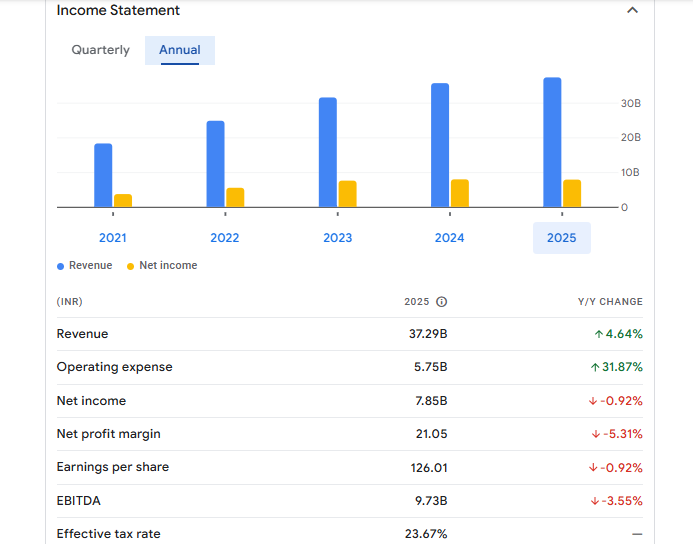

TATA ELXSI Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 37.29B | 4.64% |

| Operating expense | 5.75B | 31.87% |

| Net income | 7.85B | -0.92% |

| Net profit margin | 21.05 | -5.31% |

| Earnings per share | 126.01 | -0.92% |

| EBITDA | 9.73B | -3.55% |

| Effective tax rate | 23.67% | — |

Read Also:- Maharashtra Bank Share Price Target Tomorrow 2025 To 2030