Taylormade Renewables Share Price Target From 2025 to 2030

Taylormade Renewables Share Price Target From 2025 to 2030: Investing in the stock market involves an academic approach that considers the fundamentals, technicals, and possible industry growth opportunities of a company. Among the firms that have caught attention in recent years is Taylormade Renewables Ltd., which is a firm involved in offering renewable energy solutions such as solar thermal systems, biomass energy, and waste-to-energy technology.

With the whole world focusing on sustainability and clean energy, Taylormade Renewables can gain much from the shift in the direction of green technology. Below is the critical review of Taylormade Renewables Ltd., beginning with its recent performance in the stock market, fundamentals, technical, ownership structure, and targets for share prices between 2025 and 2030.

Company Overview – Taylormade Renewables Ltd.

Taylormade Renewables Ltd. is engaged in India’s rapidly growing renewable energy sector. The company specializes in and installs green energy solutions including:

- Concentrated solar thermal (CST) technology systems

- Solar dryers for industrial and agricultural applications

- Biomass cooking systems

- Waste-to-energy systems

Taylormade products are ideally suited to India’s ambitious plans of curbing carbon emissions and incorporating clean energy capacity. Government policies, subsidies, and environmental considerations are going to propel demand for such technology to a significant extent.

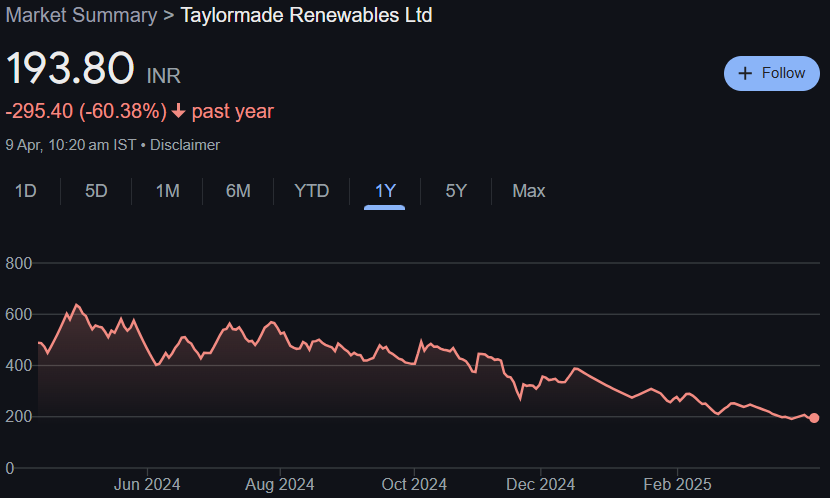

Recent Stock Market Performance

Let us get closer to recent price action and stock prices now:

- Open: ₹195.50

- High: ₹195.50

- Low: ₹188.00

- Previous Close: ₹195.30

- 52-Week High: ₹658.70

- 52-Week Low: ₹187.55

- Current Price (Bid-Ask): ₹193.80

- Market Capitalization: ₹232.18 Cr

- Volume: 852 shares

- Total Traded Value: ₹0.02 Cr

The share fell by roughly 60% in the last year, from ₹658.70 to under ₹200. Such a severe fall is a cause for worry but also an accumulation chance if market sentiment and fundamentals improve.

Fundamental Analysis

Despite the recent weakening of the stock, Taylormade Renewables has solid fundamentals:

- P/E Ratio (TTM): 22.32

- EPS (TTM): ₹8.75

- Book Value: ₹57.72

- P/B Ratio: 3.38

- Debt-to-Equity: 0.22 (low leverage)

- ROE (Return on Equity): 15.23%

- Dividend Yield: 0.00% (no dividend payment in the quarter)

- Industry P/E: 66.10

These numbers indicate that the company is fairly undervalued when compared to the rest of the renewable energy sector. The debt level is minimal, indicating a strong balance sheet, and the double-digit ROE indicates efficient use of capital.

