Tata Investment Share Price Target Tomorrow 2025 To 2030

Tata Investment Corporation Limited (TICL), established in 1937 by Tata Sons, is a non-banking financial company (NBFC) headquartered in Mumbai, India. Initially known as The Investment Corporation of India, TICL focuses on long-term investments in equity shares, debt instruments, and mutual funds across various industries. The company’s income primarily derives from dividends, interest, and capital gains on its investments. TICL’s diversified portfolio includes holdings in sectors such as automobiles, banking, chemicals, consumer goods, healthcare, information technology, and infrastructure. Tata Investment Share Price on NSE as of 18 April 2025 is 6,280.00 INR.

Tata Investment Share Market Overview

- Open: 6,289.50

- High: 6,333.50

- Low: 6,225.50

- Previous Close: 6,258.50

- Volume: 20,411

- Value (Lacs): 1,283.65

- VWAP: 6,281.38

- UC Limit: 7,510.00

- LC Limit: 5,007.00

- 52 Week High: 8,074.25

- 52 Week Low: 5,145.15

- Mkt Cap (Rs. Cr.): 31,819

- Face Value: 10

Tata Investment Share Price Chart

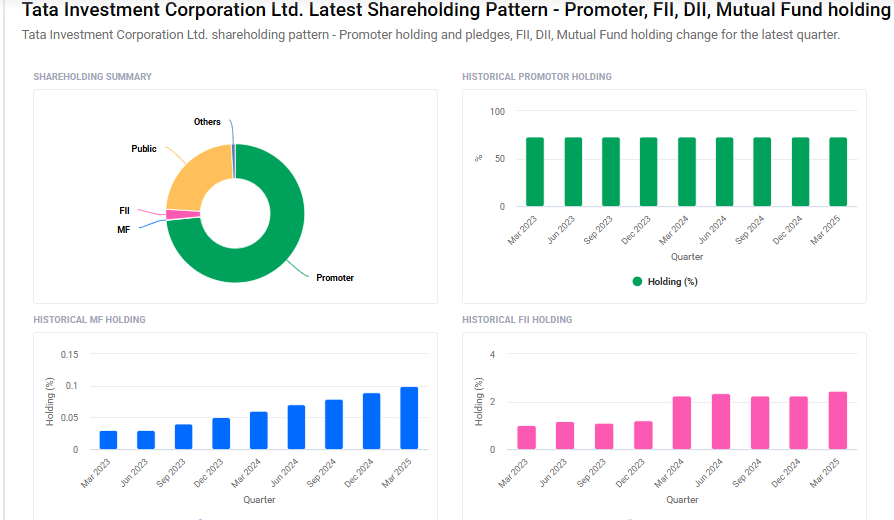

Tata Investment Shareholding Pattern

- Promoters: 73.4%

- FII: 2.5%

- DII: 1%

- Public: 23.1%

Tata Investment Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹8080

- 2026 – ₹10,030

- 2027 – ₹12,040

- 2028 – ₹14,050

- 2030 – ₹16,060

Major Factors Affecting Tata Investment Share Price

-

Performance of Portfolio Companies

Tata Investment Corporation primarily earns through dividends and capital gains from its investments in various companies. The financial health and stock performance of these portfolio companies directly influence Tata Investment’s income and, consequently, its share price. -

Market Sentiment and Economic Conditions

Being an investment company, Tata Investment’s share price is sensitive to overall market trends. Positive economic indicators and bullish markets can boost investor confidence, while economic downturns or market volatility may lead to a decline in its stock value. -

Dividend Policy and Yield

Investors often look for consistent and attractive dividends. Tata Investment has maintained a healthy dividend payout in the past. Any changes in its dividend policy or fluctuations in dividend yield can impact investor sentiment and influence the share price. -

Interest Rate Fluctuations

Changes in interest rates can affect the attractiveness of dividend-paying stocks like Tata Investment. Rising interest rates may lead investors to prefer fixed-income securities over equities, potentially impacting the demand and price of Tata Investment shares. -

Regulatory Changes in Investment Policies

Alterations in financial regulations, taxation policies, or investment norms can influence the operations of investment companies. Such regulatory changes can affect Tata Investment’s profitability and, in turn, its share price. -

Company’s Financial Performance

Tata Investment’s own financial health, including its revenue, profit margins, and return on equity, plays a crucial role in determining its stock price. Consistent growth and strong financial metrics can attract investors, while underperformance may lead to a decline in share value.

Risks and Challenges for Tata Investment Share Price

-

Market Volatility

Tata Investment’s performance depends heavily on stock market movements because it invests in a wide range of listed companies. If the market becomes unstable due to economic or global events, the value of its portfolio may fall, which can directly affect its share price. -

Dependency on Portfolio Companies

Since Tata Investment earns from dividends and capital gains, its success is tied to how well its invested companies perform. If any of these businesses face financial trouble or market challenges, it could reduce Tata Investment’s income and lower investor confidence. -

Interest Rate Changes

Rising interest rates may shift investor interest from equity investments to safer fixed-income options like bonds or fixed deposits. This can reduce demand for shares like Tata Investment, especially if the dividend yield doesn’t look attractive compared to interest-based options. -

Limited Core Operations

Tata Investment doesn’t run any large business operations of its own. It earns mostly through investments. This lack of diversified income sources makes the company more vulnerable to investment-related risks compared to firms that generate revenue from multiple business lines. -

Regulatory and Taxation Changes

Changes in government policies, such as capital gains tax rules or dividend taxation, can impact investment companies. Any unfavorable regulation could lower profits or investor returns, potentially putting downward pressure on the company’s share price. -

Economic Slowdowns

In times of economic slowdown or recession, the value of investments tends to decline. Lower corporate earnings, reduced dividend payouts, and a fall in consumer and investor confidence can all hurt Tata Investment’s returns and make the stock less attractive to buyers.

Read Also:- Morarjee Textiles Share Price Target Tomorrow 2025 To 2030