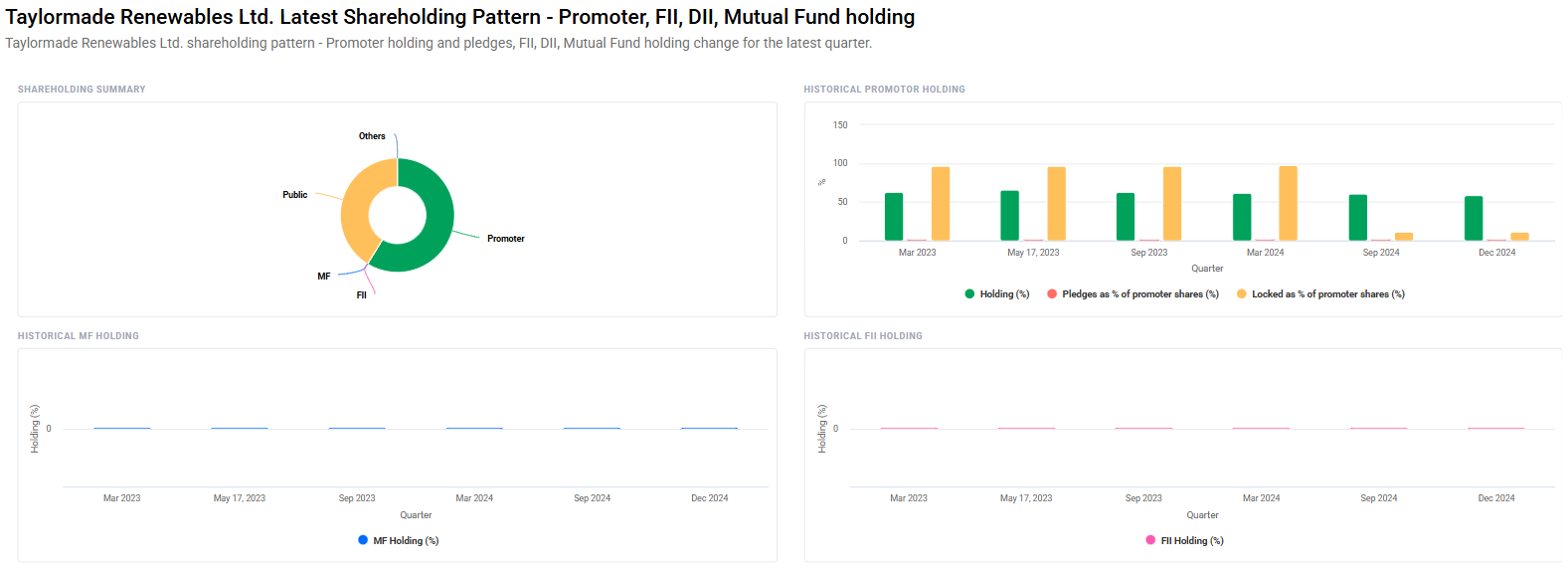

Ownership Structure

- Promoters’ Holding: 58.79% (Decreased from 61.09% in the Dec quarter)

- Retail and Others: 41.21%

The minimal drop in promoter holding is perhaps something to worry about; however, they still retain majority ownership, reflecting firm faith in the business processes. The retail holding reflects the optimism of individual investors despite recent volatility.

Technical Analysis – Is the Stock Oversold?

- Day RSI (Relative Strength Index): 34.9 (heading towards oversold zone)

- MACD: -11.9 (bearish indication below middle line)

- MACD Signal Line: -13.3

- ADX (Average Directional Index): 36.4 (strong trend present)

- MFI (Money Flow Index): 18.8 (oversold, potential reversal)

- ROC (Rate of Change): -21.1 (negative rate of change)

- ATR (Average True Range): 7.4 (high volatility)

The technicals choose a chart of a stock, which is in decline but is also poised to make a potential comeback. The MFI and RSI indicate that the stock is in an oversold region, where a short-term comeback can be triggered. But negative MACD and ROC values are of concern for momentum buyers.

Taylormade Renewables Share Price Prediction (2025-2030)

With good fundamentals of the company, future demand for the clean energy sector, and continued government incentives, the stock can offer exponential returns in the future. Below are year-by-year share price targets:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹700 |

| 2026 | ₹1200 |

| 2027 | ₹1700 |

| 2028 | ₹2200 |

| 2029 | ₹2700 |

| 2030 | ₹3200 |

These targets have been presumed on the assumption that the company will be increasing revenues, adding new products to its basket, and working on government-sponsored clean energy projects at state and national levels.

Why the Targets Are Justified?

Government Drive towards Renewable Energy:

The 500 GW non-fossil fuel capacity by 2030 is a target India is working towards. Taylormade Renewables has the maximum to benefit out of this push.

Adoption of Clean Technology:

Solar thermal dryers and waste-to-energy technologies are being adopted across agriculture, food processing, and industry.

Growth Potential:

If it goes abroad or forms tie-ups with state governments or PSUs, the top lines can go manifold.

Undervalued Position:

With P/E of 22.32 compared to industry average of 66.10, the stock has scope for multiple expansion in case the earnings continue to be strong.

Investment Strategy Based on Time Horizon

Short-Term Investors (1-2 Years)

- Risk: High

- Strategy: Wait for reversal confirmation (above ₹220).

- Target: ₹700

- Entry Point: After rebound with volume confirmation

Medium-Term Investors (3-5 Years)

- Risk: Moderate

- Strategy: Accumulate ₹180-₹200

- Exit Target: ₹1,700 to ₹2,200

Long-Term Investors (5+ Years)

- Risk: Low

- Strategy: Compounding growth by buying and holding

- Exit Target: ₹3,000+ by 2030

Risks and Concerns

- Volatility: 60% plunge in one year suggests extremely volatile prices.

- Promoter Selling: Slight lowering of holding capacity can create impressions.

- Not Paying Dividend: Passive income will not be received by the investors.

- Sector Competition: Major players and foreign companies venturing into the domain of renewables may draw market share away.

FAQs – Taylormade Renewables Ltd.

Q1. Would Taylormade Renewables be a long-term investment choice?

Yes, the firm is in a high-growth industry. High demand for green energy solutions and minimal leverage make it a good bet in the long term.

Q2. Why did the share lose more than 60% of its value in one year?

The drop may be attributable to sector rotation, profit taking, or macroeconomic factors. But technically speaking, it is now oversold and hence set to recover.

Q3. Taylormade Renewables has what aim in 2025?

2025 share price target is ₹700, both on the back of industry growth as well as consistent earnings performance.

Q4. Does the company offer dividend?

Taylormade Renewals pays no dividends anymore. It is reinvesting profits to increase the business.

Q5. What are the key risks of investing in this stock?

Key risks include high volatility, low liquidity, reducing promoter holding, and intensive competition in the clean energy field.

Q6. Who are the investors able to invest in this stock?

Long term to medium term investors who are convinced about the future of clean energy and are able to hold on during short term volatility can invest in the stock.

Taylormade Renewables Ltd. is a risky, but potentially rewarding bet on the alternative energy front. Short term players need to exercise caution, but long term players can consider it value for money at current levels, if the company continues to perform on its growth strategy.

As India marches towards meeting its clean energy targets, shares such as Taylormade Renewables can be giant gainers. With a strong foundation and excellent industry tailwinds, this share can deliver multi-fold returns in the next decade.